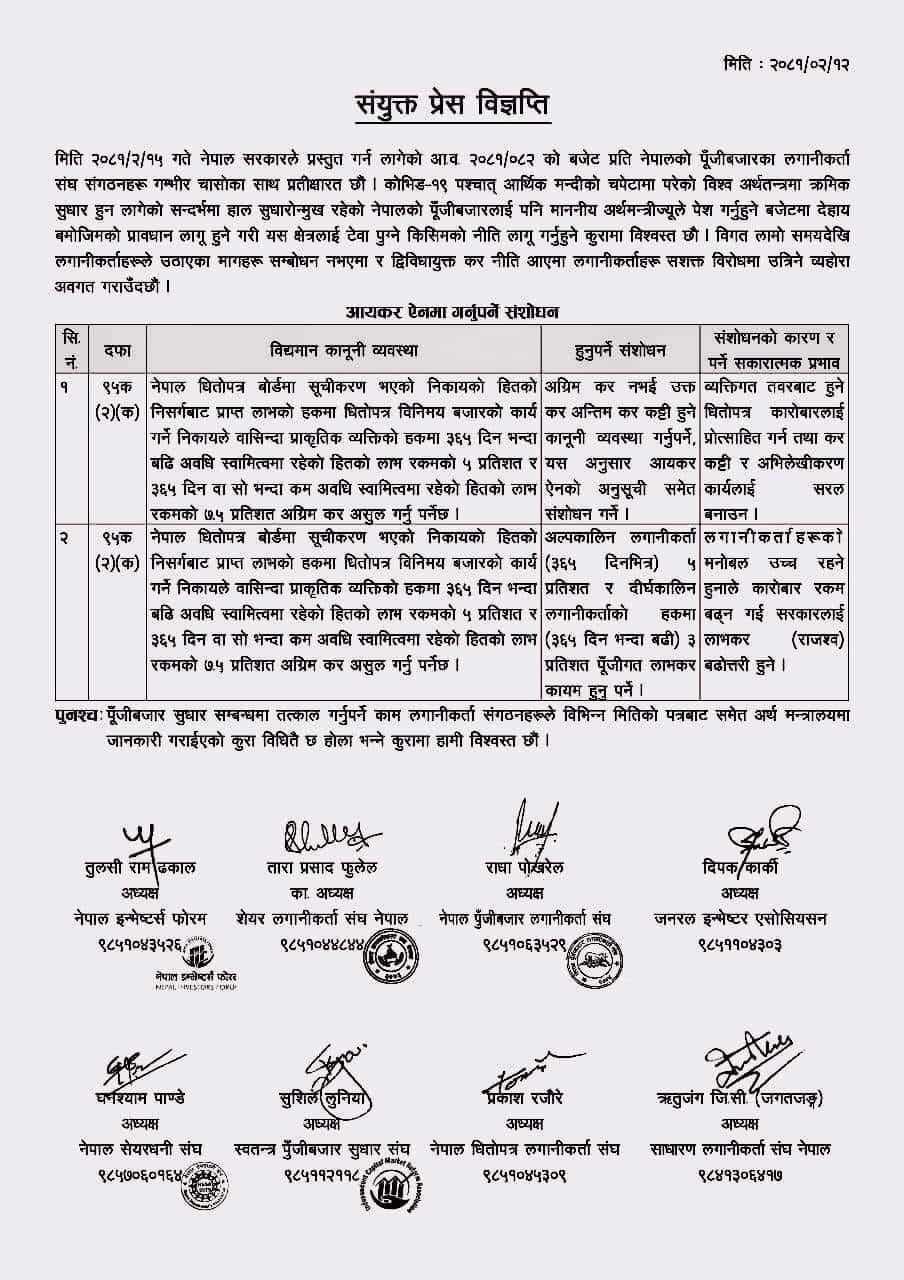

| Detail | Information |

| Budget Presentation Date | Jestha 15, 2081 |

| Fiscal Year | 2081/82 |

| Current Tax on Capital Gains (>365 days) | 5% |

| Current Tax on Capital Gains (≤365 days) | 7.5% |

| Proposed Short-term Capital Gains Tax | 5% |

| Proposed Long-term Capital Gains Tax | 3% |

| Goal of Proposed Amendments | Increase individual participation, simplify tax processes, boost investor confidence, increase trading volumes, enhance government revenue |

Investor associations are pushing for revisions to current tax regulations. They propose changing the withholding tax to a final tax and altering the Income Tax Act’s schedules. Specifically, they suggest lowering the short-term capital gains tax (for shares held for 365 days or less) to 5% and the long-term capital gains tax (for shares held for over 365 days) to 3%.

These suggested changes aim to boost individual participation in the stock market, simplify tax collection, and improve record-keeping efficiency. The investment community believes these reforms will enhance investor confidence, increase trading volumes, and ultimately raise government tax revenues.

Investor groups have consistently communicated these proposals to the Ministry of Finance through multiple letters. They remain hopeful that the Ministry understands their concerns and recognizes the urgent need for reform in the capital market sector.

Press Release for आयकर ऐनमा गर्नुपर्ने संशोधन (Amendments to the Income Tax Act)

You may also like: