Nepal Rastra Bank (NRB) is preparing to identify and classify large banks as Systemically Important Banks (SIBs) within the current fiscal year. These banks will be regulated and supervised under a separate framework, different from smaller banks.

What Are Systemically Important Banks?

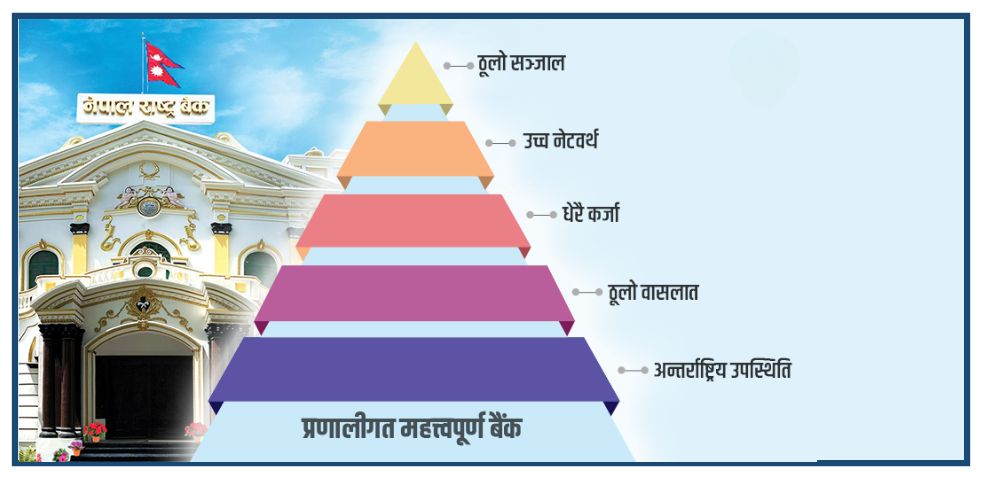

Systemically Important Banks are large financial institutions whose failure could severely impact the overall banking system and economy. These banks have a large network, high net worth, and significant presence in both domestic and international markets. If one of these banks fails, it can create a ripple effect that disturbs the financial system.

Why Is This Classification Important?

According to international standards like the Basel Committee on Banking Supervision, countries must identify and regulate banks that pose higher risks to the financial system. The Capital Adequacy Framework 2015 of Nepal has also mentioned systemically important banks.

Dr. Chiranjeevi Nepal, a former governor, had proposed a special regulatory mechanism in the monetary policy of FY 2075/76 to identify and supervise these banks. However, the plan was delayed due to the focus on bank mergers under Governor Maha Prasad Adhikari.

New Framework Almost Ready

According to Guru Paudel, Executive Director of NRB’s Regulation Department, the framework to identify these banks is in the final stage. It will be ready within this fiscal year, and from the next fiscal year, classification and regulation will begin.

The classification will be based on:

-

Size of the bank’s assets and balance sheet

-

Business volume

-

Number of branches

-

Use of complex financial tools

-

Presence in international markets

-

High volume of credit lending

Banks with larger size and more complex operations will be selected as SIBs.

Special Supervision for SIBs

The new framework will not only define what makes a bank systemically important but will also include specific regulatory and supervisory mechanisms for those banks. The aim is to prevent problems in large banks from spreading to the whole financial system.

Guru Paudel explained, “Big banks need proper monitoring. If such banks face issues, it could impact the whole economy. That’s why all banks should not be treated the same.”

Global Practices

Countries like India, the US, UK, China, Russia, and Canada have already implemented such frameworks. In India, the Reserve Bank of India has classified SBI, ICICI Bank, and HDFC Bank as systemically important banks.

This practice gained global attention after the 2008 financial crisis, which showed how the failure of a few big banks could bring down entire economies. In 2010, the Basel III guidelines were introduced to manage these risks. The Financial Stability Board (FSB), including G20 nations, now publishes a list of globally important financial institutions.

Nepal Rastra Bank’s Plan

NRB is preparing to follow global standards by:

-

Increasing capital requirements for SIBs

-

Applying capital surcharges and buffer capital

-

Managing liquidity risks

-

Strengthening risk management methods

Why Now?

Although no single bank in Nepal holds over 10% of the total banking system’s assets, the overall size of many banks is growing rapidly. Also, there has been a rising trend of excessive credit expansion by some banks, which is a major concern for the economy.

Bankers and financial experts have also demanded timely action to identify and regulate such banks to prevent potential financial instability.

Conclusion

Nepal Rastra Bank is taking a significant step by identifying and regulating systemically important banks. This move will strengthen Nepal’s financial system and ensure long-term economic stability. With a proper framework in place, large banks will be closely monitored to avoid systemic risks in the future.