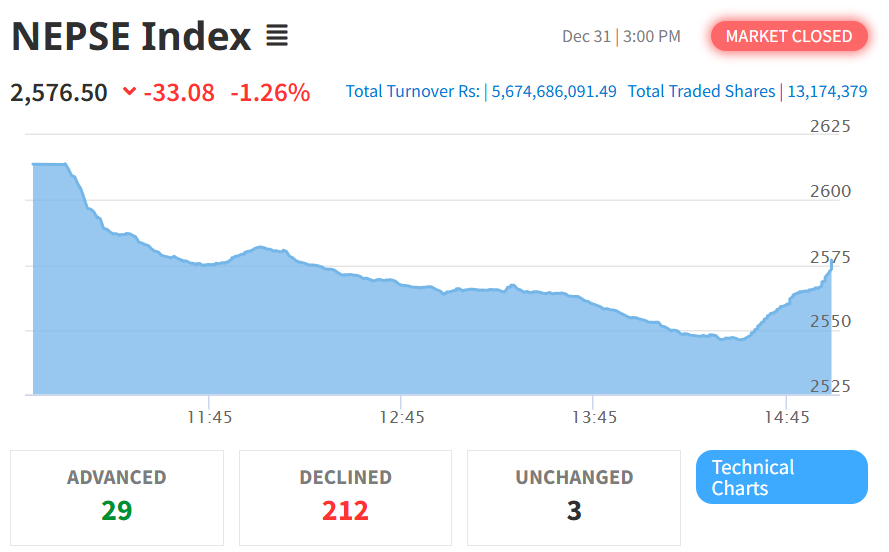

On December 31 (16th Poush), the stock market declined by 33.08 points, closing at 2,576.50, a 1.26% decrease compared to the last trading day. Despite the overall decline, turnover increased to NPR 5.67 Arba, up from NPR 5.47 Arba. The market was unstable throughout the day, reaching a low of 2,546.11, and recovered slightly before closing.

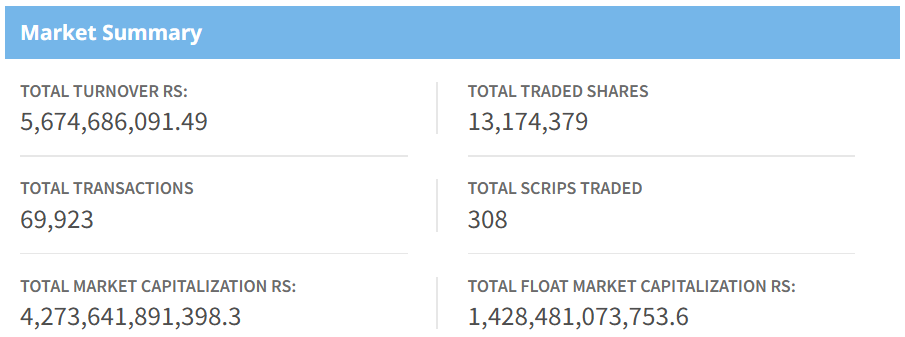

Market Summary

By the end of the trading session, the market summary shows that 13,174,379 shares were traded through 13,174,379 transactions involving 308 scrips. Among the traded companies, 29 experienced a rise in stock prices, 212 saw declines, and 3 remained unchanged. The overall market sentiment remained negative, with the majority of shares being sold.

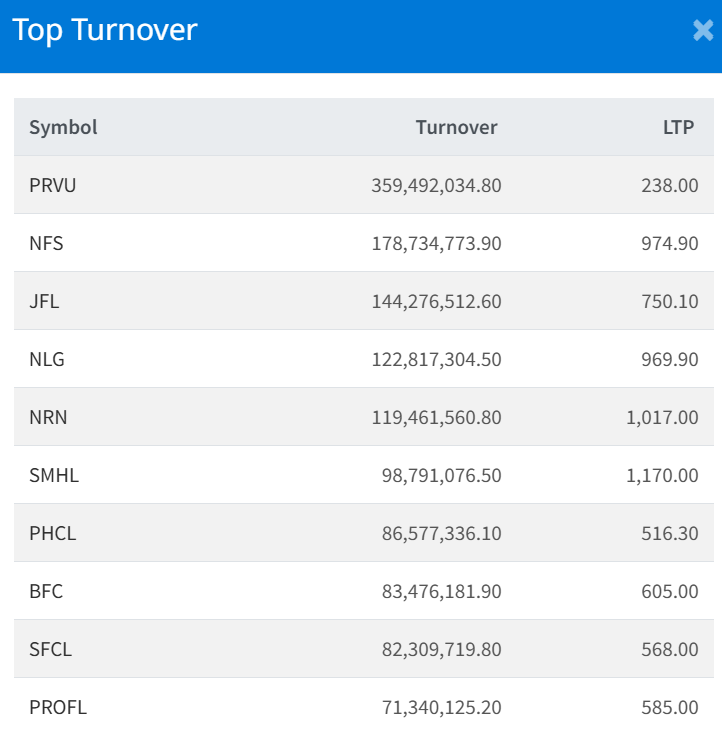

Top Turnover

Prabhu Bank Limited (PRVU) led the turnover chart with NPR 34.94 crores in total trades. It closed at Rs. 238 per share, down from the previous trading day’s close of Rs. 241.10.

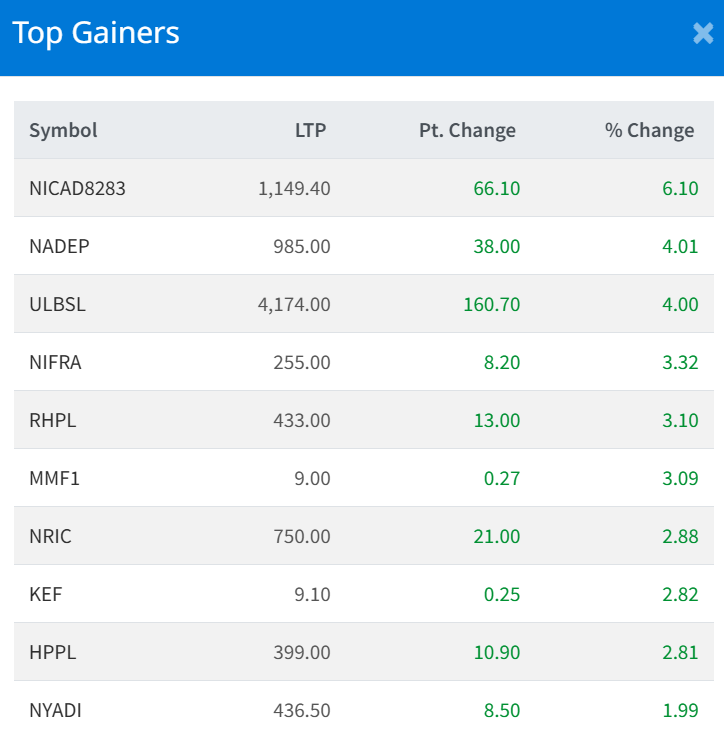

Top Gainer

11% NIC Asia Debenture 082/83 (NICAD8283) achieved the highest growth, increasing by 6.10% to close at Rs. 1,149.40, up from the previous day’s price of Rs. 1,083.30. However, the top Gainers of today’s market are as follows:

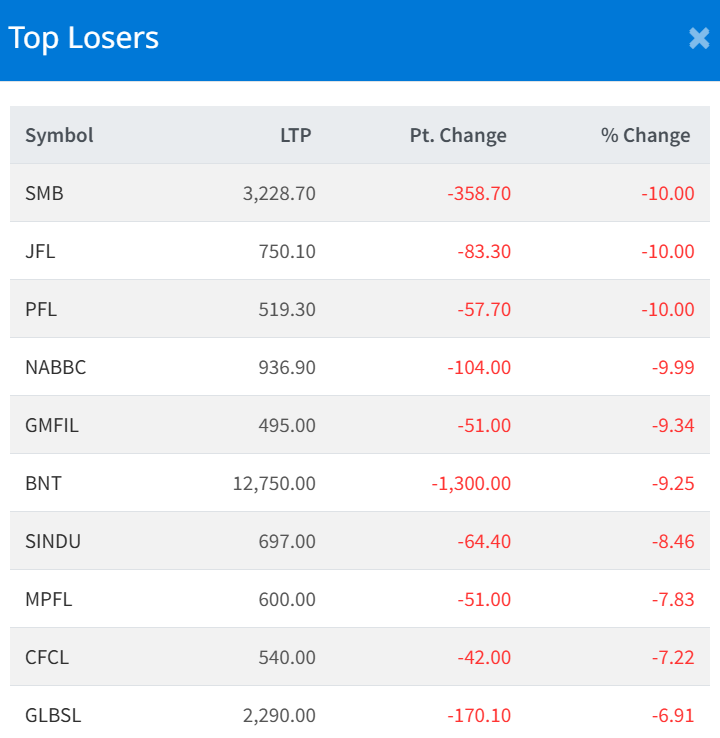

Top Loser

Three companies—Support Microfinance Bittiya Sanstha Ltd. (SMB), Janaki Finance Company Limited (JFL), and Pokhara Finance Limited (PFL)—experienced the maximum decline of 10.00%, while Narayani Development Bank Limited (NABBC) followed closely with a 9.99% drop. However, the top Losers of today’s market are as follows:

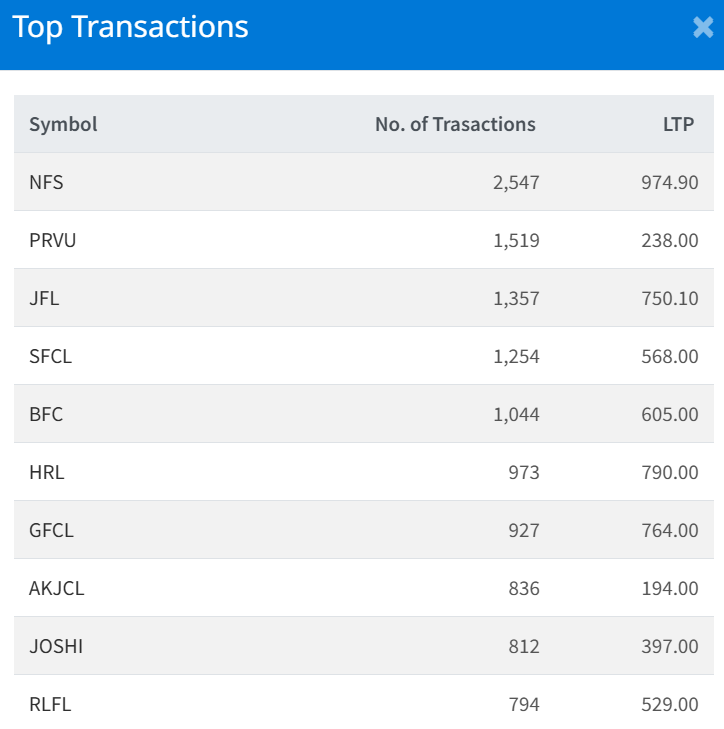

Top Transaction

Nepal Finance Ltd. (NFS) recorded the highest number of transactions, completing 2,547 trades at a last traded price of Rs. 974.90.

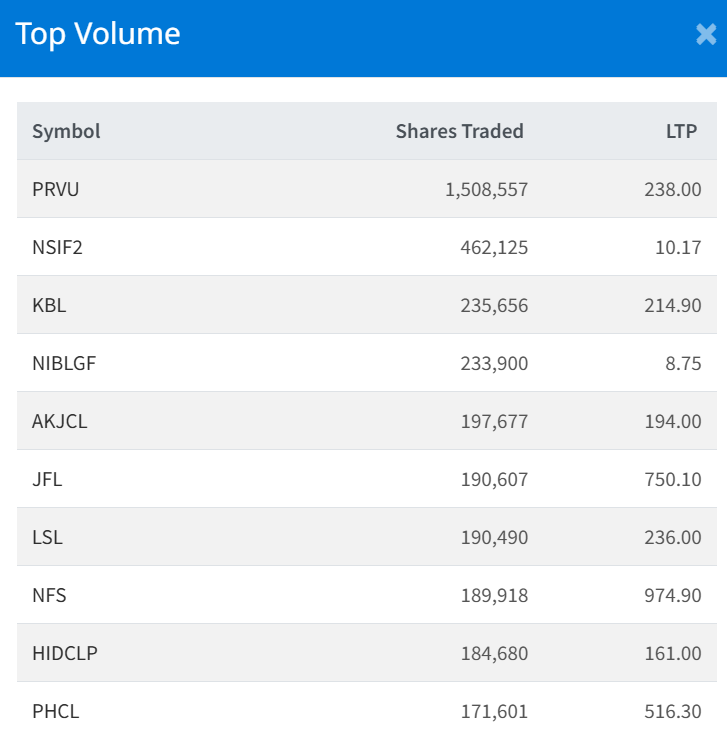

Top Volume

Prabhu Bank Limited (PRVU) also led in trading volume, with 1,508,557 shares traded at a closing price of Rs. 238.00.

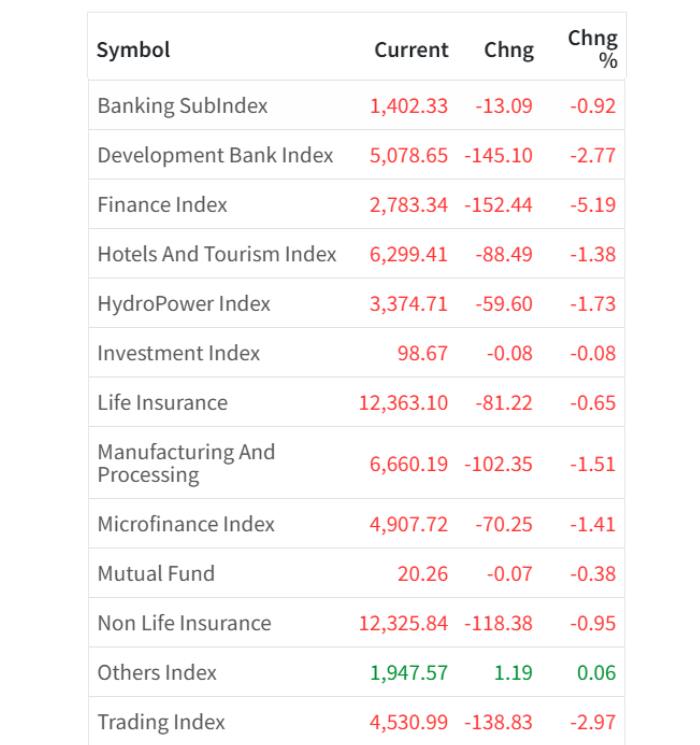

Sector-wise Performance

All sectors closed in the red, except the Others Index, which showed a marginal gain of 0.06%.

- Finance Index: Recorded the largest decline, dropping by 152.44 points (5.19%).

- Investment Index: Showed the smallest decline, falling by 0.08 points.

The overall trend of the market remained bearish, reflecting widespread selling pressure across sectors.