Insurance News

Why did NEPSE stopped the share trading of Citizen Life Insurance Company?

NEPSE stopped the share trading of Citizen Life Insurance Company in the secondary market temporarily, stating that the company damaged Nepal’s stock market reputation.

Citizen Life declared dividends on Monday, Bishakh 24, 2081, but the Insurance Authority ordered to cancel them. The company notified NEPSE that the announced dividends were canceled.

On the other hand, NEPSE sent a letter to SEBON on Monday, expressing concerns about Citizen Life’s impact on NEPSE’s image requesting to stop the company’s share trading, and looking for suggestions from the board for further action.

On the other side, Investors are demanding to cancel Monday’s transactions. NEPSE hasn’t decided yet whether to cancel them. A decision will be made based on the Securities Board’s advice.

You may also like:

Blogs

Asian Life Insurance to Issue Rights Shares from Asar 25

Asian Life Insurance Company Limited (ALICL) has announced the opening of its rights share issuance from Asar 25, 2082 (July 9, 2025). The company is offering 42% rights shares based on its current paid-up capital.

This means that shareholders will receive 4.2 new shares for every 10 existing shares they own. This issuance aims to raise over NPR 1.42 billion, with each share priced at NPR 100.

Key Details of the Rights Issue

| Topic | Information |

| Company Name | Asian Life Insurance Company Limited (ALICL) |

| Rights Share Ratio | 10:4.2 (42%) |

| Total Rights Shares to be Issued | 14,279,312.48 shares |

| Total Amount to be Raised | NPR 1,427,931,248 |

| Par Value Per Share | NPR 100 |

| Current Paid-Up Capital | NPR 3.39 billion |

| Paid-Up Capital After Issuance | NPR 4.82 billion |

| Issue Manager | Muktinath Capital Limited |

| Credit Rating | [ICRA Nepal] IRN A- (Adequate Safety) |

The company had set the book closure date for Jestha 16, 2082 (June 29, 2025). This means that only those shareholders who held shares until Jestha 14, 2082 (June 27, 2025) are eligible to apply for the rights shares. The application period for the rights issue will begin from Asar 25, 2082 (July 9, 2025) and will remain open until Shrawan 13, 2082 (July 28, 2025).

Application Process

- Eligible shareholders (who held shares before the book closure date) can apply for rights shares.

- Applications can be submitted through:

- Muktinath Capital

- Selected branches of Muktinath Bikas Bank (e.g., Biratnagar, Pokhara, Nepalgunj, etc.)

- Asian Life Insurance offices

- ASBA-approved banks and financial institutions

- Online via Meroshare (using C-ASBA system)

Why This Matters to Investors

- The rights issue provides existing shareholders with an opportunity to increase their holdings at par value.

- The company’s credit rating of A- suggests good ability to meet financial obligations.

- After the rights issuance, the company will have a stronger capital base of NPR 4.82 billion, which may support future business expansion.

AGM

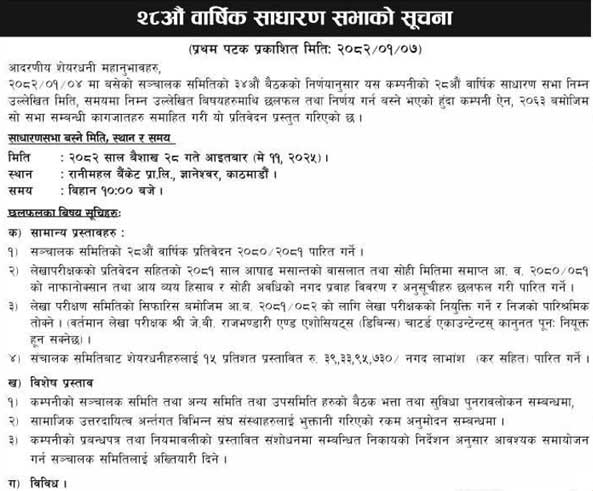

SALICO 28th AGM 2082: Key Updates on 15% Dividend and Financial Reports

Sagarmatha Lumbini Insurance Company Limited (SALICO) has scheduled its 28th Annual General Meeting (AGM) on Baishakh 28, 2082 (May 11, 2025). The meeting will take place at Ranimahal Banquet Pvt. Ltd., Gyaneshwar, Kathmandu, starting at 10:00 AM.

15% Cash Dividend Approved for FY 2080/81

During its 34th Board Meeting on Chaitra 28, SALICO’s board proposed a 15% cash dividend from its paid-up capital of Rs. 2.62 Arba, totaling Rs. 39.33 crore (including taxes). This proposal will be finalized during the AGM. Shareholders registered before Baishakh 17, 2082 (April 30, 2025) are eligible for the dividend and can vote on this agenda.

Key Agendas of the SALICO 28th AGM

-

Financial Approvals:

- Approval of the Board’s Annual Report for FY 2080/81.

- Endorsement of audited financial statements, profit/loss accounts, cash flow reports, and schedules as of Ashad 2081.

- Appointment of an auditor for FY 2081/82 and approval of their remuneration. Current auditor J.B. Rajbhandari & Associates (Dibins) may be reappointed.

-

Special Proposals:

- Review of meeting allowances and facilities for the Board and sub-committees.

- Approval of corporate social responsibility (CSR) payments made to various organizations.

- Amendments to the company’s Memorandum and Articles of Association based on regulatory guidelines.

Book Closure and Eligibility

The book closure date is set for Baishakh 17, 2082. Only shareholders registered by this date can claim dividends or attend the AGM. Ensure your details are updated with SALICO to avoid missing out.

Why Attend the SALICO 28th AGM?

This AGM is crucial for shareholders to:

- Vote on dividend distribution.

- Review the company’s financial health.

- Influence decisions on governance and CSR activities.

Notice: SALICO 28th AGM 2082

Blogs

Three Candidates Recommended for Health Insurance Board Executive Director

Selection Process and Recommendations

A recommendation committee formed to appoint the Executive Director of the Health Insurance Board has shortlisted three candidates for the position. The committee, after evaluating 10 applicants, conducted presentations and interviews on Falgun 18 and 19 (March 2 and 3).

Based on the evaluations, the committee recommended the following candidates:

- Kamal Panthi

- Dr. Krishna Prasad Adhikari

- Dr. Raghuraj Kafle

The Ministry of Health has forwarded the committee’s recommendations to the Council of Ministers for final approval. The decision is expected to be made in the upcoming cabinet meeting.

Current Interim Arrangement

Until the new Executive Director is appointed, Dr. Saroj Sharma, the Chief of the Quality Standards and Regulation Division at the Ministry of Health, is serving as the acting Executive Director of the Health Insurance Board.

Next Steps

The Council of Ministers will review the recommendations and make the final decision on the appointment. The selected candidate will lead the Health Insurance Board, which plays a crucial role in managing Nepal’s health insurance programs and ensuring accessible healthcare services for citizens.

-

Blogs3 days ago

Blogs3 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs2 hours ago

Blogs2 hours agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs3 hours ago

Blogs3 hours ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs2 hours ago

Blogs2 hours agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs4 hours ago

Blogs4 hours agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs6 months ago

Blogs6 months agoSiuri Nyadi Power Limited Added to IPO Pipeline by SEBON

-

Blogs4 days ago

Blogs4 days agoBanks Invest Rs. 16.45 Trillion in Directed Loans, 14% in Agriculture Sector | Says Nepal Rastra Bank