Hydro Power News

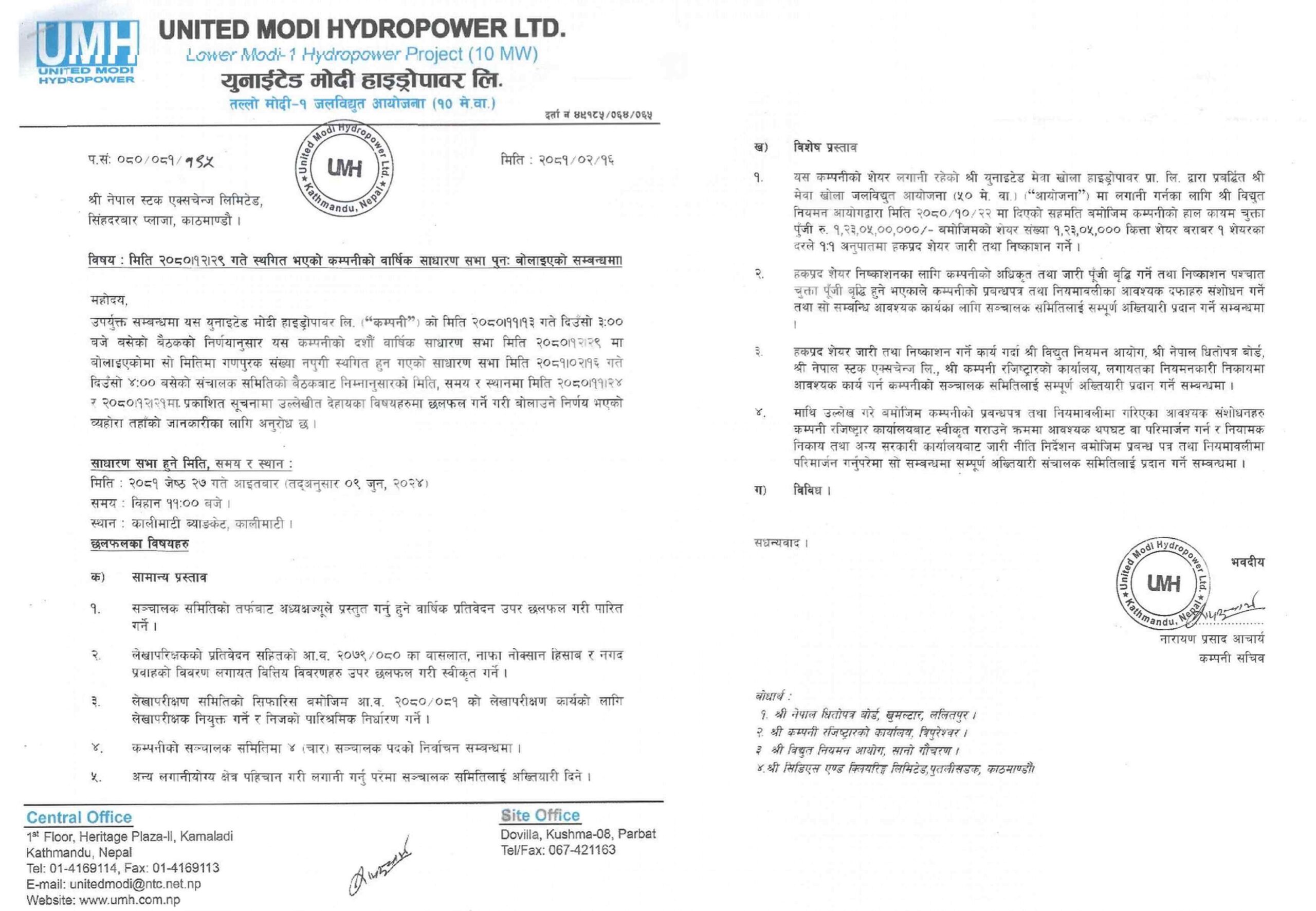

United Modi Hydropower postponed its 10th AGM to 27th Jestha

United Modi Hydropower postponed its 10th AGM (Annual General Meeting) to Jestha 27th, 2081. The meeting will occur at the Kalimati Banquet in Kalimati, Kathmandu, at 11:00 AM.

The AGM was originally scheduled on the 29th of Chaitra, 2080, but was postponed due to insufficient shareholder participation.

AGM Agendas:

- Annual Report Endorsement: Approval of the company’s annual report.

- Auditor’s Report: Approval of the auditor’s report for 2079/080, including profit and loss statements, financial reports, and cash flow reports.

- Auditor Appointment: Appointment of the auditor and determination of their remuneration for the fiscal year 2080/81.

- Election of Directors: Election of 4 directors.

- Issuance of Right Shares: Approval of the issuance of right shares in the ratio of 1:1.

- Capital Increase: Increase the authorized and issued capital to facilitate the issuance of right shares, with corresponding amendments to the company’s charter and regulations. The board is granted full authority to execute necessary actions and handle regulatory matters with relevant authorities during this process.

The book closure date was set for 7th Chaitra. Shareholders recorded before this date are eligible to attend the AGM.

Notice: United Modi Hydropower postponed its 10th AGM

You may also like:

Blogs

Hydropower Gains 7.8% in One Month, Outperforming All Sectors

In the past month, Nepal’s share market has shown only slight growth, with the NEPSE index rising by just 1.68%. However, the hydropower sector has emerged as the top-performing sector, recording a sharp 7.89% increase during the same period. This rise comes even as several other sectors faced a decline.

Some hydropower companies have seen their stock prices jump by as much as 92% within a month. Two of the most notable performers are Butwal Power Company and newly listed Pure Energy, both of which have reached their highest-ever market prices.

Not only has the sector index grown, but trading volume and turnover have also increased significantly. A month ago, hydropower stocks accounted for around 50% of the total market turnover. Now, that figure has surged to nearly 70%. For example, on a recent trading day, out of a total NPR 9.08 billion turnover, NPR 6.03 billion (or 66%) came from the hydropower sector alone.

Companies with the Highest Price Growth in One Month

Hydropower Gains 7.8% in One Month

Why is Hydropower Attracting More Investors?

The key reason behind this increased interest is the improving financial reports of hydropower companies and the expectation of even better results. According to Bharat Ranabhat, former president of the Stock Brokers Association of Nepal, falling interest rates have reduced the financing costs of hydropower projects. This has positively impacted the profit margins of these companies.

Investors believe that the upcoming fourth-quarter financial reports will be even more favorable. As explained by investor Subash Chandra Dhungana, electricity production increases during the monsoon season, boosting income. Traditionally, most of a hydropower company’s annual earnings are made in the months of Baisakh, Jestha, and Ashad — the fourth quarter of the Nepali fiscal year.

In the share market, the banking and hydropower sectors are often seen as the two strongest. Historically, when banks underperform, hydropower tends to rise, and vice versa. This pattern is visible again. While banks are currently struggling with rising non-performing loans (NPLs) and increasing loan loss provisions, hydropower is gaining strength due to financial improvement.

Other sectors face challenges in this quarter. For example, banks, development banks, and finance companies are affected by rising NPLs, which directly reduce profits. Insurance companies, both life and non-life, have seen a rise in share numbers due to rights and bonus shares; however, business growth has not kept pace, resulting in a decline in earnings per share.

Production and processing companies are also under pressure due to weak demand and slow sales. These difficulties are not present in the hydropower sector. Power produced is sold as per agreements, and payments are received promptly, which provides stability and confidence to investors.

Big Investors Turn to Hydropower

With other sectors struggling, large investors have shifted their focus to hydropower. Companies with larger capital have seen both prices and trading volumes rise. One key feature of this sector is the wide range of company sizes. Hydropower firms in Nepal have paid-up capital ranging from NPR 134 million to over NPR 8.72 billion. This allows both big investors and general shareholders to find suitable options in this sector. The share prices also vary widely — from under NPR 200 to as high as NPR 1,850 per share — increasing the sector’s overall appeal.

Spotlight on Butwal Power Company

Among all hydropower companies, Butwal Power Company (BPC) has gained significant attention. Its share price is at a record high, and it consistently ranks among the top five in daily trading volume. BPC had planned to sell 3.1 million shares of Nyadi Hydropower, but the Securities Board of Nepal (SEBON) halted the sale. SEBON stated that since BPC’s directors are also involved in Nyadi, the sale goes against regulatory rules.

Despite this, rumors in the market suggest that BPC may still make a huge profit by selling those shares at nearly four times their original price. The shares were initially valued at NPR 100 each, and now the market value is around NPR 440. If the sale goes through, BPC could earn over NPR 1 billion in profit, which might be distributed as dividends to shareholders.

Other hydropower companies are also rumored to be planning similar share sales, leading to expectations of strong fourth-quarter earnings from asset sales.

Conclusion

The hydropower sector is currently the most attractive area of Nepal’s stock market. With better financial performance, timely earnings, low risk of payment delays, and a wide range of investment options, it has caught the attention of both large and small investors. As other sectors struggle, hydropower continues to shine, making it the clear leader in this month’s share market activity.

Blogs

SEBON Approves Sanvi Energy Limited IPO Proposal

Sanvi Energy Limited has received approval from the Securities Exchange Board of Nepal (SEBON) to launch its Initial Public Offering (IPO). The company will issue 37,90,000 equity shares at a face value of NPR 100 per share, aiming to raise a total of Rs. 37.90 crore.

Nepal SBI Merchant Banking Limited has been selected to manage the IPO process, ensure compliance with regulatory standards, and oversee share distribution.

CARE Issuer Rating

CARE Ratings Nepal Limited (CRNL) has reaffirmed Sanvi Energy’s issuer rating of ‘CARE-NP BB+ (Is)’, indicating a moderate risk of delays in meeting financial obligations. This rating underscores the company’s credible position in Nepal’s market.

About Sanvi Energy Limited

Sanvi Energy Limited (SEL), established in 2011 and converted to a public limited company in 2020, is dedicated to hydropower development in Nepal. Led by experienced professionals, SEL operates one hydropower plant under the BOOT model and is developing another to expand its renewable energy portfolio. The company is currently working on the Jogmai Khola Small Hydroelectric Project (7.6 MW) and the Jogmai Cascade Hydroelectric Project (5.2 MW) in Ilam District. Committed to sustainability, transparency, and ethical business practices, SEL aims to develop multiple small and medium-sized hydropower projects, contributing to clean energy and infrastructure growth in Nepal.

Conclusion

Sanvi Energy Limited’s IPO approval marks a pivotal step in its growth strategy, enabling public investment in its renewable energy ventures. With a moderate-risk rating and experienced leadership, SEL aims to strengthen its role in Nepal’s hydropower sector. Investors can participate in this opportunity through the upcoming IPO, managed by Nepal SBI Merchant Banking Limited.

This development highlights SEL’s commitment to sustainable energy and transparency, positioning it as a key player in Nepal’s infrastructure development.

Blogs

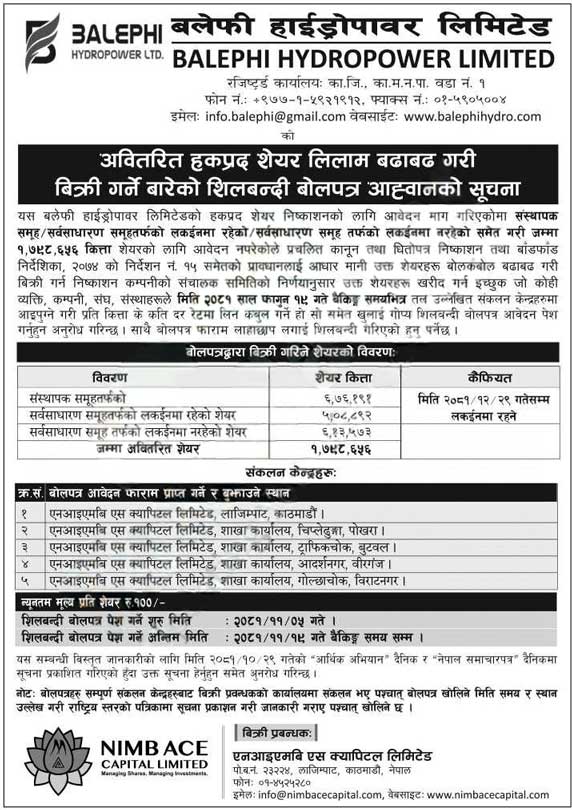

Balephi Hydropower Concludes Unclaimed Right Shares Auction

Balephi Hydropower Limited (BHL) successfully conducted the auction for its unclaimed right shares on Falgun 22, 2081. The auction was managed by NIMB Ace Capital Limited, with the bidding process taking place at their premises in Lazimpat, Kathmandu, starting at 8:00 AM.

Auction Overview

The Key Dates and Share Details of the auction are as follows:

- Auction Period: The auction opened on 5th Falgun and concluded on 19th Falgun, 2081, at the end of banking hours.

- Shares Auctioned:

- Promoter Shares: 6,76,191 units.

- Ordinary Right Shares: 5,08,892 units.

- Eligibility: Both individuals and companies were eligible to participate in the auction.

This auction was conducted for the unclaimed portion of the company’s 1:1 right share issue, which was offered to shareholders from 27th Mangsir to 17th Poush, 2081.

Auction Rules and Bidding Process

- Minimum Bid Rate: Rs. 100 per share.

- Minimum Bid Quantity: 100 units.

- Maximum Bid Quantity: No upper limit, but bidders were required to comply with regulatory limits on shareholding per entity.

Tentative Cut-Off Rates

Preliminary Results Await Final Confirmation as per the auction manager, the tentative cut-off rates are as follows:

- Promoter Shares: Rs. 225.5 per share.

- Ordinary Right Shares: Rs. 322.5 per share.

- Lock-in Shares of the Public: Rs. 227.10 per share.

These rates are subject to change once all checks and reconciliations are completed.

Key Highlights of the Auction

- Auction managed by NIMB Ace Capital Limited in Lazimpat, Kathmandu.

- 6,76,191 promoter shares and 5,08,892 ordinary right shares auctioned.

- Minimum bid rate set at Rs. 100, with no upper limit on bid quantity.

- Tentative cut-off rates indicate strong investor interest.

Notice of Balephi Hydropower Concludes Unclaimed Right Shares Auction

Conclusion

The auction of unclaimed right shares by Balephi Hydropower Limited reflects the company’s efforts to optimize its capital structure and provide opportunities for investors. The tentative cut-off rates suggest robust demand for both promoter and ordinary shares. Once finalized, these rates will provide clarity on the success of the auction and the company’s financial outlook.

-

Blogs3 days ago

Blogs3 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs2 hours ago

Blogs2 hours agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs4 hours ago

Blogs4 hours ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs3 hours ago

Blogs3 hours agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs4 hours ago

Blogs4 hours agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs6 months ago

Blogs6 months agoSiuri Nyadi Power Limited Added to IPO Pipeline by SEBON

-

Blogs4 days ago

Blogs4 days agoBanks Invest Rs. 16.45 Trillion in Directed Loans, 14% in Agriculture Sector | Says Nepal Rastra Bank