SIP: What is SIP investment in Nepal?

SIP is a popular, safe, and effective way for investors to achieve their financial goals. SIP investment over time benefits from rupee-cost averaging, compounding, and professional fund management. In this article, you will learn the basics of SIP investment.

What is SIP?

SIP stands for Systematic Investment Plan. SIP is a method of investing money regularly in mutual funds. Instead of making a lump-sum investment, you contribute a fixed amount at regular intervals, typically monthly.

SIP भनेको Mutual Funds मा नियमित रूपमा पैसा लगानी गर्ने एउटा सुरक्षित तरिका हो, जहाँ तपाईंले लगानी गरे बापत घाटा हुने सम्भावना कम हुने गर्छ। एकमुष्ट लगानी गर्नुको सट्टा, तपाइँ नियमित अन्तरालहरूमा, सामान्यतया मासिक रूपमा एक निश्चित रकम invest गर्नुहुन्छ।

Several mutual funds allow you to invest in the SIP scheme. As of 2024, 33 closed-end mutual funds and 7 open-ended mutual funds are listed in the Nepal Stock Exchange.

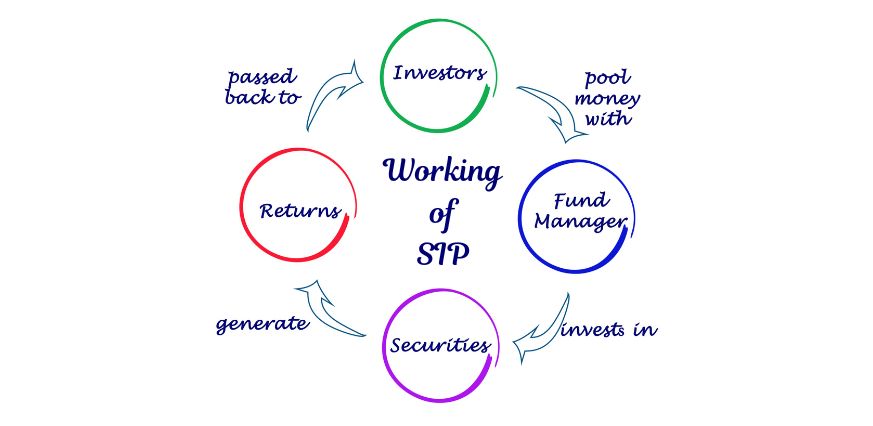

How does SIP work?

In SIP, you invest a fixed amount regularly in a mutual fund weekly, monthly, quarterly, or semi-annually depending upon your choice. The amount you invest depends on the fund’s price at that time. If the price is low, you get more units, and if the price is high, you get fewer units. This is called rupee-cost averaging which helps balance out the ups and downs in the market. This strategy could help you get better returns in the long run.

Example: Let’s say, Sita decides to start a SIP investment with NPR 5,000 per month. She chooses a mutual fund that historically has provided an average annual return of 12%. Here’s how her investment might grow over time:

Month 1:

- Sita invests NPR 5,000.

- With a 12% annual return, her investment grows to NPR 5,600 (NPR 5,000 principal + NPR 600 return).

Month 2:

- Sita invests another NPR 5,000.

- Her total investment is now NPR 10,000.

- With a 12% annual return, her investment grows to NPR 11,200 (NPR 10,000 principal + NPR 1,200 return).

Month 3:

- Sita invests another NPR 5,000.

- Her total investment is now NPR 15,000.

- With a 12% annual return, her investment grows to NPR 16,800 (NPR 15,000 principal + NPR 1,800 return).

As Sita keeps investing NPR 5,000 every month regularly, her invested money will grow more and more because of the compounding effect of SIP. This will help to grow her savings slowly and achieve her financial goals in the long run.

What are the benefits of SIP?

- It helps to keep you financially disciplined and encourages you to save.

- It helps to grow your wealth by the power of compounding.

- The mutual fund is managed by professionals who make financial investment decisions. It means that you do not have to worry about investments because the professionals know what they are doing.

- You can achieve your big capital goals with SIP. You can buy the car you want or buy a house.

What is a SIP calculator?

The SIP calculator is a calculator that allows you to calculate how much you will have after a certain amount of time, at a certain rate on your regular deposits.

The SIP calculator shows how much you can gain when you deposit a fixed amount.

You can manually calculate SIP returns using this formula:

M = P x [{(1 + i) ^ n – 1} / i] x (1 +i)

Where,

- M = the total amount you receive on maturity.

- P = the amount you invest at regular intervals.

- i = the periodic rate of interest.

- n = the number of payments you have made.

How to renew your SIP?

Most of the time, your SIP is renewed automatically. But, you can ask your mutual fund to stop the automation process, if you do not want the automation process, you can ask your mutual fund to stop. But if your term ends after maturity, it does not get renewed.

FAQs

What is SIP in Nepal?

SIP stands for Systematic Planned Investment. The individuals invest a fixed amount in a certain mutual fund scheme, quarterly or monthly for a . This recurring investment is compounded over time.

Is SIP safe to invest in?

Yes, SIP is a safe way to invest and build your wealth. It is a long process and requires you to be aware of what you’re doing and keep up with the regular deposits.

How many open-ended mutual funds are there in Nepal?

As of 2024, there are 7 open-ended mutual funds.

Is SIP legal in Nepal?

Yes, SIP is legal in Nepal.

How many close-ended mutual funds are there in Nepal?

33 close-ended mutual funds in Nepal are listed on the Nepal Stock Exchange.

What is better SIP or FD?

It depends on what your goal is if you want to preserve capital, you can invest in a fixed deposit. But if you want a high return, you should invest in SIP.

Conclusion

SIP investment is one of the different ways you can accumulate wealth. Not only will it help you put an end to your bad spending habits, but the compounding effect will compound your interest and principal deposit.

You do not have to worry about bad investments too, because a group of experienced professionals will make informed decisions on your behalf. It is secure but, just make sure to understand the scheme you plan on applying for.