कम्पनी समाचार

World Bank Extends Rs. 13.33 Billion Concessional Loan to Nepal Government

Nepal’s government decided to get a special loan of Rs. 13.33 billion from the World Bank to help with different projects. They made this decision during a meeting last Wednesday. Around $100 million loan is for developmental initiatives assisting Nepal to grow.

They told everyone about this decision during a news conference by the Ministry of Communications and Information Technology on May 3. They also said the government said yes to Attorney General Dr. Dinmani Pokharel and Deputy Attorney General Sanjeev Raj Regmi to go to a meeting in New Delhi on May 7.

Also, Minister Rekha Sharma said that the government agreed for Chief Election Commissioner Dinesh Kumar Thapaliya to go to India from May 4 to 9 to watch elections there. The government wants to change the design of the Rs. 100 note. They’ll replace the old map of Nepal with a new one.

Minister Sharma said they approved a plan for Nepal’s Supreme Court and India’s Supreme Court to work together better. They also okayed a plan for Nepal’s Ministry of Foreign Affairs to work closer with Spain.

They also picked a new person, Shrawan Kumar Gautam, to lead the Problematic Cooperatives Management Committee. They also canceled the National Information and Technology Development Committee (Formation) Order from 2058 BS. And they moved some secretaries around to make things work better.

You may also like:

Blogs

Sampada Laghubitta Reports Strong Profit Growth in Q3 of FY 2081/82

Sampada Laghubitta Bittiya Sanstha has shown a solid financial performance in the third quarter of fiscal year 2081/82. The microfinance company earned a net profit of Rs. 10.70 crores, which is a big rise of 74.88% compared to Rs. 6.12 crores during the same quarter last year.

The company’s earnings per share (EPS) also improved, reaching Rs. 20.37, up from Rs. 11.65. Strong lending activities mainly supported this growth. Its net interest income jumped by 127.54%, reaching Rs. 48.33 crores, compared to Rs. 21.24 crores in the previous year.

Loan disbursements increased slightly by 3.22%, totaling Rs. 10.06 Arba. Customer deposits also grew by 3.85%, reaching Rs. 2.64 Arba. On the other hand, the company’s total borrowings dropped by 3.45%, settling at Rs. 6.33 Arba.

Employee-related expenses almost doubled, increasing by 93.61% to Rs. 23.47 crores. Moreover, the company faced a huge jump in impairment costs, which shot up to Rs. 5.87 crores from just Rs. 7.23 lakhs a year earlier. This shows the company has set aside more money to cover possible loan losses.

Even with the rising costs, Sampada Laghubitta managed to grow its operating profit to Rs. 15.29 crores, a 74.88% increase, reflecting its overall strong performance. However, after making necessary adjustments and allocations, the company ended the quarter with a negative distributable profit of Rs. 72.89 lakhs.

The capital adequacy ratio slightly decreased to 8.46% from 8.50%, and the percentage of non-performing loans (NPL) rose to 6.71% from 4.10%, indicating a decline in loan quality. On a positive note, the cost of funds came down to 7.84% from 9.90%, and the net worth per share increased by 10.83%, reaching Rs. 153.98.

By the end of the third quarter, the company’s stock was trading at Rs. 971.08 with a price-to-earnings (PE) ratio of 47.68 times.

Key Financial Highlights

| Indicator | Q3 FY 2081/82 | Q3 FY 2080/81 | Change |

|---|---|---|---|

| Net Profit | Rs. 10.70 Cr | Rs. 6.12 Cr | ↑ 74.88% |

| Earnings Per Share (EPS) | Rs. 20.37 | Rs. 11.65 | ↑ 74.88% |

| Net Interest Income | Rs. 48.33 Cr | Rs. 21.24 Cr | ↑ 127.54% |

| Customer Loans | Rs. 10.06 Arba | Rs. 9.74 Arba* | ↑ 3.22% |

| Customer Deposits | Rs. 2.64 Arba | Rs. 2.54 Arba* | ↑ 3.85% |

| Borrowings | Rs. 6.33 Arba | Rs. 6.56 Arba* | ↓ 3.45% |

| Personnel Expenses | Rs. 23.47 Cr | Rs. 12.12 Cr* | ↑ 93.61% |

| Impairment Charges | Rs. 5.87 Cr | Rs. 7.23 Lakhs | ↑ 8000%+ |

| Operating Profit | Rs. 15.29 Cr | Rs. 8.74 Cr* | ↑ 74.88% |

| Distributable Profit | -Rs. 72.89 Lakhs | – | Negative |

| Capital Adequacy Ratio (CAR) | 8.46% | 8.50% | ↓ 0.04% |

| Non-Performing Loans (NPL) | 6.71% | 4.10% | ↑ 2.61% |

| Cost of Funds | 7.84% | 9.90% | ↓ 2.06% |

| Net Worth Per Share | Rs. 153.98 | Rs. 138.94* | ↑ 10.83% |

| Market Price (End of Q3) | Rs. 971.08 | – | – |

| P/E Ratio | 47.68x | – | – |

Blogs

51,292.50 Unit FPO Of Wean Nepal Laghubitta Bittiya Sanstha Approved By SEBON

The Securities Board of Nepal (SEBON) has officially approved the Further Public Offering (FPO) of Wean Nepal Laghubitta Bittiya Sanstha Limited (WNLB). This FPO will allow the general public to invest in the company and support its growth. Below are the key details of the FPO:

1. FPO Details

- Total FPO Shares: WNLB is offering 51,292.50 units of FPO shares.

- Face Value: Rs. 100 per share.

- Amount to be Raised: Rs. 51.29 lakhs.

2. Impact on Paid-up Capital

- Current Paid-up Capital: Rs. 7.92 crores.

- Post-FPO Paid-up Capital: Rs. 8.43 crores (after issuing the FPO shares).

3. Issue Manager

- Nepal SBI Merchant Banking Limited has been appointed as the FPO issue manager.

4. How to Apply

- Eligibility: The general public can apply for the FPO shares.

- Application Process: Applications can be submitted through C-ASBA (Centralized Application Supported by Blocked Amount) approved banks and financial institutions.

What This Means for Investors

- Investment Opportunity: The FPO provides an opportunity to invest in a growing microfinance institution of Nepal at a par value of Rs 100 per share.

- Growth Potential: The funds raised will help WNLB expand its operations and enhance its financial stability.

- Transparency: SEBON’s approval ensures regulatory compliance and investor protection.

Conclusion

Wean Nepal Laghubitta Bittiya Sanstha Limited (WNLB) is set to issue 51,292.50 units of FPO shares at a par value of Rs. 100 per share, aiming to raise Rs. 51.29 lakhs. This FPO will increase the company’s paid-up capital to Rs. 8.43 crores, supporting its growth and expansion plans. With Nepal SBI Merchant Banking Limited as the issue manager, the FPO process is expected to be smooth and transparent. Investors are encouraged to participate in this opportunity to contribute to WNLB’s growth while potentially earning returns on their investments.

Blogs

Commercial Banks Interest Rate For Falgun | Key Updates 2081

Nepal Rastra Bank (NRB) has set new rules to limit the gap between personal fixed deposit interest rates and minimum savings account rates to a maximum of 5%. Similarly, institutional fixed deposits must have interest rates at least 1% lower than personal fixed deposits. However, banks can offer 1% higher interest rates on personal remittance fixed deposits.

Due to excess liquidity in the banking system, interest rates have remained stable. Experts believe this trend will continue in the coming months. Although loan disbursements are rising, banks are unable to lower interest rates further. From mid-July to mid-January of the current fiscal year, banks have issued loans worth Rs. 265.56 billion.

For the month of Falgun, commercial banks in Nepal have announced their updated interest rates, which mostly remain unchanged. However, Global IME Bank has raised its fixed deposit interest rates by 0.25%. Citizens Bank International has decreased its institutional fixed deposit rates by 0.40%, while Laxmi Sunrise Bank has lowered its individual fixed deposit rates by 0.25%. Other commercial banks have kept their rates the same.

Overall, Nepal’s banking sector continues to maintain steady interest rates, with minor changes by a few banks.

-

Blogs3 days ago

Blogs3 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs2 hours ago

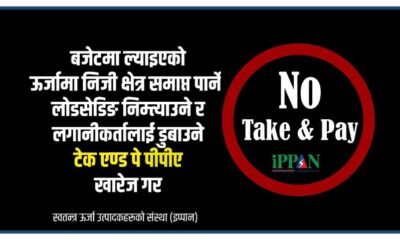

Blogs2 hours agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs4 hours ago

Blogs4 hours ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs3 hours ago

Blogs3 hours agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs4 hours ago

Blogs4 hours agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs6 months ago

Blogs6 months agoSiuri Nyadi Power Limited Added to IPO Pipeline by SEBON

-

Blogs4 days ago

Blogs4 days agoBanks Invest Rs. 16.45 Trillion in Directed Loans, 14% in Agriculture Sector | Says Nepal Rastra Bank