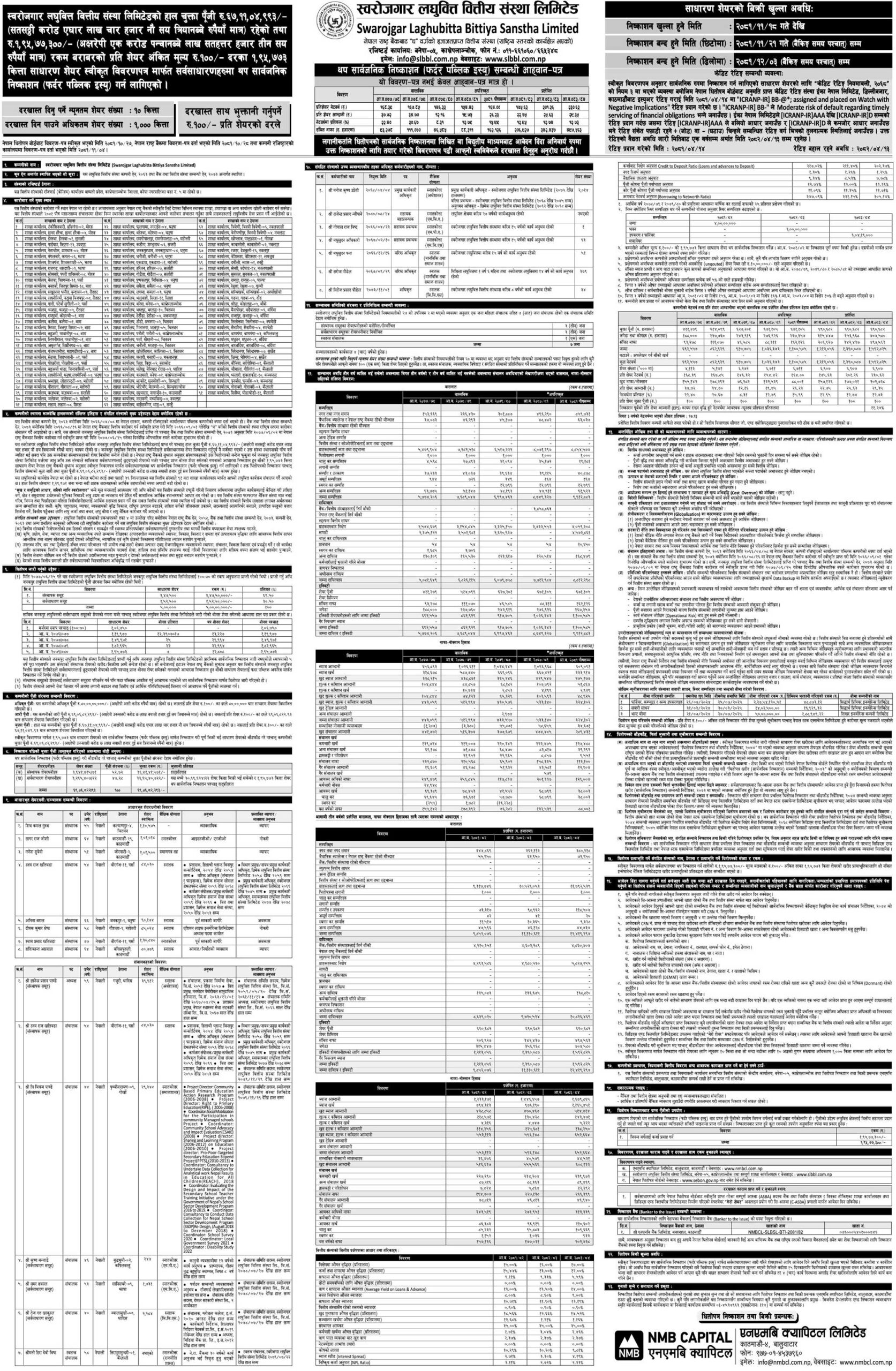

Swarojgar Laghubitta Bittiya Sanstha Limited (SLBBL) has published an offer letter for its Further Public Offering (FPO), providing an opportunity for the general public to invest in the company. Below are the key details of the FPO:

Application Details

To apply, you need to request at least 10 units, but you can apply for up to 1,000 units. The application process is done through C-ASBA, which means you must apply using banks or financial institutions that are approved for this system.

- Rating Agency: ICRA Nepal.

- Issuer Rating: [ICRANP-IR] BB-.

- Outlook: Watch with Negative Implications.

- Interpretation: The rating indicates a moderate risk of default in meeting financial obligations. The BB-rating reflects SLBBL’s relative position within its category but does not apply to any specific debt instrument.

What This Means for Investors

- Investment Opportunity: The FPO offers a chance to invest in a microfinance institution at face value of Rs. 100 per share.

- Risk Consideration: The BB rating suggests moderate risk, so investors should carefully assess their risk appetite before investing.

- Growth Potential: The funds raised will support SLBBL’s expansion and operational improvements.

Conclusion

Swarojgar Laghubitta Bittiya Sanstha Limited (SLBBL) is issuing 1,95,773 unit FPO shares at a face value of Rs. 100 per share, aiming to raise Rs. 1.95 crores. With NMB Capital Limited as the issue manager, the FPO process is expected to be transparent and efficient. However, investors should note the BB-issuer rating, which indicates a moderate risk of default. This FPO provides an opportunity to invest in SLBBL’s growth while contributing to the microfinance sector’s development.

Notice: Swarojgar Laghubitta Bittiya Sanstha To Issue FPO From Falgun 18