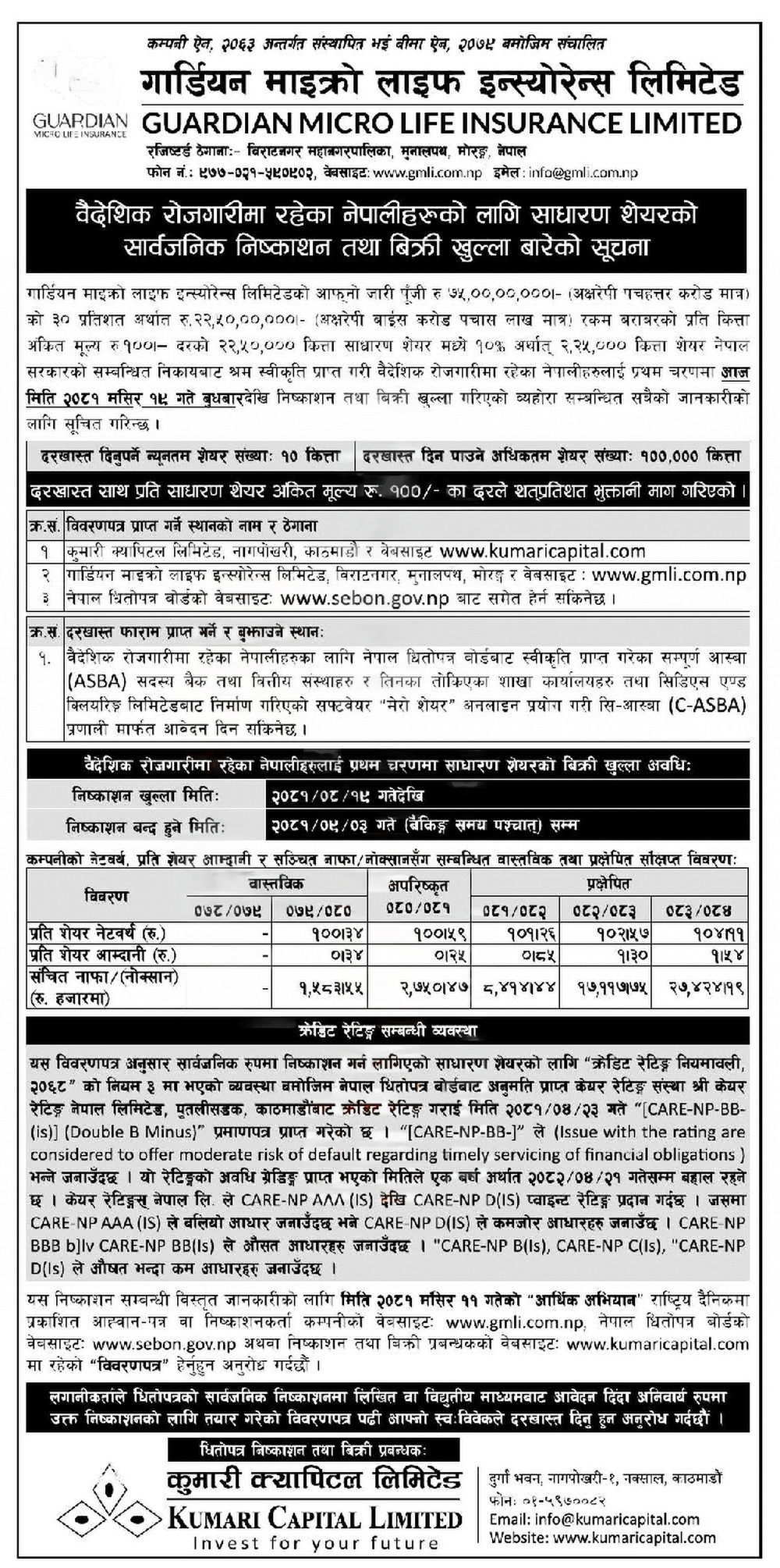

Guardian Micro Life Insurance Limited has opened its Initial Public Offering (IPO) today, Mangsir 19, for Nepalese citizens residing abroad. The IPO will close on Poush 3, 2081 and the date will not be extended.

IPO Details:

Guardian Micro Life Insurance has separated 2,25,000 units of shares worth 2 crores 25 lakh Nepalese Working Abroad which is 10% of the total share of 22,50,000 units (total shares allocated for the public). The price per IPO share is fixed at Rs. 100.

According to the agreement between the companies Kumari Capital will manage the IPO issuance, where each individual applying for the IPO can submit their application as follows:

- Minimum Application: 10 units.

- Maximum Application: 1,00,000 units.

- Issue Manager: Kumari Capital.

The result of this IPO insurance will be published within one week after the allotment. Following this allotment Guardian Micro Life Insurance will open IPO Insurance for the General Public residing in Nepal.

Credit Rating:

Additionally, for the individuals thinking about the company status, the company has been assigned a CARE NP Double B Minus Issuer Rating by CARE Ratings Nepal, indicating moderate risk in meeting financial obligations.

Read Now: Total IPO shares of Guardian Micro Life Insurance approved by SEBON