Recently, 20 commercial banks in Nepal shared their financial reports for the third quarter of the current fiscal year. The data shows that 10 banks experienced a decline in their Earnings Per Share (EPS) compared to the same period last year.

Key Highlights

- 10 out of 20 banks saw a drop in EPS.

- NIC Asia Bank and Himalayan Bank recorded the largest declines in EPS.

- Everest Bank has the highest EPS among all commercial banks in Q3.

- NIC Asia Bank has the lowest EPS.

EPS Changes (Compared to Last Year)

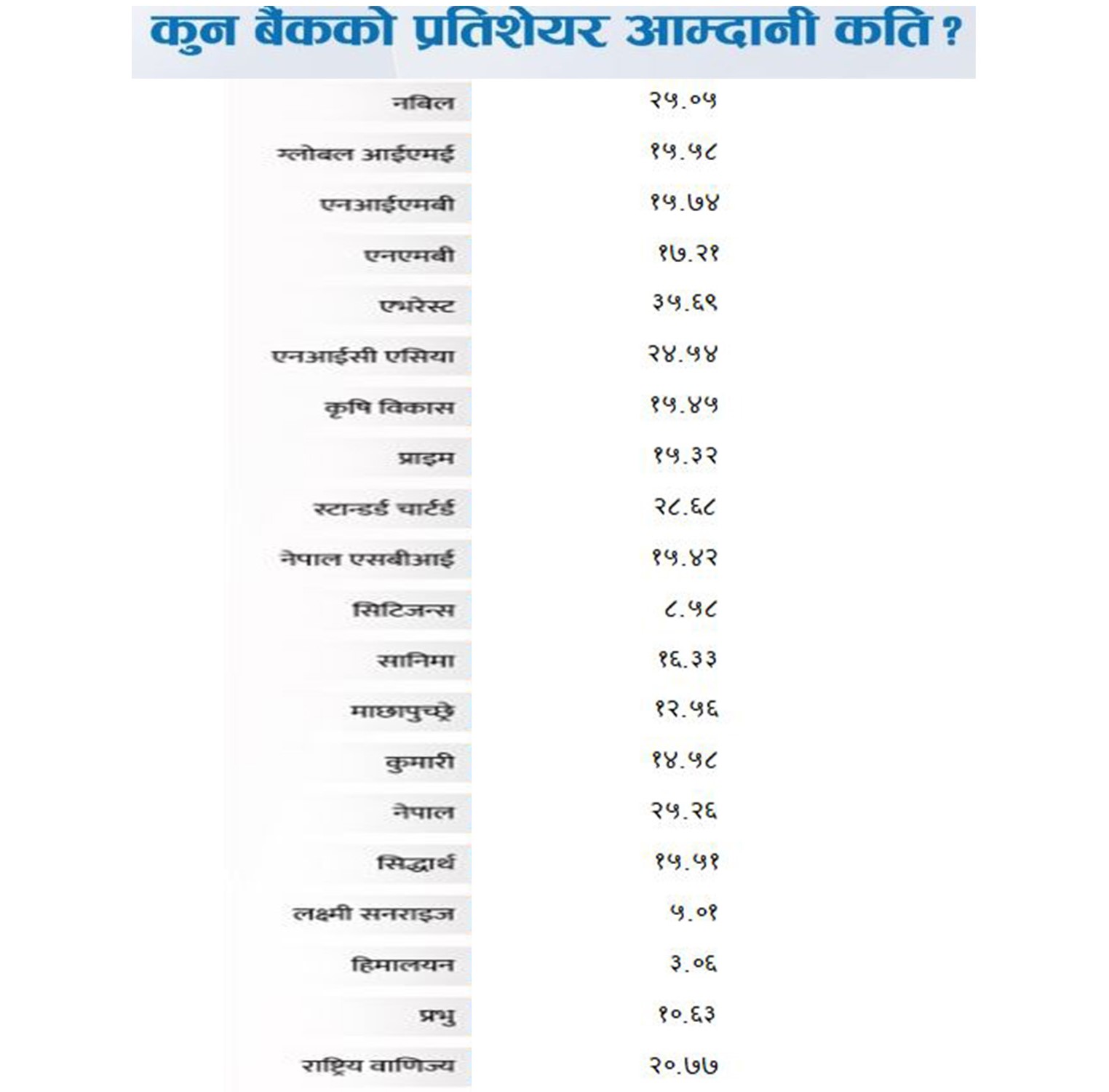

Current EPS of Major Banks

EPS of Commercial Banks in Q3

Important Notes

- Everest Bank leads with the highest EPS (₹35.61), while NIC Asia Bank has the lowest (₹1.45).

- Standard Chartered Bank recorded the highest Earnings Per Share (EPS) of ₹34.60 last year, which has declined to ₹28.86 this year.

- Most banks faced reduced profits due to economic challenges or increased operational costs.