Blogs

What are the benefits of owning a share?

Many people are excited about investing in the shares market and enjoy the benefits of owning a share. You might also have thought about investing in stocks but haven’t done it because you’re not sure what you’ll get back and make a profit or not.

Investing in stocks comes with risks but it can be minimized with proper research about your investment. Owning a share can be a great way to invest your money. When you own stocks in different companies, you will have more savings, keep your money safe from inflation and taxes, and help you make money from your investment. So, in this blog, you will learn about shares and the benefits of owning a share.

What are shares?

You must understand what shares are before you learn about the benefits of owning shares. Shares are the smallest unit of the company. This means that when you own shares, you own a portion of the company. You can partake in the decision-making of the company and affect the operation of the company.

They are listed in the primary market as IPOs or Initial Public Offering. If the initially issued IPO is not sufficient for the funds, they can also issue a FPO which is also known as Follow on Public Offer. Shares of publicly listed companies can be bought from the secondary market, and for that, you must open a TMS account from any brokers in Nepal.

What are the benefits of owning a share of the company?

The benefits of owning a share of the company are listed below:

Cash Dividend

The cash dividend is the monetary compensation paid to the shareholders for their investment. The company pays a certain amount of the profit it makes in a year as cash dividends to the shareholders.

It is done periodically such as; monthly, quarterly, or annually, depending on the terms of the company. They can also be a one-time payment, meaning the payment is made after settlement.

It is important to note that a cash dividend is given out only when the company is operating at a profit. The profit after retained earnings is given and distributed as profit.

Bonus Share

Bonus shares are the shares that are offered as compensation to the shareholders for their investments. Sometimes, the company does not distribute cash dividends and retains them with themselves for the future. But, they will have to pay their shareholders in some way or they could lose their shareholders.

The shareholders do not have to buy these shares. They are offered to the existing shareholders based on the current amount of shares they hold. The profit of the company is held within the company and the shares are given out as payment.

Profit in the secondary market

One of the benefits of owning shares is you can sell them. The share market is a dynamic market where the prices of the shares are constantly fluctuating.

If the company does well, the value of its shares can increase, whereas, if the company does not do well, the shares of the company will fall below the market price.

You can make a profit by taking advantage of this fluctuation in the share market. When the value of the shares of the company increases, you can sell your shares. This way, you can earn fast and do not have to wait for when the company starts distributing the cash dividend.

Making decisions for the company

Being the shareholder of a company means you are part owner of the company. You can also partake in the decision-making of the company. It means that you can affect the decision-making of the company, based on what you think is the best for the company.

Now, the impact of your decisions is affected by how many shares you own. This should be basic knowledge. If you own only 20 shares, you will not make the same impact as someone who owns 100 shares.

Why do companies issue shares?

Companies will issue their shares when they need capital funds. The funds raised by issuing shares are then used for running the company. As compensation, the company offers cash dividends or bonus shares to the shareholders of the company.

If you do not want to hold the shares of the company any longer. You can sell the shares in the secondary market. If the valuation of your share has increased, you will gain capital gain and if the value of your share has decreased, you will incur capital loss.

Conclusion

The company always operates in favor of the shareholder. They make decisions that will increase the value of the shareholders. If you can do proper research, you can make money in the share market. But you will have to be very alert and make only calculated decisions.

You cannot expect to earn money if you have not made any proper decisions. So, choose what company you want to invest in wisely.

You may also like:

- Common mistakes to avoid when trading stocks

- How to calculate WACC and transfer shares from EDIS in Meroshare

- Basics to know before starting investment in Share Market

FAQs

What is the benefit of owning a share?

Owning a share can give you a lot of benefits like cash dividends, bonus shares, and profit from selling the share in the share market.

What is kitta in the share market?

In the Nepalese share market, ‘kitta’ refers to the unit of share.

Do you get money from owning shares?

Yes, you do receive cash dividends from owning shares. The cash dividend is the distribution of the company’s profit to the shareholders.

What happens when you own 1 share?

If you are applying for IPOs, you cannot just buy 1 share of the company. But, if you are in the secondary market, you can buy 1 share, which means if are a part of the company.

What are the risks of being a shareholder?

Being a shareholder of the shareholder means you are equally prone to the risks of the company.

Why do shareholders get paid?

Shareholders get paid as compensation for their investment. Shareholders get paid when the company earns profit.

Blogs

Chhyangdi Hydropower Extends Deadline for Rights Share Application | Until 27th Ashad

The deadline for the ongoing rights share issue of Chhyangdi Hydropower Limited (CHL) has been officially extended until 27th Ashad, 2082. The issue had originally opened on 23rd Jestha, 2082, with an earlier closing date set for 12th Ashad, 2082.

Key Details of the Rights Share Issue

| Details | Information |

|---|---|

| Total Right Shares Issued | 3,869,775 units (1:1 ratio) |

| Face Value per Share | Rs. 100 |

| Total Issue Amount | Rs. 38.69 Crore |

| Current Paid-up Capital | Rs. 38.69 Crore |

| Post-Issue Paid-up Capital | Rs. 77.39 Crore |

As per the Central Depository System and Clearing Limited (CDSC), 23,503 applicants have applied for 2,317,902 units (worth Rs. 23.17 Crore) as of yesterday.

Eligibility and Application Process

Only those shareholders who held shares before the book closure date of 2nd Jestha, 2082, are eligible for this right share offering.

Interested shareholders can apply through:

- Global IME Capital Limited, Naxal, Kathmandu (Issue Manager)

- Designated branches of Global IME Bank Limited across Lamjung, including Besisahar, Sundarbazar, Bhulbhule, Siundibar, Udipur, and Dordhi

- Any C-ASBA-approved banks and financial institutions

- Online via “MeroShare”.

Applicants are advised to complete the process before banking hours on 27th Ashad, 2082 (Friday).

Important Note:

Payments must be made through an account payee cheque drawn in the name “GICL-BOK-CHHYANGDI RIGHT SHARE”, as per the instructions from Global IME Capital Ltd.

Contact Information

- Chhyangdi Hydropower Ltd

Phone: 977-01-4526483 / 4524925

Email: [email protected] | Website: www.chpl.com.np - Global IME Capital Ltd (Issue Manager)

Phone: 977-01-5970138

Email: [email protected] | Website: www.globalimecapital.com

Notice: Chhyangdi Hydropower Extends Deadline for Rights Share Application

Blogs

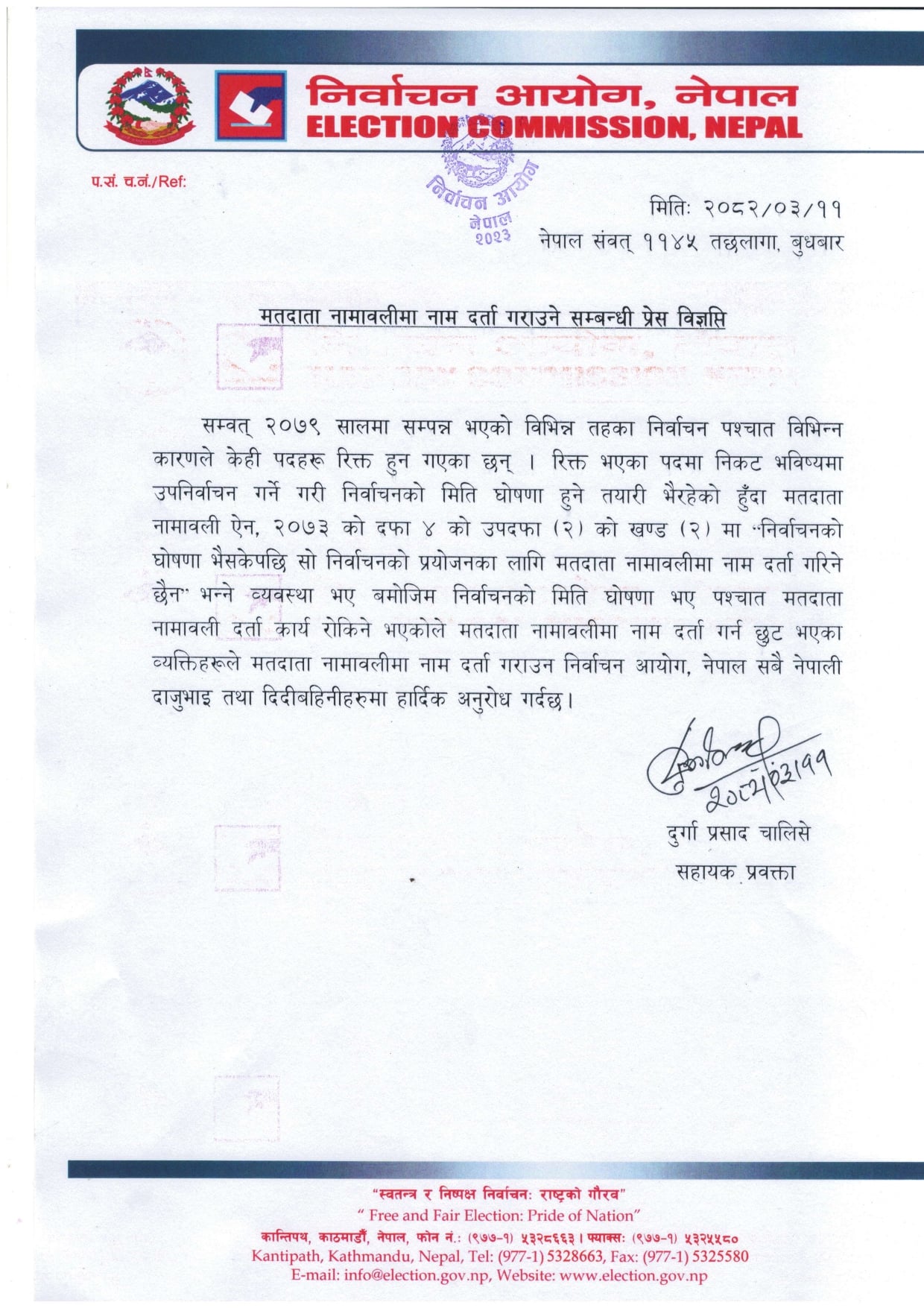

Election Commission Preparing to Announce By-Election Date | Voter Registration Now Open

The Election Commission of Nepal has begun preparations for by-elections to fill vacant positions at various levels of government. As part of this process, the Commission is urging all eligible Nepali citizens who have not yet registered their names in the voter list to do so immediately.

According to the Assistant Spokesperson of the Election Commission, Mr. Durga Prasad Chalise, individuals will not be allowed to register in the voter list once the election date is officially announced. Therefore, he emphasized the importance of early registration to avoid being left out.

The Election Commission recently held discussions with the Prime Minister, Mr. KP Sharma Oli, and the Acting Chief Election Commissioner, Mr. Ram Prasad Bhandari. They talked about setting a date for the by-elections. The main focus was on two key areas: Rupandehi Constituency No. 3 for the House of Representatives and Manang Province Assembly Constituency No. 1 (B). Elections in these regions are likely to be held in the second week of Kartik.

The position in Rupandehi became vacant after the passing of Rastriya Prajatantra Party MP Deepak Bohora. In Manang, the seat became empty after provincial assembly member Deepak Manange was sent to jail. In addition to these, more than a dozen ward chairman positions are also currently unoccupied in various local governments.

The Election Commission has issued a public notice dated 2082/03/11 (Nepali calendar) urging all citizens to register in the voter list immediately. The notice mentions that, according to Clause 4(2)(2) of the Voter List Act, 2073, voter registration will be stopped as soon as the election date is declared.

Hence, this is a final chance for anyone who missed earlier opportunities to register. The Commission has made a heartfelt appeal to all brothers and sisters across the country to take this opportunity seriously and get their names included in the voter list.

The Election Commission assures that the upcoming elections will be conducted fairly and freely, in line with its guiding principle:

“Free and Fair Election: Pride of the Nation.”

For more information or assistance, people can visit the official website of the Election Commission at www.election.gov.np or contact their office at Kantipath, Kathmandu.

Notice: Election Commission Preparing to Announce By-Election Date

Blogs

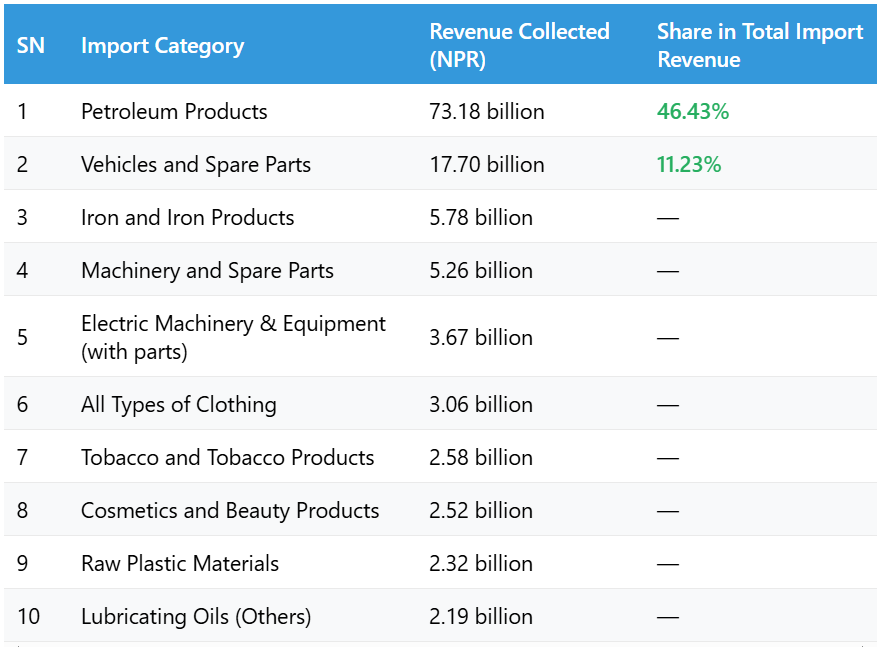

Birgunj Customs Office Collects Highest Revenue from Petroleum Imports

The Birgunj Customs Office has collected the highest revenue from the import of petroleum products in the first 11 months of the current fiscal year 2081/82. According to the office, a total of NPR 73.18 billion was collected in revenue from petroleum imports alone.

During this period, Nepal spent about NPR 174.09 billion to import five different types of petroleum products. These petroleum imports contributed 46.43% of the total revenue collected from the top 20 imported items, making it the most important source of income for the customs office.

Major Revenue Contributors from Imports

What Officials Say

Customs Chief Administrator Deepak Lamichhane stated that petroleum products and vehicle imports are the main sources of customs revenue at Birgunj. He highlighted that these two sectors consistently contribute the highest share of government income collected through imports.

Conclusion

The data from the Birgunj Customs Office shows that fuel and vehicles remain Nepal’s most heavily imported and taxed items. With more than 46% of the revenue coming from petroleum alone, any changes in fuel prices or import volumes can significantly affect national customs revenue.

-

Blogs4 days ago

Blogs4 days agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs4 days ago

Blogs4 days agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs1 week ago

Blogs1 week agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs4 days ago

Blogs4 days agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs3 months ago

Blogs3 months agoPure Energy IPO For General Public

-

Blogs4 days ago

Blogs4 days ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs1 year ago

Broker no. 58: Naasa Securities Co. Ltd.