IPO News

Reliance Spinning Mills Faces Inquiry for Allegedly Changing Finances to Raise IPO Price

Reliance Spinning Mills is under investigation for its IPO as lawmakers raise concerns about its finances. In a recent parliamentary meeting, a member of parliament Dipak Khadka from the Nepali Congress asked why the company is permitted to issue shares at premium prices when other initial public offerings (IPOs) are being put on hold.

The Securities Board of Nepal (SEBON) approved the IPO at Rs 820.80 per share, despite the chairperson position being vacant after the retirement of the previous chairperson, Ramesh Hamal.

Accusations have been raised that the company changed its financial details, hiding a Rs 753.68 million debt and raising its earnings per share (EPS) to Rs 54.34 when the actual value is Rs 2.08. The committee has asked SEBON to explain what is wrong.

Reliance Spinning Mills was set to issue shares to Nepalese citizens working abroad after selling shares to institutional investors at Rs 912 per unit. However, experts suggest that due to the company’s debt, the IPO price should not exceed Rs 538.35 per share.

You may also like:

Blogs

Trade Tower Limited Announces IPO Result for the General Public

Trade Tower Limited has successfully allotted shares for its Initial Public Offering (IPO) to the general public. The company issued 32,96,505.19 shares, worth Rs 32.96 crores, at Rs 100 per share.

The first phase of the IPO was previously opened for Nepalese workers living abroad. The Trade Tower’s second phase IPO was opened to the general public from Jestha 14 to Jestha 20, 2082.

Share Distribution Breakdown

Out of the total 3,97,169.30 shares offered:

- 10% (3,97,169.30 shares) were already allotted to Nepalese workers living abroad.

- 2% (79,433.86 shares) were set aside for company employees.

- 5% (1,98,584.65 shares) were reserved for mutual funds.

- The remaining 32,96,505.19 shares were made available to the general public.

Allotment Process and Oversubscription

The second phase of the IPO was oversubscribed by 7.31 times. The company received 2,074,285 valid applications, while 14,897 applications were invalid.

Through a lottery process:

- 329,650 applicants received 10 shares each.

- 5 applicants received 1 share each.

- 1 applicant was allotted 0.19 shares.

Conclusion

Trade Tower’s IPO allotment shows strong investor interest and growing confidence in the company. This allotment process marks a significant step forward for its financial future.

Blogs

Trade Tower Limited Opens 32,96,505.19 Units IPO For General Public

Trade Tower Limited (TTL) has opened the second phase of its Initial IPO for general public starting today, from Jestha 14th to Jestha 19th, 2082. If the issue is not fully subscribed within this period, the deadline will be extended up to Jestha 28th, 2082.

Earlier, the company had successfully issued 10% of the total 39,71,69,300 shares, i.e., 3,97,169.30 units of IPO shares to Nepalese citizens working abroad. Out of the remaining shares, 2% or 79,433.86 units have been set aside for the company’s employees, and 5% or 1,98,584.65 units have been allocated for mutual funds. The remaining 32,96,505.19 units of shares are now being issued to the general public through this IPO at a par value of Rs. 100 each.

| Key Point | Details |

| IPO Open Date | Jestha 14th – Jestha 19th |

| Extended Deadline (if not subscribed) | Jestha 28th, 2082 |

| Public Issue (Remaining Shares) | 32,96,505.19 units |

| Par Value per Share | Rs. 100 |

| Minimum Application | 10 units |

| Maximum Application | 1,000 units |

| Issue Manager | LS Capital Limited |

| Credit Rating | [ICRANP-IR] BB- (Moderate Risk) |

About Company

Established in 2006, Trade Tower Group is a leading business conglomerate in Nepal, specializing in leasing, financing, and infrastructure development. Its parent company, Trade Tower Limited (formerly Kanchanjunga Housing Limited), was founded in 2007 and operates from Thapathali, Kathmandu. The group’s flagship project, Trade Tower Thapathali, was completed in 2011. It has since expanded into hospitality with Hotel Crystal Pashupati, a three-star hotel in Gaushala, which began partial operations in 2024. With over 350 promoters, the company is chaired by Mr. Shiva Hari Dangal. Post-IPO, promoter ownership will remain at around 51%. Focused on growth, the group continues to drive innovation in the infrastructure and hospitality sectors.

Blogs

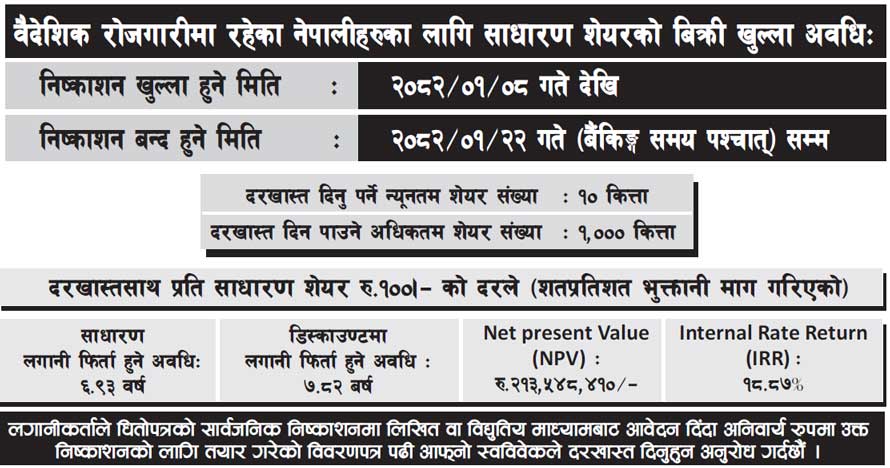

Trade Tower Opens IPO for Nepali Working Abroad | 397,169.30 Units

Trade Tower Limited has announced an Initial Public Offering (IPO) exclusively for Nepalese citizens working abroad. The IPO of Trade Tower is opening today, 8th Baishakh, and will remain open until 22nd Baishakh, 2082. Applications must be submitted within this period, as the deadline will not be extended.

Key Share Allocation Details

| Allocation Group | Percentage | Number of Units | Status |

|---|---|---|---|

| Employees | 2% | 79,433.86 units | Reserved |

| Collective Investment Fund | 5% | 198,584.65 units | Reserved |

| Foreign Workers | 10% | 397,169.30 units | Open from 8th Baishakh |

| General Public | 83% | 3,296,505.19 units | Post-reserved share allocation |

Note: Unsold shares reserved for employees, foreign workers, or the collective fund will be offered to the general public.

Key Highlights of the IPO

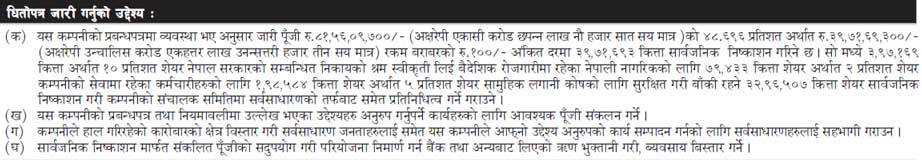

- Total Capital: Rs. 81.56 crores.

- Public Issue: 48.696% (39,71,693 units worth Rs. 39.71 crores).

- Investment Range: Apply for 10 to 1,000 units per applicant.

- Issue Manager: LS Capital Limited.

- Eligibility: Nepalese citizens abroad with valid labor permits.

- Ownership: Over 350 promoters currently hold 100% shares, but post-IPO, their stake will reduce to 51%.

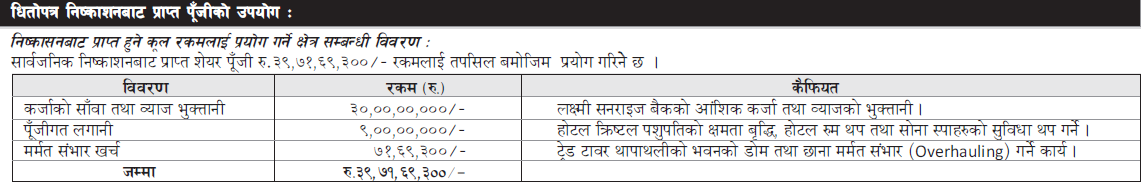

Utilization of the IPO Raised funds

Purpose of the Trade Tower IPO Issue

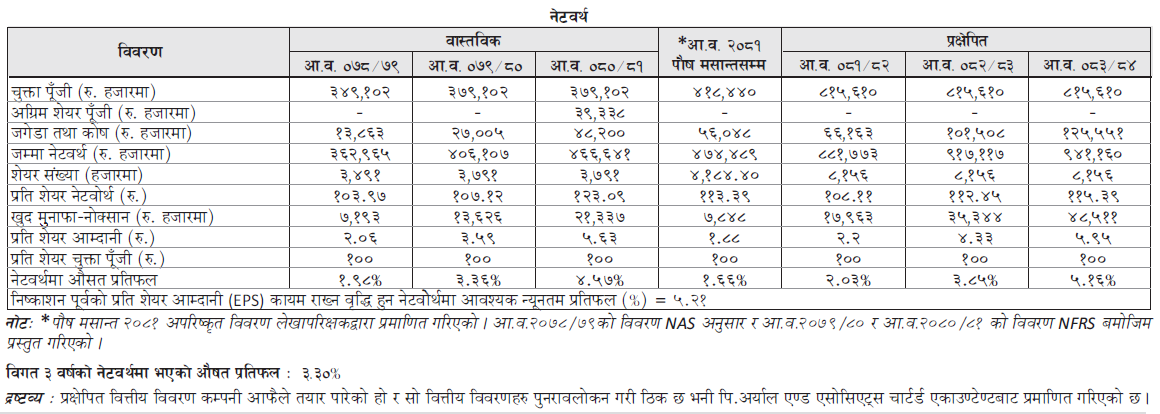

Net Worth Details of the Company

Issuer Rating of Trade Tower

As per this prospectus, the ordinary shares to be publicly issued have been rated “[ICRANP-IR] BB-” by ICRA Nepal Ltd., authorized by the Securities Board of Nepal under Rule 3 of the Credit Rating Regulations, 2068. This rating, reaffirmed on January 20, 2025, indicates a moderate risk of default in timely financial obligations. ICRA Nepal’s ratings range from [ICRANP-IR] AAA (strong) to [ICRANP-IR] D (weak), with “+” or “-” showing position within the category. Details are in Clause Ga.22 (ta), page 51.

- Rating Date: Jan 20, 2025 (2081/10/07)

- Valid Until: Jan 20, 2026 (2082/10/07)

About Trade Tower Company (TTL)

The Company was established in 2007 and is a leading Nepali enterprise specializing in leasing, financing, and infrastructure development. Under the visionary leadership of Chairman Mr. Shiva Hari Dangal, the company has transformed from its origins as Kanchanjunga Housing Limited into a dynamic player in housing, hospitality, and commercial real estate.

Key Ventures & Achievements:

- Trade Tower, Thapathali: A landmark commercial complex in Kathmandu, operational since 2011. Built on a 32-year leasehold from Nepal Food Corporation, it has delivered consistent rental income for over a decade, establishing itself as a reliable revenue stream.

- Crystal Hotel, Gaushala: A luxurious 3-star hotel with 90 rooms, partially operational since April 2024. This venture significantly boosts the company’s earnings while enhancing Nepal’s hospitality sector.

- Bhaisepati Public Housing Project: A completed residential initiative that catered to urban housing needs, with all units sold to satisfied clients.

-

Blogs4 days ago

Blogs4 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs12 hours ago

Blogs12 hours agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs13 hours ago

Blogs13 hours agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs14 hours ago

Blogs14 hours ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs14 hours ago

Blogs14 hours agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs6 months ago

Blogs6 months agoSiuri Nyadi Power Limited Added to IPO Pipeline by SEBON

-

Blogs3 months ago

Blogs3 months agoPure Energy IPO For General Public