Blogs

How to load collateral into your TMS account?

Collateral is the amount of money in your NEPSE TMS account provided by your broker. Different brokers offer different amounts of collateral, depending on their policies. Some brokers don’t offer collateral because they don’t want to take risks. When you want to trade futures or options, you need to put money in your trading account. If you don’t have enough money, your broker can lend you some extra money, called collateral.

“In simple terms, Collateral भनेको तपाईको TMS account मा भएको पैसा हो, तपाईले shares किन्दा Collateral को प्रयोग गर्नसक्नु हुन्छ। तपाईले Collateral आफै load गर्न सक्नु हुन्छ, अथवा आफ्नो broker लाई भनेर Collateral load गर्न सक्नु हुन्छ।

Some brokers provide a credit limit of up to 1 lakh if you deposit 25 thousand but you have to pay back in time. Collateral is required when you have to buy a share in the secondary market online.

How to load collateral into your TMS account?

If you want to load Collateral into your TMS account/broker account yourself follow the given steps: (आफै Collateral load गर्नको लागि तल दिएका steps follow गर्नुहोस् )

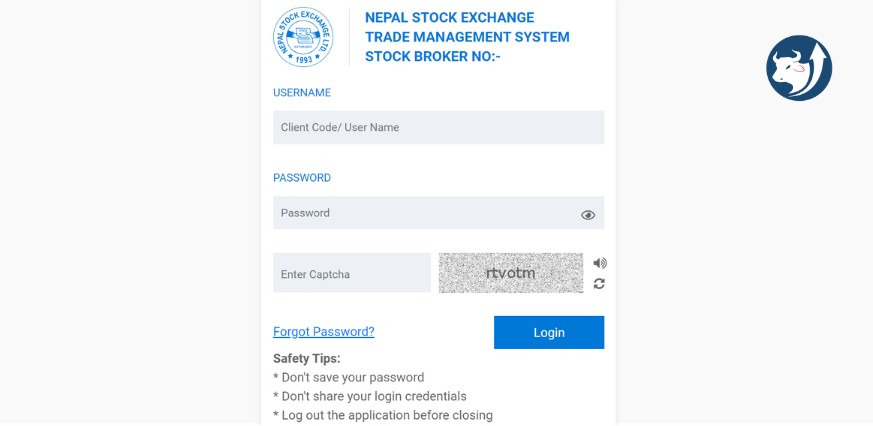

Step 1: Log in to your TMS account.

URL Format: https://tms[broker_number].nepsetms.com.np/login.

If you don’t know your broker number, then select your broker from the list of brokers in Nepal. Click on the TMS Login of your broker. Then you will be redirected to the NEPSE TMS login page.

STEP 2: The TMS login page as below will appear. Enter your credentials to log in.

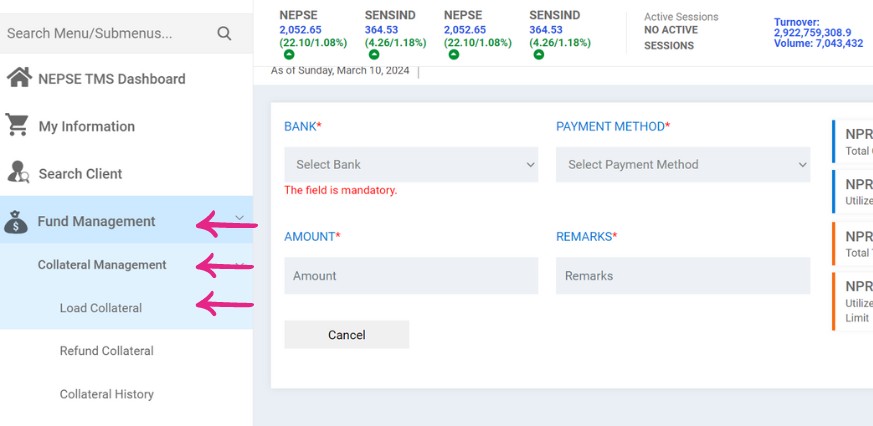

STEP 3: You will see a screen as shown below. Go to Fund Management →Select Collateral Management → Load Collateral.

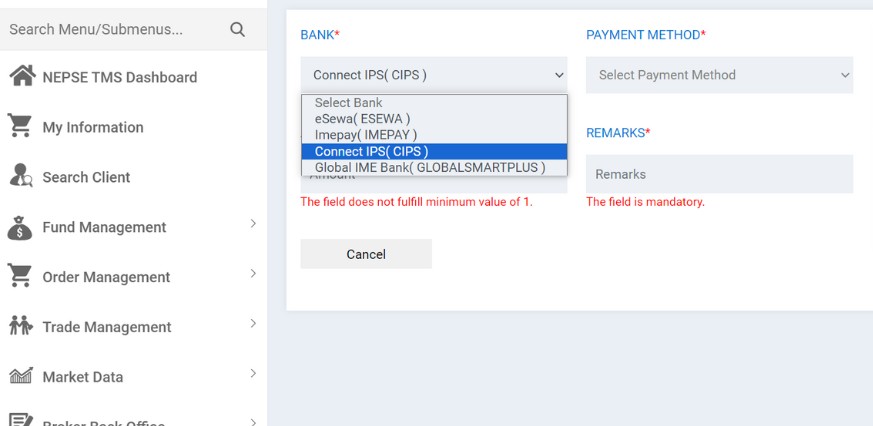

STEP 4: You have four options: eSewa, Imepay, Connect IPS (CIPS), and Global IME Bank. Select any one option. For example: let’s select Connect IPS. The process is almost the same for all the options.

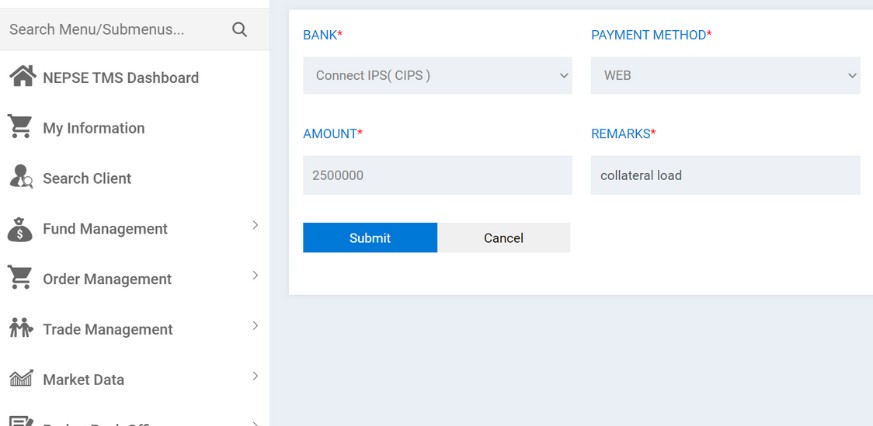

STEP 5: Select Payment Method → Enter Your Amount → Enter Remarks then click “Submit”.

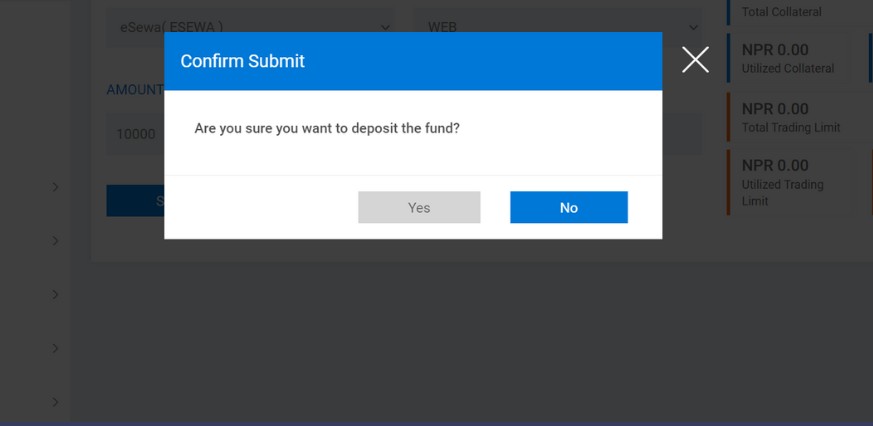

STEP 6: After submitting your request, you will see the Confirmation screen Click “Yes”.

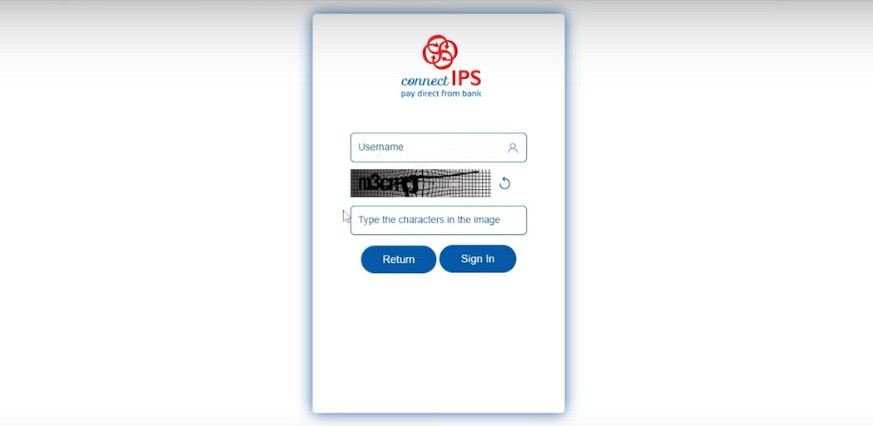

Step 7: Then you will be redirected to the connect IPS page. Enter your username, and Captcha then you will be asked to enter a password.

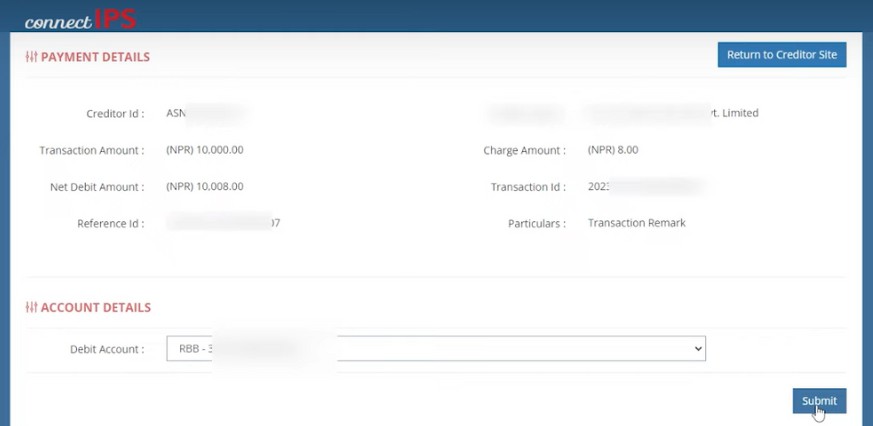

Step 8: Now you can enter the amount you want to load under the “Payment Details” and you can select your bank under the “Account Details.” Click Submit.

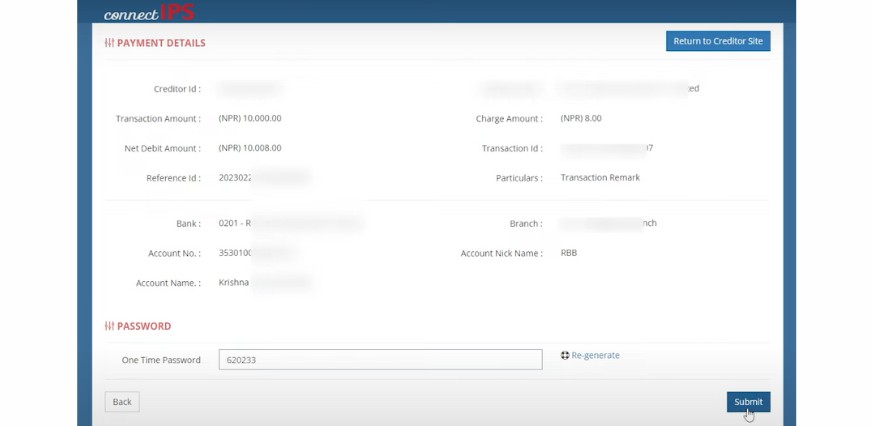

Step 9: Enter the OTP sent to your mobile. Click Submit.

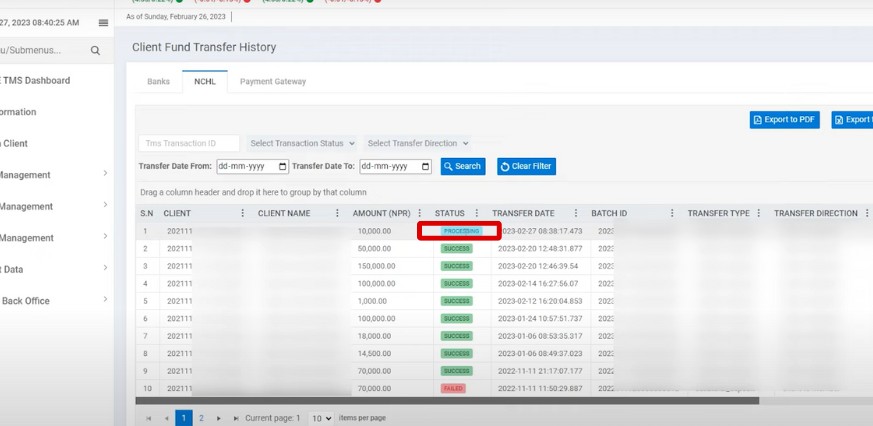

Step 10: Then you will see the dashboard as shown below, status as processing. After a few minutes, collateral will be credited to your account.

Following these steps, you can load Collateral into your TMS account. Collateral can also be loaded using eSewa, Imepay, and Global IME Bank. The process of loading collateral using other platforms is similar.

You may also like:

- Common mistakes to avoid when trading stocks

- Basics to know before starting investment in Share Market

- How to calculate WACC and transfer shares from EDIS in Meroshare

FAQs:

How to load collateral from Connect eSewa?

The steps of loading the collateral are the same for all, if you want to load collateral using eSewa then under STEP 5: Select Payment Method as eSewa → Enter Your Amount → Enter Remarks then click “Submit” and the remaining process is the same as above.

What is collateral in the share market?

What is 100% collateral?

100% collateral refers to assets or funds that are considered to have a value equal to the amount being secured. The total collateral includes both the amount received from pledging equity holdings and liquid funds. Collateral obtained from liquid funds is viewed as entirely cash when used for taking any positions.

Can I withdraw collateral?

Yes, you can withdraw collateral only if you have made a loan repayment. The cash collateral cannot be withdrawn until the loan has been fully repaid by the borrower.

Blogs

Birgunj Customs Office Collects Highest Revenue from Petroleum Imports

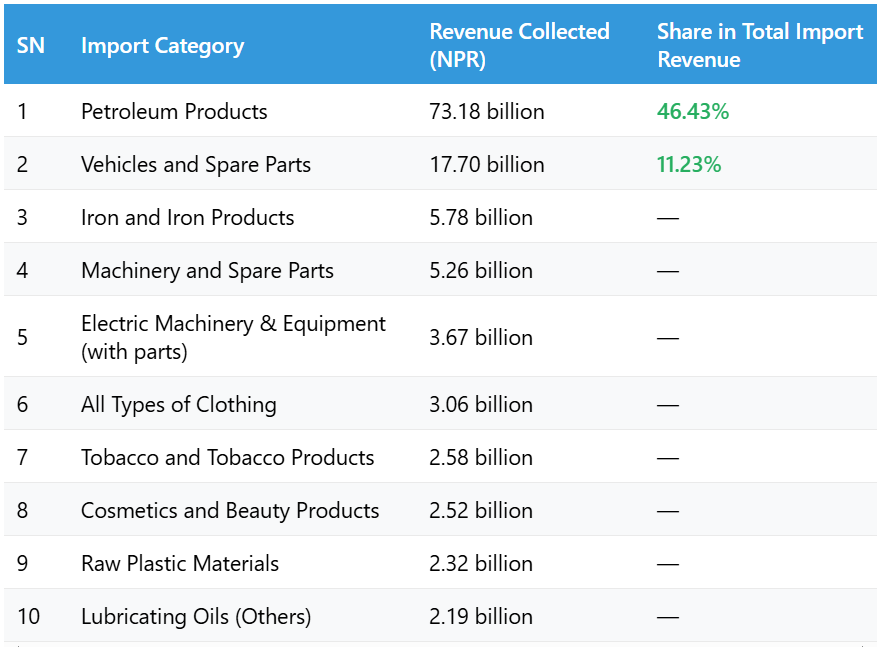

The Birgunj Customs Office has collected the highest revenue from the import of petroleum products in the first 11 months of the current fiscal year 2081/82. According to the office, a total of NPR 73.18 billion was collected in revenue from petroleum imports alone.

During this period, Nepal spent about NPR 174.09 billion to import five different types of petroleum products. These petroleum imports contributed 46.43% of the total revenue collected from the top 20 imported items, making it the most important source of income for the customs office.

Major Revenue Contributors from Imports

What Officials Say

Customs Chief Administrator Deepak Lamichhane stated that petroleum products and vehicle imports are the main sources of customs revenue at Birgunj. He highlighted that these two sectors consistently contribute the highest share of government income collected through imports.

Conclusion

The data from the Birgunj Customs Office shows that fuel and vehicles remain Nepal’s most heavily imported and taxed items. With more than 46% of the revenue coming from petroleum alone, any changes in fuel prices or import volumes can significantly affect national customs revenue.

AGM

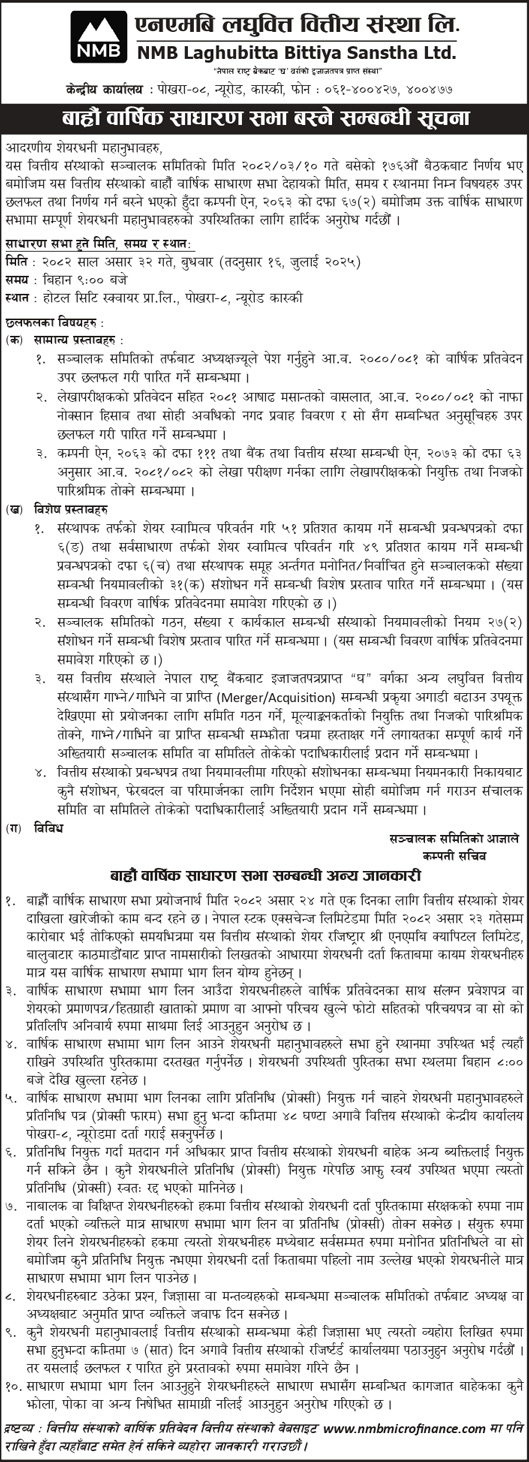

NMB Laghubitta to Hold 12th Annual General Meeting on July 16

NMB Laghubitta Bittiya Sanstha Ltd., a licensed “D” class microfinance institution by Nepal Rastra Bank, has announced its 12th Annual General Meeting (AGM). The AGM will discuss financial performance, proposed amendments, and other key matters.

Key Details of the AGM

| Topic | Details |

|---|---|

| AGM Number | 12th Annual General Meeting |

| Date | Asar 32, 2082 (Wednesday, July 16, 2025) |

| Time | 9:00 AM |

| Venue | Hotel City Square Pvt. Ltd., Pokhara-8, New Road, Kaski |

| Book Closure Date | Asar 24, 2082 (July 8, 2025) |

| Eligibility Cut-off | Shareholders registered till Asar 23 are eligible |

| Share Registrar | NMB Capital Ltd., Baluwatar, Kathmandu |

| Official Website | www.nmbmicrofinance.com |

Agenda of the AGM

A. General Proposals

-

Discussion and approval of the Chairman’s Annual Report for FY 2080/81.

-

Approval of financial statements, including balance sheet, profit & loss, and cash flow for FY 2080/81.

-

Appointment of an auditor for FY 2081/82 and determination of their remuneration.

B. Special Proposals

-

Amendments in MoA/Bylaws regarding:

-

Promoter and public shareholding ratio to be set at 51% and 49% respectively.

-

Number of directors representing promoter shareholders.

-

-

Changes in board formation, number of members, and tenure.

-

Authorization to initiate a merger/acquisition with other “D” class microfinance institutions.

-

Authorization to make further amendments based on regulatory directives from Nepal Rastra Bank.

C. Miscellaneous

-

Discussion of any shareholder queries.

-

Clarifications will be provided by the Chairman or an authorized person.

Important Instructions for Shareholders

-

Share registration will be closed on Asar 24 for AGM purposes.

-

To attend the AGM, shareholders must carry:

-

Entry pass (attached to the annual report)

-

Share certificate or Beneficiary (BO) Account proof

-

Valid ID with photo

-

-

Shareholders must sign the attendance book at the venue starting from 8:00 AM.

-

Shareholders may appoint a proxy representative; however, the proxy form must be submitted at least 48 hours before the meeting.

-

Minor or mentally disabled shareholders must be represented by their registered guardians.

-

No bags or restricted items will be allowed inside the AGM venue.

-

Any shareholder inquiries must be submitted in writing at least 7 days in advance to the registered office.

Notice: NMB Laghubitta 12th Annual General Meeting (AGM)

Blogs

Private Power Producers Protest ‘Take and Pay’ Provision in Budget

Private energy entrepreneurs in Nepal have taken to social media, protesting the government’s decision to introduce the ‘Take and Pay’ (Liu Ra Tir) system for electricity purchase agreements (PPA) in the new fiscal year budget.

Under this system, the government would only pay for the electricity it uses, instead of paying for the total electricity generated by hydropower projects. Entrepreneurs argue this move could severely hurt the private sector, discourage investment, and push the country back toward power shortages.

Online Campaign Targets Top Officials

Energy producers are now directly appealing to key government figures. They have publicly tagged Prime Minister Pushpa Kamal Dahal, Finance Minister Barshaman Pun, Energy Minister Shakti Bahadur Basnet, and NEA Executive Director Kulman Ghising on social media, urging them to withdraw the Take and Pay provision.

This digital campaign comes just days after developers handed over a memorandum to the Prime Minister and bombarded top officials with hundreds of SMS messages requesting the same.

Why Are Entrepreneurs Worried?

Entrepreneurs claim that this decision will:

- Weaken the private sector’s role in the energy industry

- Risk the return of load-shedding (power cuts)

- Causes financial losses to investors

- Damage the overall economy

The Independent Power Producers’ Association of Nepal (IPPAN) has strongly opposed the provision. According to IPPAN’s Vice President and protest coordinator Mohan Kumar Dangi, the policy shift will discourage private hydropower development, especially for Run-of-River (RoR) projects, which are most affected by the new model.

Ongoing Protests and Next Steps

Since Asar 6, private power developers have been staging a phase-wise protest. On the third day of their movement, they moved their campaign to social media to raise public awareness and pressure the government.

Dangi warned that if the government ignores these peaceful efforts, the protests will escalate. Planned steps include:

- Lobbying political party leaders in Parliament

- Launching a nationwide street protest

- Returning the keys of privately built hydropower projects to the government — a symbolic act of handing over control

Background: The Budget Controversy

The controversy started when the budget for FY 2082/83 (announced on Jestha 15) stated that all future PPAs for RoR hydropower projects would be done under the Take and Pay model only. This was a major change from the previous Take or Pay model, where producers were paid even if electricity wasn’t consumed, offering more security for private investors.

Conclusion

The ‘Take and Pay’ decision has sparked serious concerns across Nepal’s private energy sector. Developers fear this could lead to a slowdown in future hydropower investments, and possibly, a return to unstable electricity supply. With pressure mounting both online and offline, the government’s next move will be critical for the future of Nepal’s energy landscape.

-

Blogs3 days ago

Blogs3 days agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs3 days ago

Blogs3 days agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs6 days ago

Blogs6 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs3 days ago

Blogs3 days agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs3 months ago

Blogs3 months agoPure Energy IPO For General Public

-

Blogs3 days ago

Blogs3 days ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs1 week ago

Blogs1 week agoBanks Invest Rs. 16.45 Trillion in Directed Loans, 14% in Agriculture Sector | Says Nepal Rastra Bank