On February 2, the stock market recorded a 69.80-point increase, closing at 2,727.58, marking a 2.62% rise from the previous trading day. The market exhibited volatility but followed an overall positive trend, closing higher. Total turnover surged to NPR 12.95 Arba, significantly up from NPR 9.40 Arba.

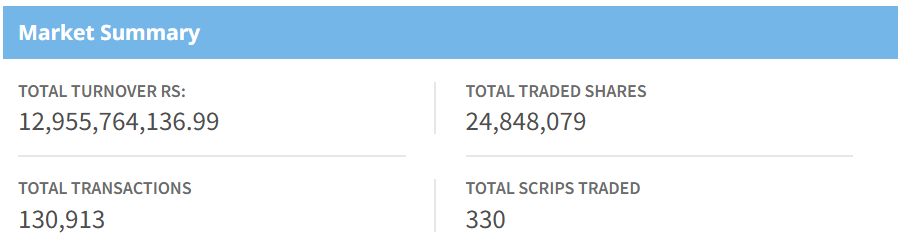

Market Summary

By the end of the trading day, the market summary shows that 24,848,079 shares were traded through 130,913 transactions involving 330 scrips. Among these, 202 companies experienced price gains, 37 saw declines, and 3 remained unchanged. The overall market sentiment remained positive, with increased buying activity.

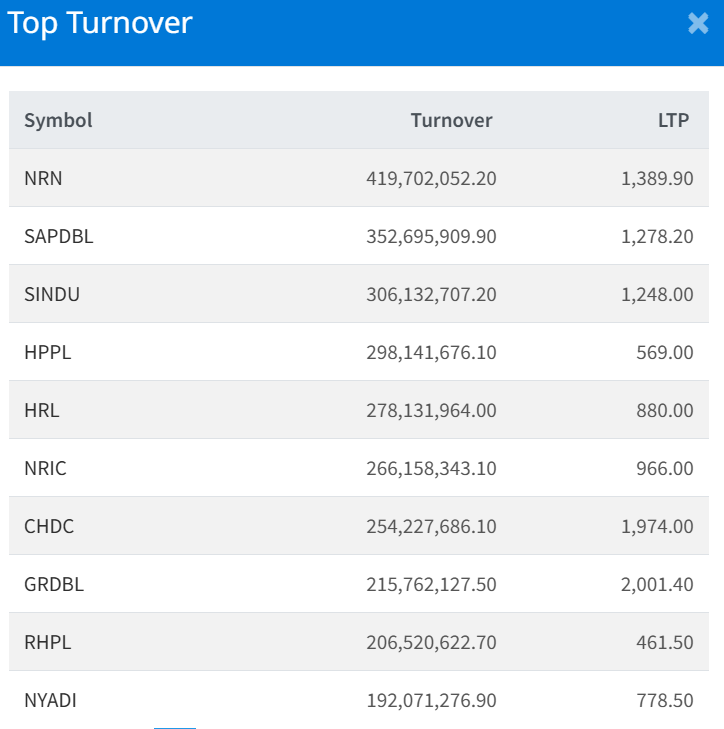

Top Turnover

NRN Infrastructure and Development Limited (NRN) recorded the highest turnover at NPR 41.97 crores. Its stock price climbed to Rs. 1,389.90, up from Rs. 1,322.00.

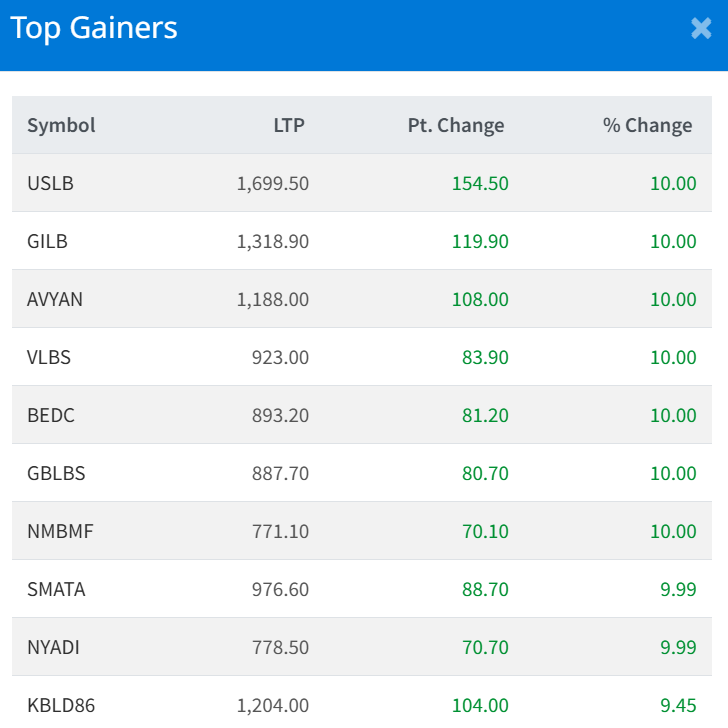

Top Gainer

Seven companies hit the positive circuit with a 10% price increase, while two others came close with a 9.99% rise.

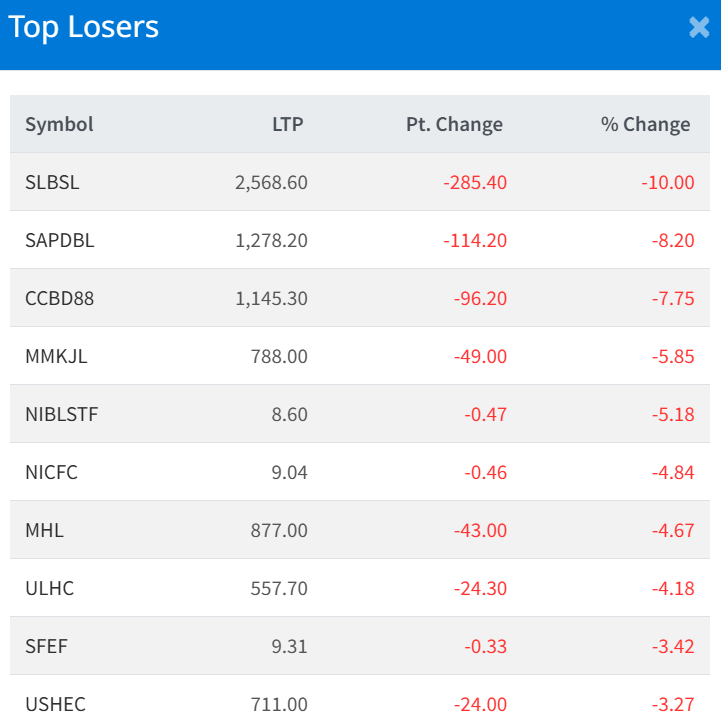

Top Losers

Conversely, Samudayik Laghubitta Bittiya Sanstha Limited (SLBSL) was the biggest loser, dropping 10%, with a last traded price (LTP) of Rs. 2,568.60.

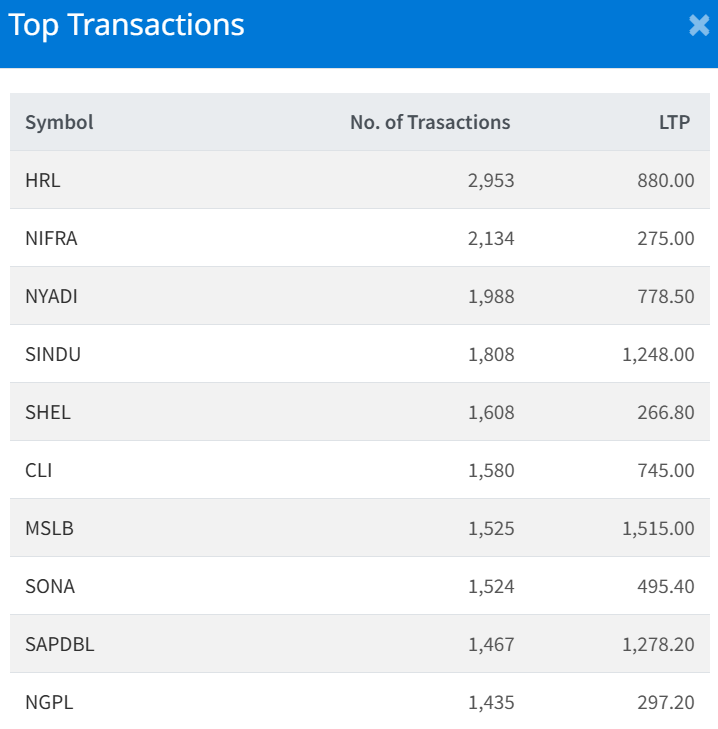

Top Transaction

In trading activity, Himalayan Reinsurance Limited (HRL) recorded the highest number of transactions, completing 2,953 trades at an LTP of Rs. 880.00.

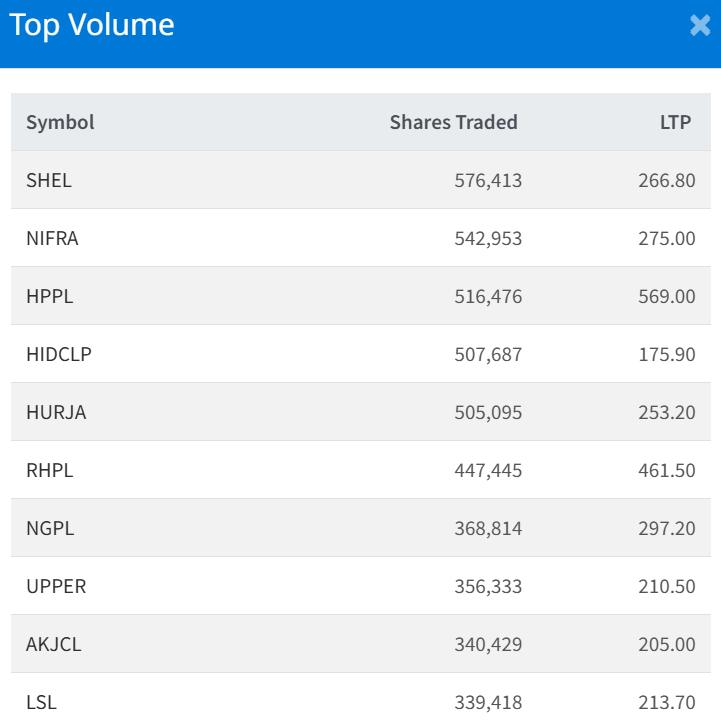

Top Volume

Singati Hydro Energy Limited (SHEL) led in trading volume, with 576,413 shares traded at an LTP of Rs. 266.80.

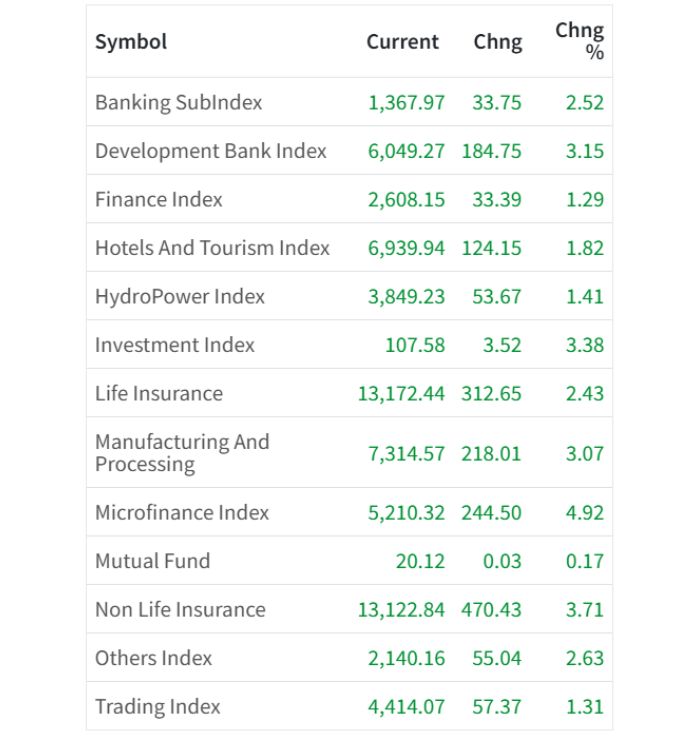

Sector-wise Performance

All sectors closed in green, indicating broad-based market optimism.

- Microfinance Index: Gained the most, rising by 4.94%.

- Mutual Fund Index: This had a slight decline, dropping by 0.17%.

The market ended the day on a strong positive note, with higher turnover and broad gains across sectors.