Blogs

What are some common mistakes to avoid when trading stocks?

More and more people are entering the stock market but almost half of them do not know what they’re doing. This leads to them incurring big capital losses and makes them think the stock market is simply not lucrative.

Here is a list of common mistakes to avoid when trading stocks to thrive in the market.

Lack of proper research

Many investors don’t research enough. This mistake isn’t just made by newbies or new amateur investors but also by seasoned or experienced investors.

People generally invest in companies, suggested by their friends and family or in those companies that they have heard of. This is not a sufficient reason for investing your money.

You need to find out the business model of the company and the financial position of the company to make an informed decision. So, you need to be updated with the share market news, trends in the market, and upcoming opportunities.

Having a short-term vision

Many people just ‘want to get rich’ by investing in shares. Sure they may earn by short-term investment but, this fogs their mind from creating wealth. Many investors tend to overlook the benefits of long-term investment.

This is also helpful for investors who are greatly affected by the graphs. Having a long-term vision makes you a lot less anxious when your company is not stable. You will have no negative emotion play and could receive higher capital gains.

Buying stocks with no volume

Some investors just look at the price of the stock and overlook the volume of the stock. ‘Volume’ in the stock market refers to how many stocks of a particular company are traded in a certain period. This is related to the liquidity of the shares.

If you purchase stocks with low or no volume, you will be stuck with it and no one will buy it from you. This is not a good sign in the stock market because as an investor you need to be able to buy and sell shares. Stocks with no volume will be a financial burden.

Allowing personal judgment to affect the investment decision

Emotions should be out of the equation when you are investing. Everything you do needs to be calculated and you should be able to predict the possible outcomes of the decision you made.

The investor should not take actions based on what he thinks is right but rather, on company analysis which has a concrete basis. Remember if investment feels like a gamble, you’re doing it wrong.

Lack of patience

The stock market is a very volatile place. There are highs and lows for all the different listed companies but, this should not scare the investors to buy or sell their shares.

Many investors sell their shares or buy new ones without proper analysis, which usually leads to them incurring losses due to excess transaction costs and limited capital gain.

Investors need to be patient and keep analyzing the market to make an informed decision and not make decisions based on an adrenaline rush.

Failing to diversify portfolio

This is a common mistake among amateur shareholders. They tend to place all their eggs in one basket. They tend to do this because the company is doing well and they expect the same to continue forever. However, this makes them vulnerable to high risk in case the company does not do well.

Diversifying your portfolio means diversifying your risk. You need to diversify the portfolio so that you do not have to incur a loss in case the company does not do well. When you diversify your portfolio

Over-diversifying the portfolio

Over-diversifying your portfolio can backfire unless you are an investment company with more than one professional investor. You should be aware of how much you can handle and what your limits are. More does not always mean good.

Sometimes, people overestimate themselves or sometimes they simply accumulate shares of different companies to the point they cannot keep track of them all. This is very risky considering how volatile the stock market is.

You may not grab the opportunity to sell your stocks on time or you may not notice one of your shares has dropped in value.

You may also like:

- Basics to know before starting investment in Share Market

- A broker platform providing new innovative experiences in stock trading: SAS(Stock Analysis Software)

- How much should you pay as broker payment

Conclusion

Investment can make or break a person. It depends on how patient he is and how fast he learns. Share this with an investment enthusiast who wants to start investing but cannot perform well. These mistakes are holding people back from reaching their true potential in the stock market.

FAQs

What is the biggest risk in trading?

The biggest risk in trading is not knowing what they are doing in the stock market.

What is the number one risk mistake traders make?

Many traders do not do their research well. They may do well for a short period but, this tactic will not work in the long run.

What are the biggest mistakes a trader should avoid in stock trading?

A trader should always make a calculated decision and not act on a whim. A trader not having a long-term goal can be one of the biggest mistakes a trader should avoid in stock trading.

What is the hardest mistake to avoid while trading?

Even an experienced trader cannot accurately predict the market. It is being impatient and not learning that are the hardest mistakes to avoid while trading.

What is the number 1 rule of trading?

The number 1 rule of trading is always diversifying your portfolio.

Blogs

Birgunj Customs Office Collects Highest Revenue from Petroleum Imports

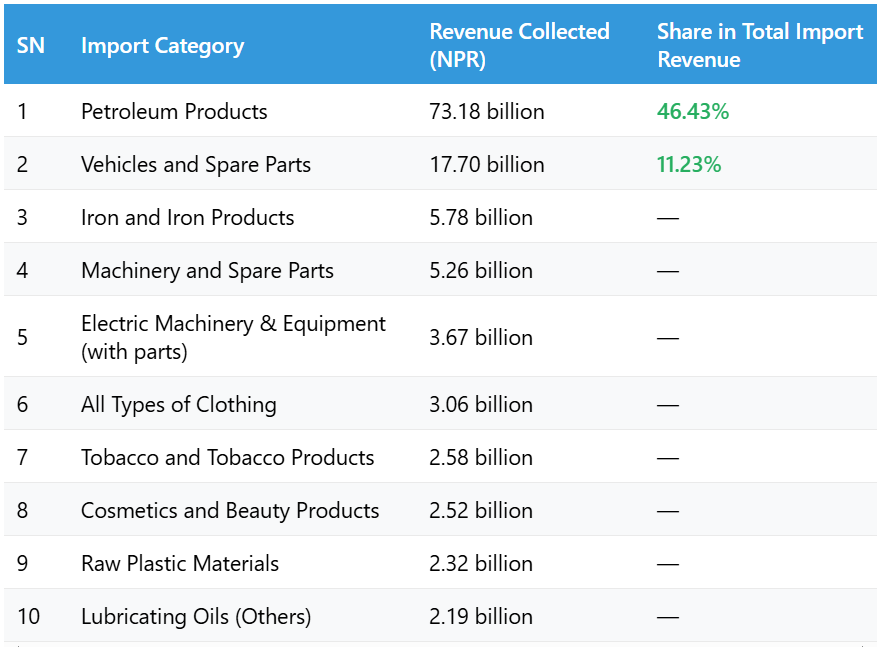

The Birgunj Customs Office has collected the highest revenue from the import of petroleum products in the first 11 months of the current fiscal year 2081/82. According to the office, a total of NPR 73.18 billion was collected in revenue from petroleum imports alone.

During this period, Nepal spent about NPR 174.09 billion to import five different types of petroleum products. These petroleum imports contributed 46.43% of the total revenue collected from the top 20 imported items, making it the most important source of income for the customs office.

Major Revenue Contributors from Imports

What Officials Say

Customs Chief Administrator Deepak Lamichhane stated that petroleum products and vehicle imports are the main sources of customs revenue at Birgunj. He highlighted that these two sectors consistently contribute the highest share of government income collected through imports.

Conclusion

The data from the Birgunj Customs Office shows that fuel and vehicles remain Nepal’s most heavily imported and taxed items. With more than 46% of the revenue coming from petroleum alone, any changes in fuel prices or import volumes can significantly affect national customs revenue.

AGM

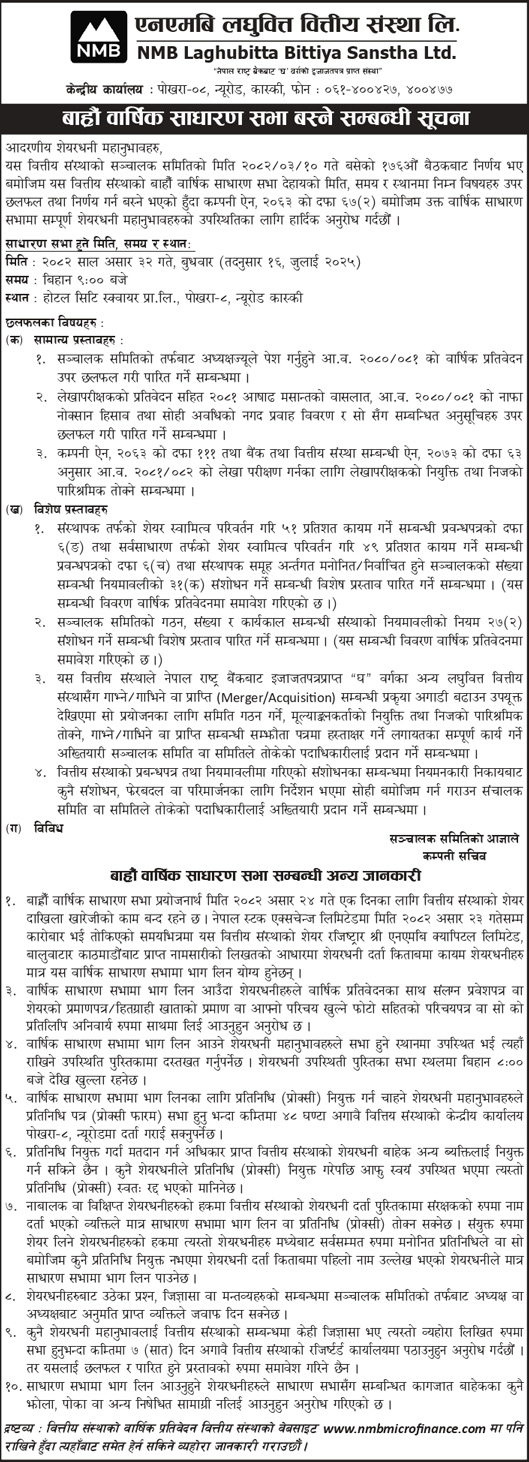

NMB Laghubitta to Hold 12th Annual General Meeting on July 16

NMB Laghubitta Bittiya Sanstha Ltd., a licensed “D” class microfinance institution by Nepal Rastra Bank, has announced its 12th Annual General Meeting (AGM). The AGM will discuss financial performance, proposed amendments, and other key matters.

Key Details of the AGM

| Topic | Details |

|---|---|

| AGM Number | 12th Annual General Meeting |

| Date | Asar 32, 2082 (Wednesday, July 16, 2025) |

| Time | 9:00 AM |

| Venue | Hotel City Square Pvt. Ltd., Pokhara-8, New Road, Kaski |

| Book Closure Date | Asar 24, 2082 (July 8, 2025) |

| Eligibility Cut-off | Shareholders registered till Asar 23 are eligible |

| Share Registrar | NMB Capital Ltd., Baluwatar, Kathmandu |

| Official Website | www.nmbmicrofinance.com |

Agenda of the AGM

A. General Proposals

-

Discussion and approval of the Chairman’s Annual Report for FY 2080/81.

-

Approval of financial statements, including balance sheet, profit & loss, and cash flow for FY 2080/81.

-

Appointment of an auditor for FY 2081/82 and determination of their remuneration.

B. Special Proposals

-

Amendments in MoA/Bylaws regarding:

-

Promoter and public shareholding ratio to be set at 51% and 49% respectively.

-

Number of directors representing promoter shareholders.

-

-

Changes in board formation, number of members, and tenure.

-

Authorization to initiate a merger/acquisition with other “D” class microfinance institutions.

-

Authorization to make further amendments based on regulatory directives from Nepal Rastra Bank.

C. Miscellaneous

-

Discussion of any shareholder queries.

-

Clarifications will be provided by the Chairman or an authorized person.

Important Instructions for Shareholders

-

Share registration will be closed on Asar 24 for AGM purposes.

-

To attend the AGM, shareholders must carry:

-

Entry pass (attached to the annual report)

-

Share certificate or Beneficiary (BO) Account proof

-

Valid ID with photo

-

-

Shareholders must sign the attendance book at the venue starting from 8:00 AM.

-

Shareholders may appoint a proxy representative; however, the proxy form must be submitted at least 48 hours before the meeting.

-

Minor or mentally disabled shareholders must be represented by their registered guardians.

-

No bags or restricted items will be allowed inside the AGM venue.

-

Any shareholder inquiries must be submitted in writing at least 7 days in advance to the registered office.

Notice: NMB Laghubitta 12th Annual General Meeting (AGM)

Blogs

Private Power Producers Protest ‘Take and Pay’ Provision in Budget

Private energy entrepreneurs in Nepal have taken to social media, protesting the government’s decision to introduce the ‘Take and Pay’ (Liu Ra Tir) system for electricity purchase agreements (PPA) in the new fiscal year budget.

Under this system, the government would only pay for the electricity it uses, instead of paying for the total electricity generated by hydropower projects. Entrepreneurs argue this move could severely hurt the private sector, discourage investment, and push the country back toward power shortages.

Online Campaign Targets Top Officials

Energy producers are now directly appealing to key government figures. They have publicly tagged Prime Minister Pushpa Kamal Dahal, Finance Minister Barshaman Pun, Energy Minister Shakti Bahadur Basnet, and NEA Executive Director Kulman Ghising on social media, urging them to withdraw the Take and Pay provision.

This digital campaign comes just days after developers handed over a memorandum to the Prime Minister and bombarded top officials with hundreds of SMS messages requesting the same.

Why Are Entrepreneurs Worried?

Entrepreneurs claim that this decision will:

- Weaken the private sector’s role in the energy industry

- Risk the return of load-shedding (power cuts)

- Causes financial losses to investors

- Damage the overall economy

The Independent Power Producers’ Association of Nepal (IPPAN) has strongly opposed the provision. According to IPPAN’s Vice President and protest coordinator Mohan Kumar Dangi, the policy shift will discourage private hydropower development, especially for Run-of-River (RoR) projects, which are most affected by the new model.

Ongoing Protests and Next Steps

Since Asar 6, private power developers have been staging a phase-wise protest. On the third day of their movement, they moved their campaign to social media to raise public awareness and pressure the government.

Dangi warned that if the government ignores these peaceful efforts, the protests will escalate. Planned steps include:

- Lobbying political party leaders in Parliament

- Launching a nationwide street protest

- Returning the keys of privately built hydropower projects to the government — a symbolic act of handing over control

Background: The Budget Controversy

The controversy started when the budget for FY 2082/83 (announced on Jestha 15) stated that all future PPAs for RoR hydropower projects would be done under the Take and Pay model only. This was a major change from the previous Take or Pay model, where producers were paid even if electricity wasn’t consumed, offering more security for private investors.

Conclusion

The ‘Take and Pay’ decision has sparked serious concerns across Nepal’s private energy sector. Developers fear this could lead to a slowdown in future hydropower investments, and possibly, a return to unstable electricity supply. With pressure mounting both online and offline, the government’s next move will be critical for the future of Nepal’s energy landscape.

-

Blogs3 days ago

Blogs3 days agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs3 days ago

Blogs3 days agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs6 days ago

Blogs6 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs3 days ago

Blogs3 days agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs3 months ago

Blogs3 months agoPure Energy IPO For General Public

-

Blogs3 days ago

Blogs3 days ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs1 week ago

Blogs1 week agoBanks Invest Rs. 16.45 Trillion in Directed Loans, 14% in Agriculture Sector | Says Nepal Rastra Bank