If you are interested in stock trading, you may have heard about buying and selling shares. The process for buying and selling shares is completely different from applying for the company’s Initial Public Offering (IPO).

In Nepal’s context, you can apply for an IPO using the MeroShare app online. However, Meroshare does not allow you to buy or sell shares. You need to open a broker account to buy or sell shares. In this blog, you will learn to open a broker account in a step-by-step process.

What is a TMS/Broker account?

A broker account is an account that allows you to buy or sell shares. Some of you may think you can buy/sell shares yourself after finding a buyer/seller, but that is not possible in the digital world. After opening a Broker account you will have a TMS account access through which you can place buy/sell orders. If you have placed a sell order and the order is executed then, you have to transfer the shares to the buyer from the Meroshare account. Here broker acts as a mediator in transferring shares and checking the status.

It is the international standard that you will need a broker account to get involved in any of such transactions.

How do you open a TMS/Broker account?

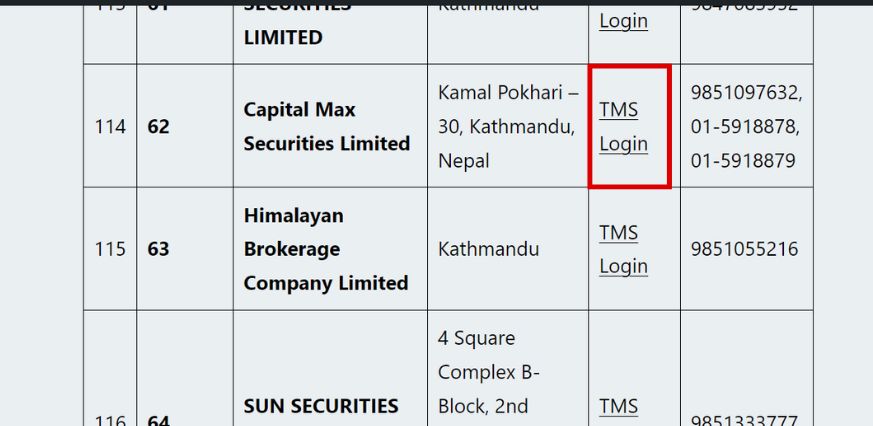

To open a broker account choose the broker from the List of stock brokers in Nepal. You can select any broker depending on your choice, we advise you to choose the broker that is nearest to you. Suppose you choose Capital Max securities, there is a “TMS login” link click on that.

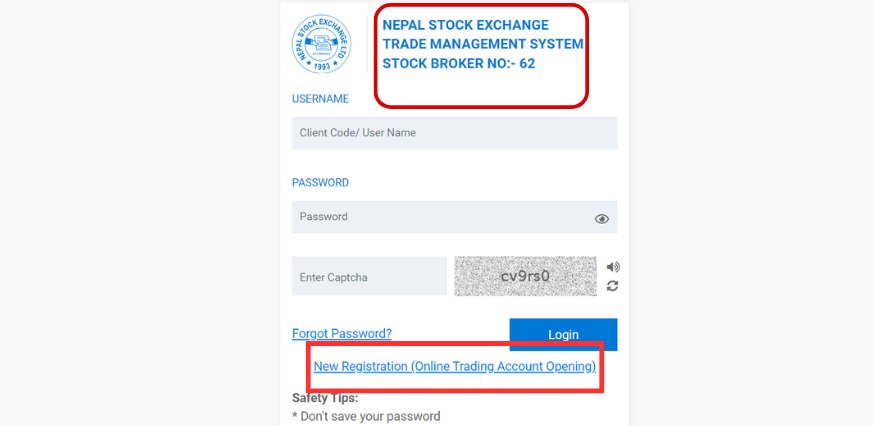

Step 1: Then, you will be directed to the NEPSE Online Trading System page. Click on the “New Registration (Online Trading Account Opening)”.

Note: For example purposes, we have selected Capital Max securities i.e. broker no. 62. Therefore we are creating a broker account from the respective broker.

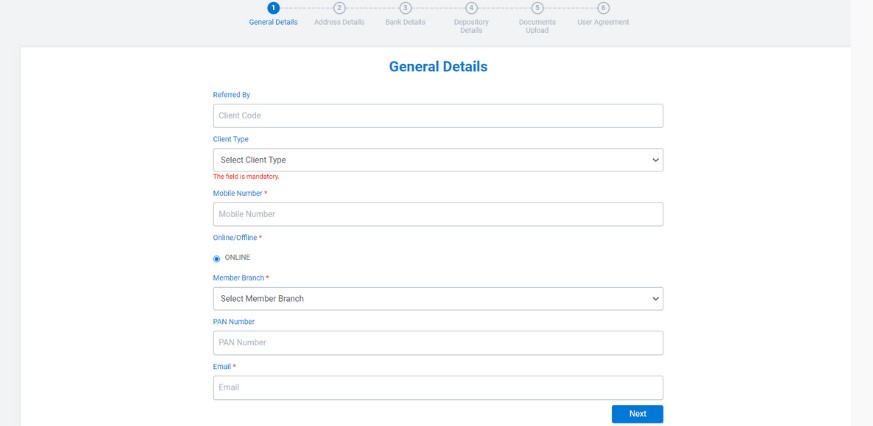

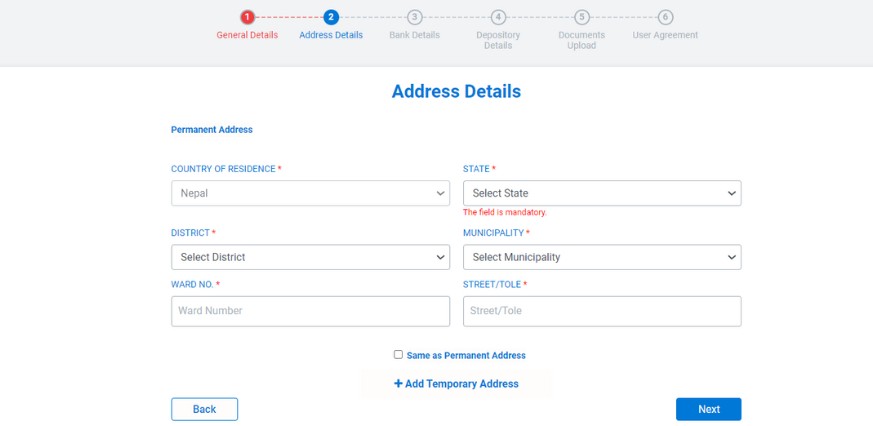

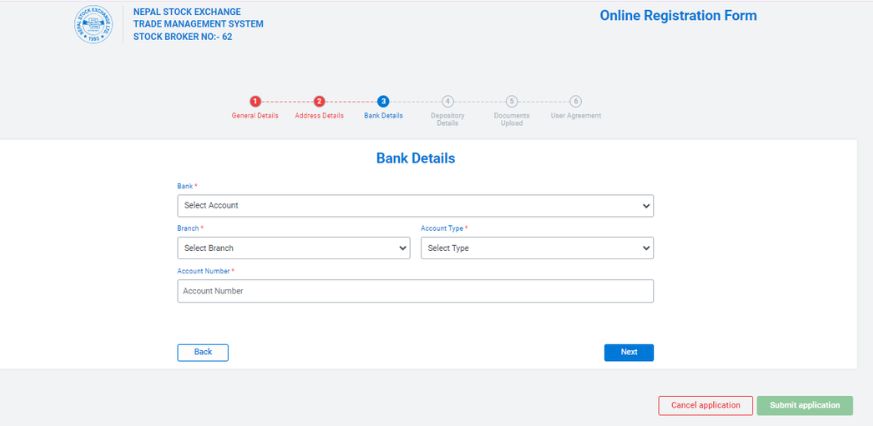

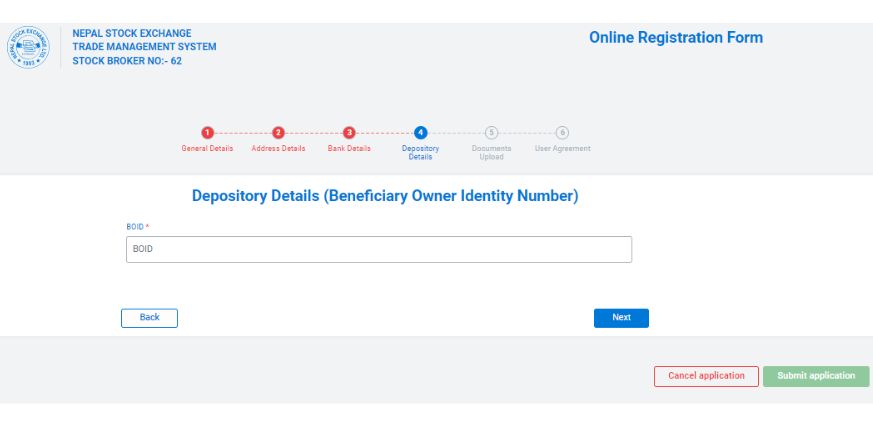

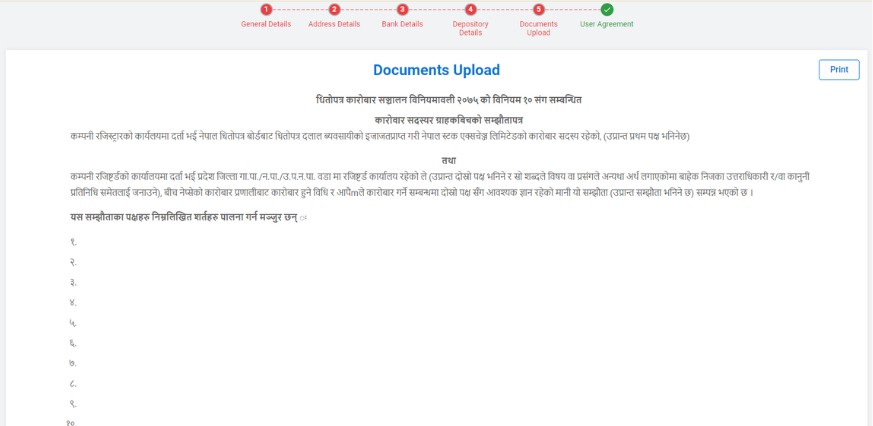

Step 2: Then, you will be redirected to an online registration form from NEPSE. Your form is divided into six parts: General Details, Address Details, Bank Details, Depositary Details, Document Upload, and User Agreement.

Step 3: Under the first part fill in your “General details”. Sections with * mark are mandatory to fill.

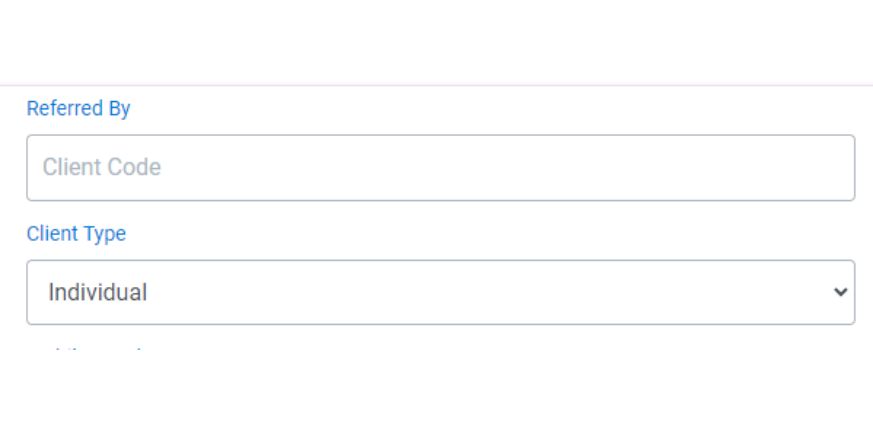

Step 4: Select your client type as ‘individual’. Similarly, fill in your address under the

Step 5: Fill in your “Address Details” and click next.

Step 6: Fill in your Bank details and click Next.

Step 7: Fill in your ‘Depository Details’ i.e. 16-digit BOID number provided by your Bank. Click Next.

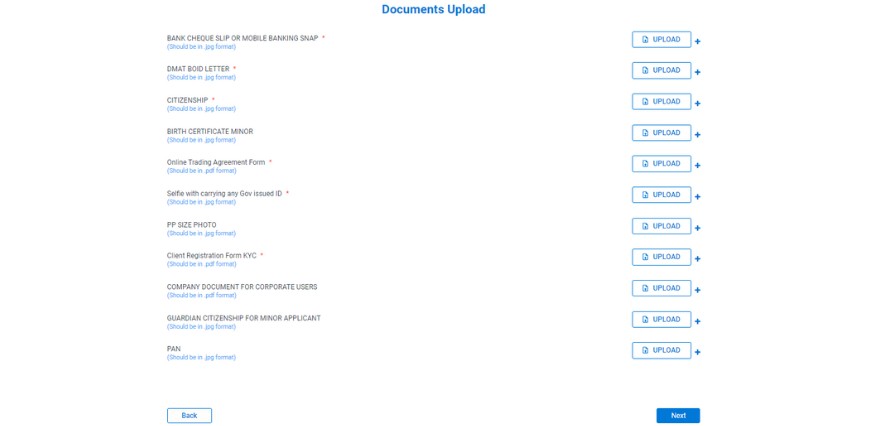

Step 8: Make sure you have your virtual documents ready, to upload them on the ‘Documents Upload’. All the documents with red asterisks are mandatory.

In the case of a minor, “You have to upload the documents without the asterisks also.” Click Next.

Step 9: Here, the Client Registration Form KYC, Online Trading Agreement Form, and COMPANY DOCUMENT FOR CORPORATE USERS should be submitted in PDF format. Fill out all the forms make a PDF, and upload it to the respective section. Click Next.

These forms can be downloaded from the respective broker’s website under the “Download Menu”.

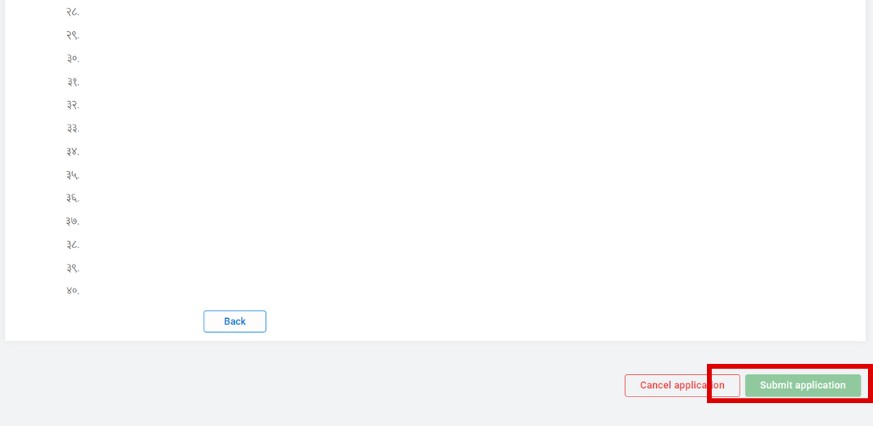

Step 10: Read the user agreement carefully and click ‘Submit Application’ to apply.

This was all you had to do from your end. Now, the broker will verify the details, and they will create a broker account for you.

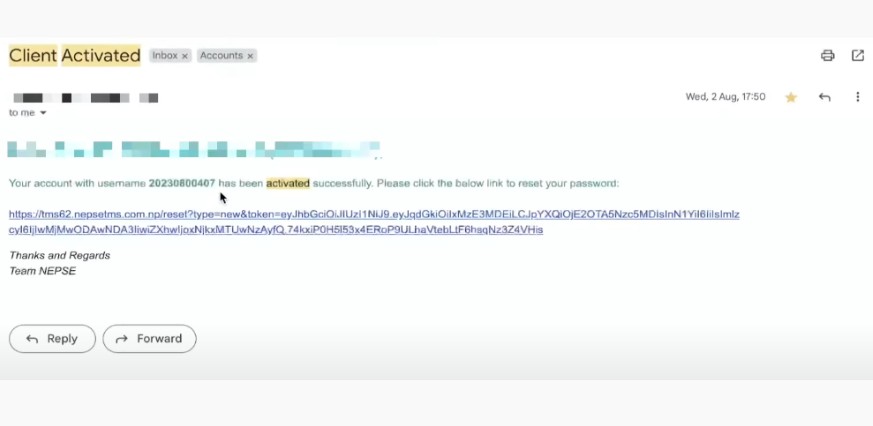

Step 11: You will be notified through an email titled ‘Client Activated’.

Step 12: Click on the provided link, and you will be redirected to another webpage. Where you can reset your password. After resetting your password, you can start trading by logging into your account.

It may be a long procedure with many details required but, this is for everyone’s safety. This was a simple and easy way to open a TMS/broker account. Don’t worry, create your broker account and begin your trading journey.

You may also like:

- Basic requirements for share trading

- Nepal Share Market: Everything you need to know

- How do I open a DEMAT account in Nepal

FAQs

Can I have more than one broker account?

Yes, you can have more than one broker account.

How much does a broker charge in Nepal?

Brokers in Nepal charge a very minimal amount. Their commission can range from 0.40 to 0.27.

What is the minimum amount to open a brokerage account?

The minimum amount to open a brokerage account depends on the brokers. So, go around and ask how much they charge.

What is the best broker account in Nepal?

So far XTB is the best broker account with a score of 4.8/10.

Is there a minimum to open a stock account?

No, there is no minimum to open a stock account.