After selling the share you have to transfer those shares to the buyer with the help of a broker. You have to calculate WACC before transferring the sold shares to the buyer. Only after completing WACC can you perform EDIS to transfer the shares. Before the launch of MeroShare, people had to visit the broker’s office to perform EDIS. Now, with MeroShare, you can perform EDIS online. In this blog, you will learn to calculate WACC and transfer shares from EDIS in Meroshare i.e. how to Transfer Shares to Buyers from Mero Share.

Why do you need to calculate WACC and perform EDIS?

Settling the collateral in your TMS account after buying shares from the secondary market is essential. Similarly, when you sell shares, you must perform WACC and EDIS. If you fail, you might have to pay a fine of up to 20%.

You need to pay a certain percentage of tax on the profit you’ve made to the government. By calculating WACC, you’ll know the amount of tax you should pay, which depends on factors like how long you hold the share and its buying price. If you sell a stock at a loss, you’re not required to pay any tax.

How to calculate WACC in Meroshare?

Follow the given steps to calculate WACC in Meroshare:

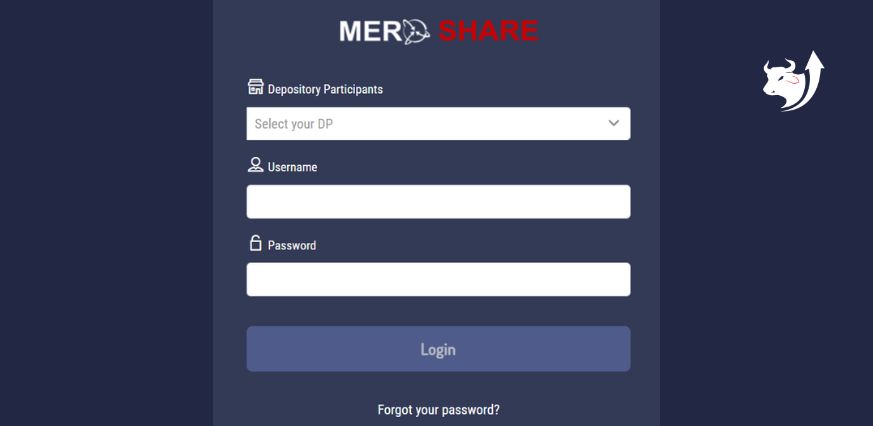

Step 1: Log in to your MeroShare account.

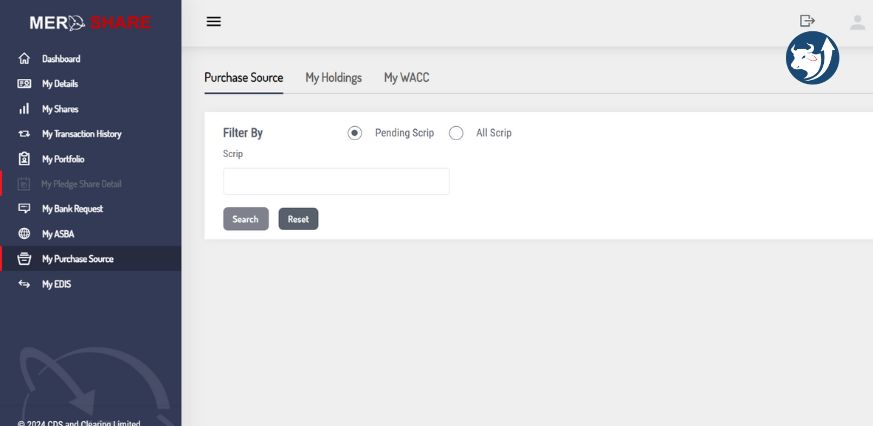

Step 2: Go to ‘My purchase Source’

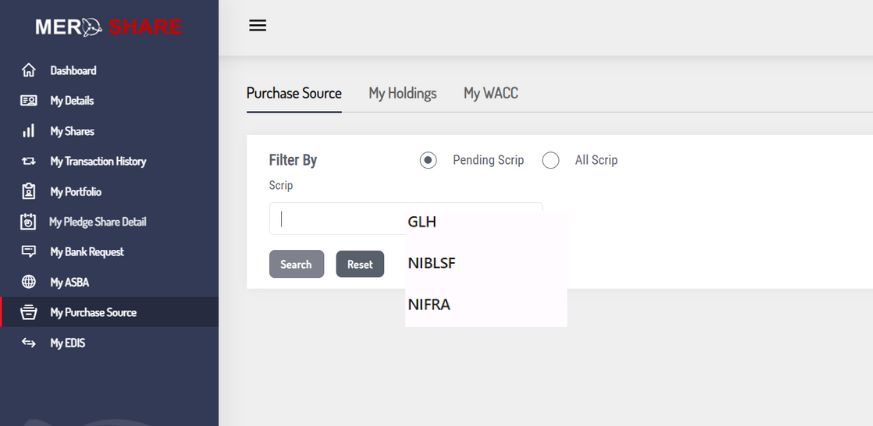

Step 3: Click on ‘Script’ in the Purchase Source field. This will give you a list of companies you own the shares of.

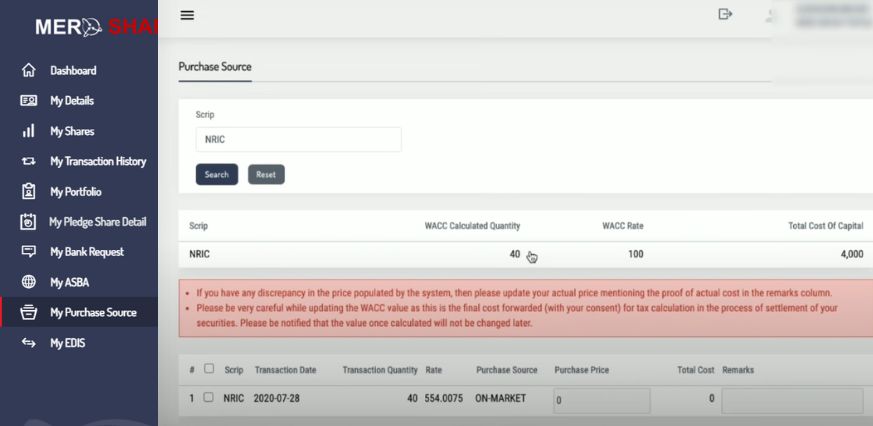

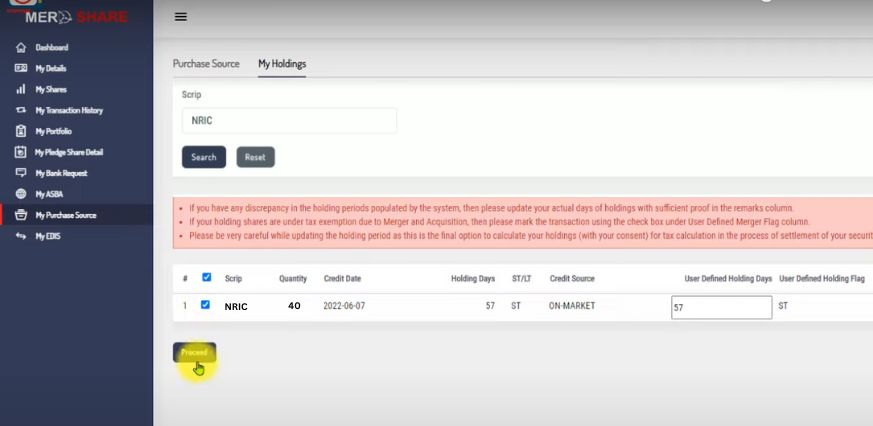

Step 4: Select the company from your list and click on ‘Search’. You will see a screen as shown below.

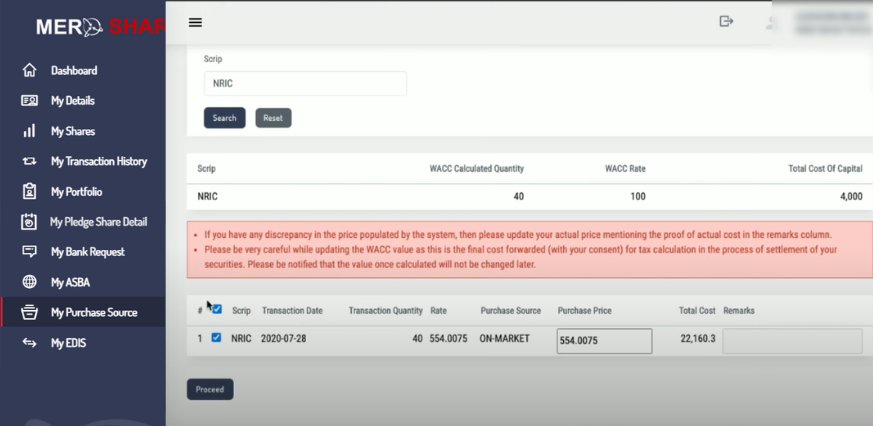

Step 5: Click on the small check box before the company, you will find the WACC of the particular stock under the Purchase Price, then click on “Proceed“.

Note: If the amount differs from what you initially paid for when buying the share, you can enter the actual amount in the ‘Purchase Price’ field. If you do so, you must input your receipt number in the ‘Remarks’ section.

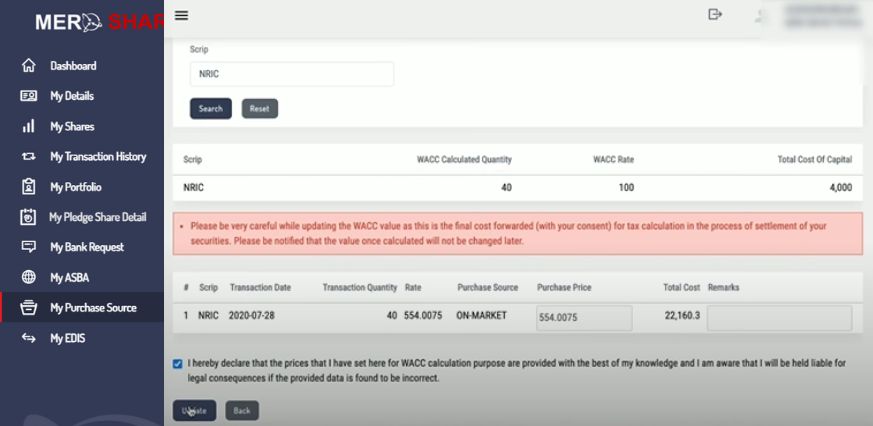

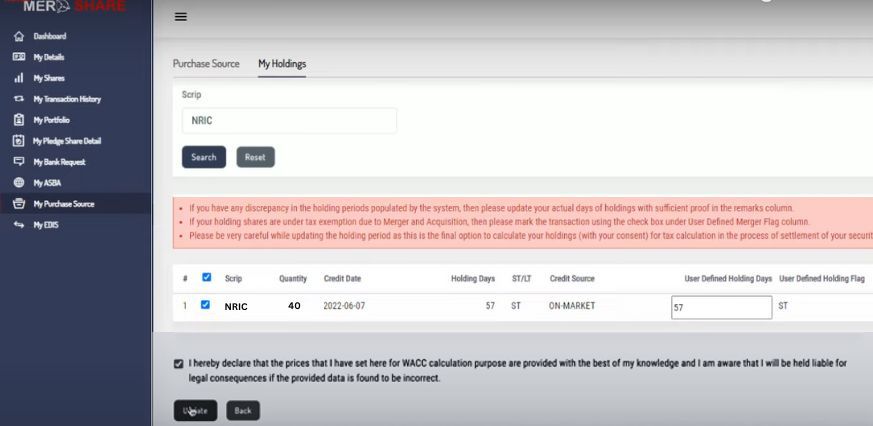

Step 6: Click on the check box to accept the terms and conditions and then click on ‘Update’.

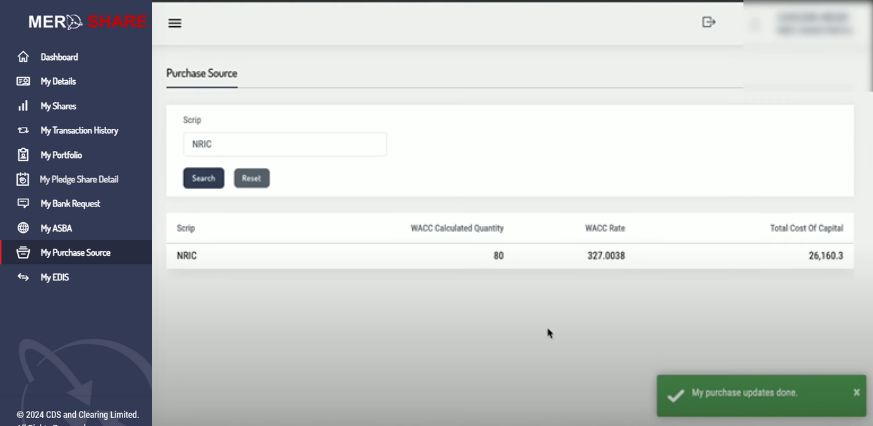

Step 7: You will receive a ‘My Purchase Update’ in a green box on your screen and you will also see the WACC rate for the company you have chosen.

Step 8: After that, you have to calculate the holding days of the particular stock. Click on “My holdings”, select your particular stock under “script” then check the box and click on Proceed.

Step 9: Check the box I hereby declare then click on Update.

Following this now you have calculated the WACC.

How to do EDIS in Meroshare/ Transfer Shares to Buyers from Mero Share.?

EDIS (transferring shares) is done after the calculation of the WACC in Meroshare. Follow the below steps:

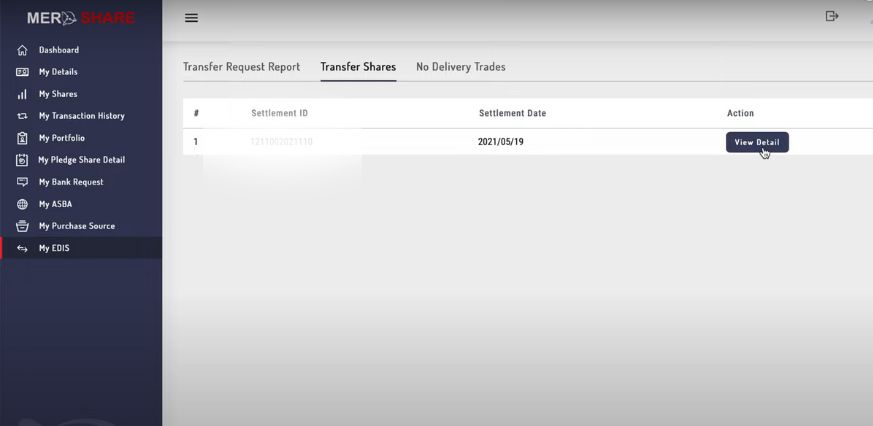

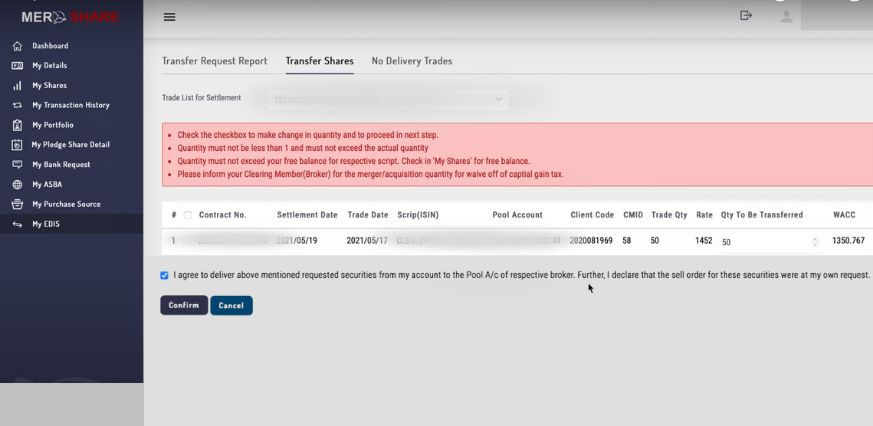

Step 1: Click on “My EDIS” and go to “Transfer Shares” where you will see the below screen. Click on “View detail”.

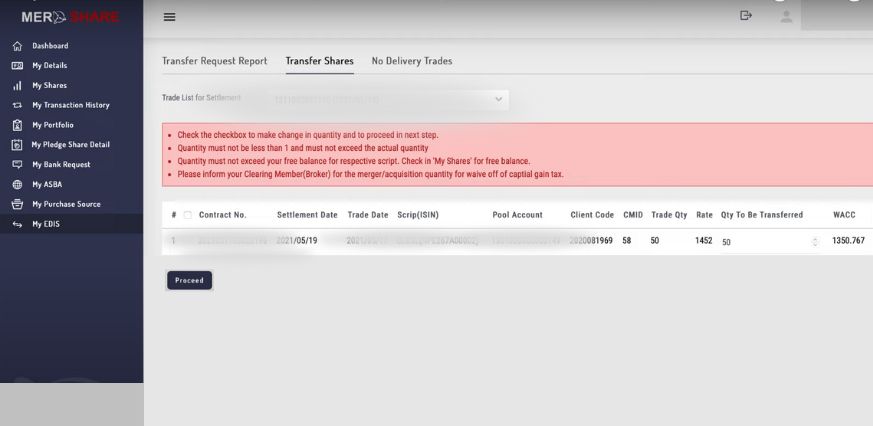

Step 2: You will see a screen as shown below showing the details including WACC. Then click on “Proceed”.

Step 3: Check the box “I agree to deliver” and click “Confirm”.

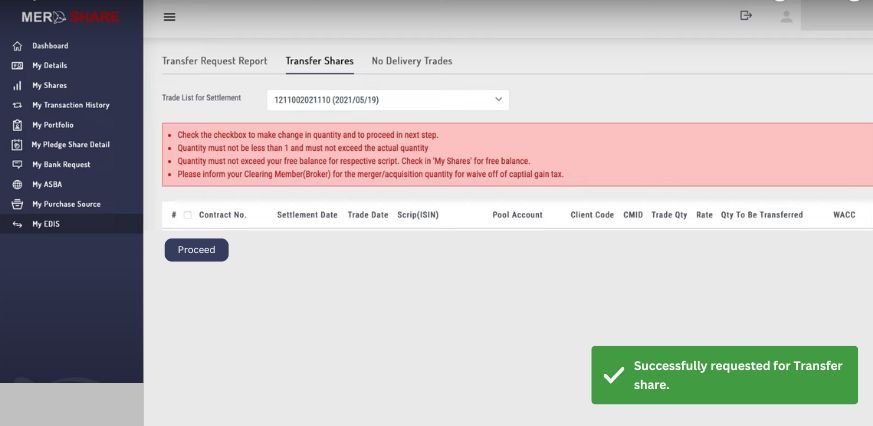

Step 4: You will receive a message “Successfully requested for Transfer share.”

Now you have successfully transferred shares completing the EDIS process.

This article was written to let you know how to calculate WACC using your MeroShare Account. You can calculate WACC on paper too, but you must do it in MeroShare for accurate calculation. And perform EDIS on time so, you won’t be fined for delaying the transfer of shares to the buyer.

You may also like:

- Basic requirements for share trading

- Nepal Share Market: Everything you need to know

- SEBON Preparing to approve a Pipeline IPO that has been stopped for five months

FAQs

Why do you calculate WACC?

WACC will let you know if you have to pay tax on capital gain or not.

How do you calculate WACC after the merger?

The formula to calculate WACC is:

WACC = {(E / V) x Re} + {(D/V) x Rd x (1 – T)}

Where,

E: Equity

V: Sum of the equity and debt market values

Re: Required Rate of return for equity,

D: Stands for Debt

Rd: Required debt cost

T: Current Tax Rate

What is WACC in the market?

WACC stands for Weighted Average Cost of Capital and it is the company’s average after-tax cost of capital from all of the sources including common stock, preferred stock, preferred stock, bonds, and debt.

Can you calculate WACC in MeroShare?

Yes, you can calculate your WACC in MeroShare.