Blogs

Nepal Share Market: Everything you need to know

Almost everyone has started investing in the Nepal Share Market. Some people you may know could be doing well for themselves, while some may be in the learning phase. It is a very feasible market for those who learn and understand it. This article talks about the Nepal Share Market basics so you can begin your trading journey.

What is the Share Market?

Before you start trading, it’s important to understand what the share market is. A share market is a financial platform that allows you to buy and sell stocks from someone willing to sell their stocks from companies listed in NEPSE.

The share market is a market where traders meet together to buy and sell shares. You can only buy and sell shares of the companies in the market that are listed in the NEPSE.

Share is the smallest unit of the company. You can easily buy shares from the secondary market at a trending price and hold a certain ownership of that company. The process of buying and selling shares is moderated by the stockbroker in Nepal.

What is the role of NEPSE in the Nepal Share Market?

The main role of the Nepal Stock Exchange (NEPSE) is to provide a regulated platform for buying and selling securities, primarily stocks, in Nepal’s stock market. It makes trading easy, determines market prices, regulates market activities, looks after the listing and delisting of securities, circulates market information, promotes market development, and protects investor interests.

NEPSE is the only stock exchange platform in Nepal that allows you to buy and sell shares and control the market. NEPSE operates under the Securities Act of 1983. Trading in the Nepal stock market is open for 5 days a week, 4 hours each day, i.e., 11 am to 3 pm from Sunday to Thursday. The timing might change due to national holidays, so remember that.

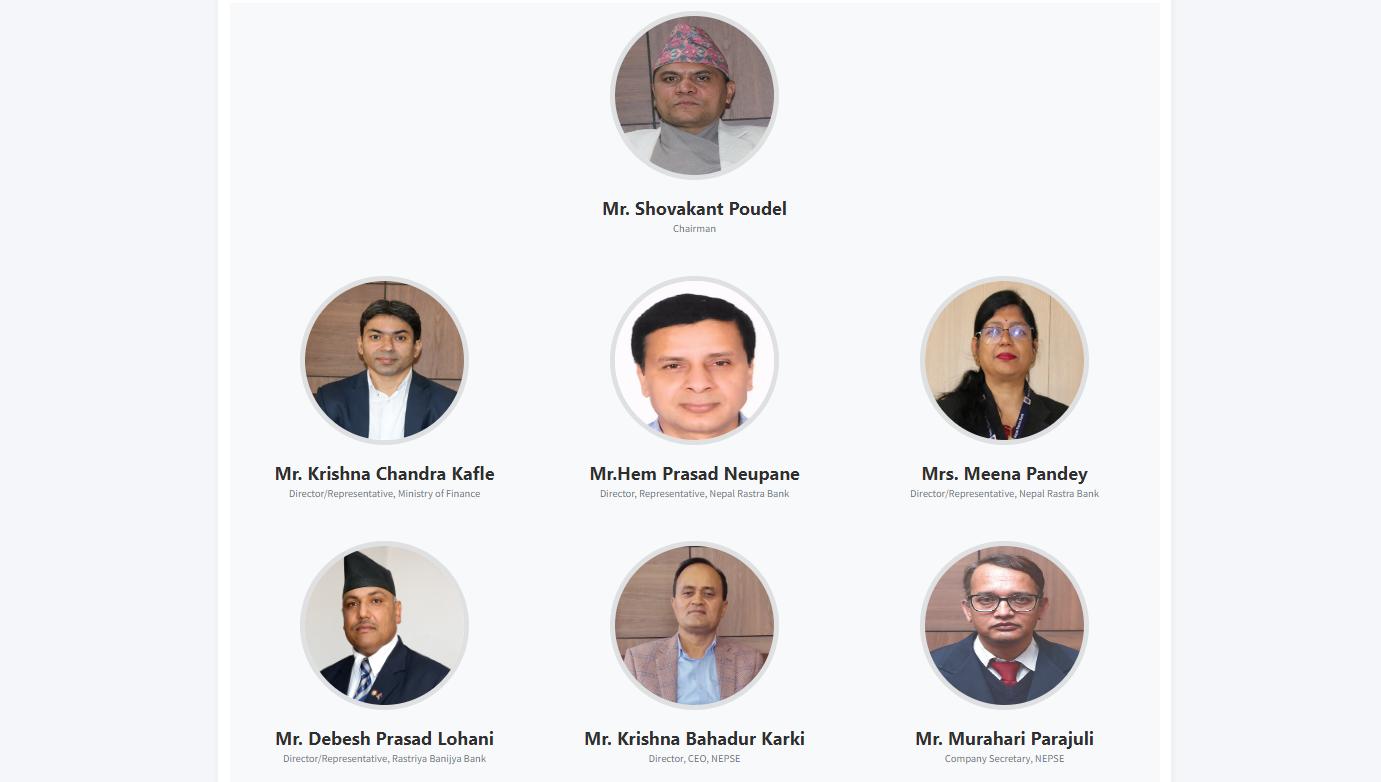

Who are the Board of Directors of NEPSE?

According to the Securities Act of 2006 (as of Baisakh 2081), the BOD of NEPSE consists of 2 members, including a Chairman from the Nepal government, 2 members from Nepal Rastra Bank, and 1 member from Rastriya Banijaya Bank. One member who will act as an expert in the capital market will be nominated by the BOD.

The image of the board of directors is taken from the website of the NEPSE.

List of members of the Board of Directors of NEPSE:

What is market analysis?

Market analysis is the analysis of what happens in the market that affects the market. It is the process of researching a specific market. Interested investors need to conduct a proper market analysis and keep themselves updated. It helps investors make informed decisions.

As an investor, there are mainly two types of market analysis you can conduct:

Technical market analysis

The technical market analysis uses graphical charts and analyzes the market using price data and value data. It only considers quantitative measurements. This makes it less in-depth than fundamental market analysis.

Fundamental market analysis

Fundamental market analysis is suitable for long-term investment. It focuses on the qualitative and quantitative factors to assess the intrinsic value of the company. It is a more in-depth analysis as it considers both qualitative and quantitative measurements.

How many companies are listed on the stock market?

As of Baishak 02, 2081 B.S, there are 246 companies listed in Nepal’s Stock Market under the different sectors:

How is NEPSE helping the market analysis?

NEPSE has created a platform for interested investors to buy and sell shares and list companies that want to sell their shares.

It also plays a big role in helping market analysis:

- Tracking the NEPSE index: it provides a summary of what is happening in the share market. This helps the investors analyze and make informed investment decisions.

- Helps with technical analysis: It keeps a record of historical data so that the analysis can make accurate trends.

- Transparency: All of the data essential to make an informed decision is transparent and available. It improves the efficiency of the market.

Share market is a growing market in Nepal. There are so many risks associated with it and it can be very daunting for beginners. But don’t be afraid, educate yourself as much as you can remember that it will take time before your big breakthrough but, the breakthrough will occur.

You may also like:

FAQs

What is the basic knowledge of NEPSE?

You should understand that NEPSE is a

What basic knowledge is required for the stock market?

You need to know that the stock market is very risky. But the higher the risk, the higher the gain. This means you need to be patient and resilient.

Who owns NEPSE?

The government of Nepal owns NEPSE.

What is the fullform of IPO?

IPO stands for Initial Public Offering, which is the shares that a company offers to its potential buyers.

Is Nepse closed on Fridays?

Yes, Nepse is closed on Fridays.

What does NEPSE stand for?

NEPSE stands for Nepal Stock Exchange Limited.

Blogs

Chhyangdi Hydropower Extends Deadline for Rights Share Application | Until 27th Ashad

The deadline for the ongoing rights share issue of Chhyangdi Hydropower Limited (CHL) has been officially extended until 27th Ashad, 2082. The issue had originally opened on 23rd Jestha, 2082, with an earlier closing date set for 12th Ashad, 2082.

Key Details of the Rights Share Issue

| Details | Information |

|---|---|

| Total Right Shares Issued | 3,869,775 units (1:1 ratio) |

| Face Value per Share | Rs. 100 |

| Total Issue Amount | Rs. 38.69 Crore |

| Current Paid-up Capital | Rs. 38.69 Crore |

| Post-Issue Paid-up Capital | Rs. 77.39 Crore |

As per the Central Depository System and Clearing Limited (CDSC), 23,503 applicants have applied for 2,317,902 units (worth Rs. 23.17 Crore) as of yesterday.

Eligibility and Application Process

Only those shareholders who held shares before the book closure date of 2nd Jestha, 2082, are eligible for this right share offering.

Interested shareholders can apply through:

- Global IME Capital Limited, Naxal, Kathmandu (Issue Manager)

- Designated branches of Global IME Bank Limited across Lamjung, including Besisahar, Sundarbazar, Bhulbhule, Siundibar, Udipur, and Dordhi

- Any C-ASBA-approved banks and financial institutions

- Online via “MeroShare”.

Applicants are advised to complete the process before banking hours on 27th Ashad, 2082 (Friday).

Important Note:

Payments must be made through an account payee cheque drawn in the name “GICL-BOK-CHHYANGDI RIGHT SHARE”, as per the instructions from Global IME Capital Ltd.

Contact Information

- Chhyangdi Hydropower Ltd

Phone: 977-01-4526483 / 4524925

Email: [email protected] | Website: www.chpl.com.np - Global IME Capital Ltd (Issue Manager)

Phone: 977-01-5970138

Email: [email protected] | Website: www.globalimecapital.com

Notice: Chhyangdi Hydropower Extends Deadline for Rights Share Application

Blogs

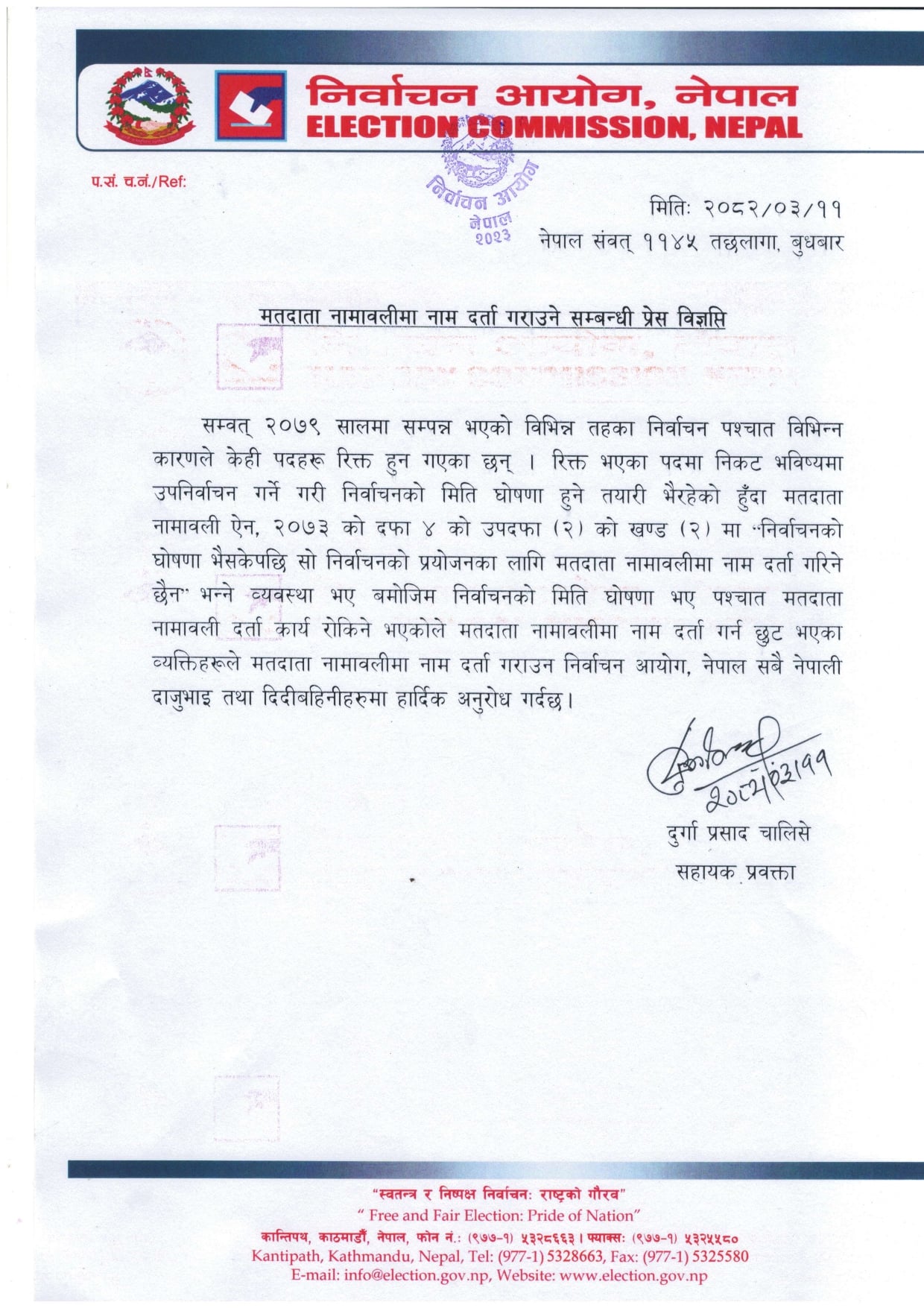

Election Commission Preparing to Announce By-Election Date | Voter Registration Now Open

The Election Commission of Nepal has begun preparations for by-elections to fill vacant positions at various levels of government. As part of this process, the Commission is urging all eligible Nepali citizens who have not yet registered their names in the voter list to do so immediately.

According to the Assistant Spokesperson of the Election Commission, Mr. Durga Prasad Chalise, individuals will not be allowed to register in the voter list once the election date is officially announced. Therefore, he emphasized the importance of early registration to avoid being left out.

The Election Commission recently held discussions with the Prime Minister, Mr. KP Sharma Oli, and the Acting Chief Election Commissioner, Mr. Ram Prasad Bhandari. They talked about setting a date for the by-elections. The main focus was on two key areas: Rupandehi Constituency No. 3 for the House of Representatives and Manang Province Assembly Constituency No. 1 (B). Elections in these regions are likely to be held in the second week of Kartik.

The position in Rupandehi became vacant after the passing of Rastriya Prajatantra Party MP Deepak Bohora. In Manang, the seat became empty after provincial assembly member Deepak Manange was sent to jail. In addition to these, more than a dozen ward chairman positions are also currently unoccupied in various local governments.

The Election Commission has issued a public notice dated 2082/03/11 (Nepali calendar) urging all citizens to register in the voter list immediately. The notice mentions that, according to Clause 4(2)(2) of the Voter List Act, 2073, voter registration will be stopped as soon as the election date is declared.

Hence, this is a final chance for anyone who missed earlier opportunities to register. The Commission has made a heartfelt appeal to all brothers and sisters across the country to take this opportunity seriously and get their names included in the voter list.

The Election Commission assures that the upcoming elections will be conducted fairly and freely, in line with its guiding principle:

“Free and Fair Election: Pride of the Nation.”

For more information or assistance, people can visit the official website of the Election Commission at www.election.gov.np or contact their office at Kantipath, Kathmandu.

Notice: Election Commission Preparing to Announce By-Election Date

Blogs

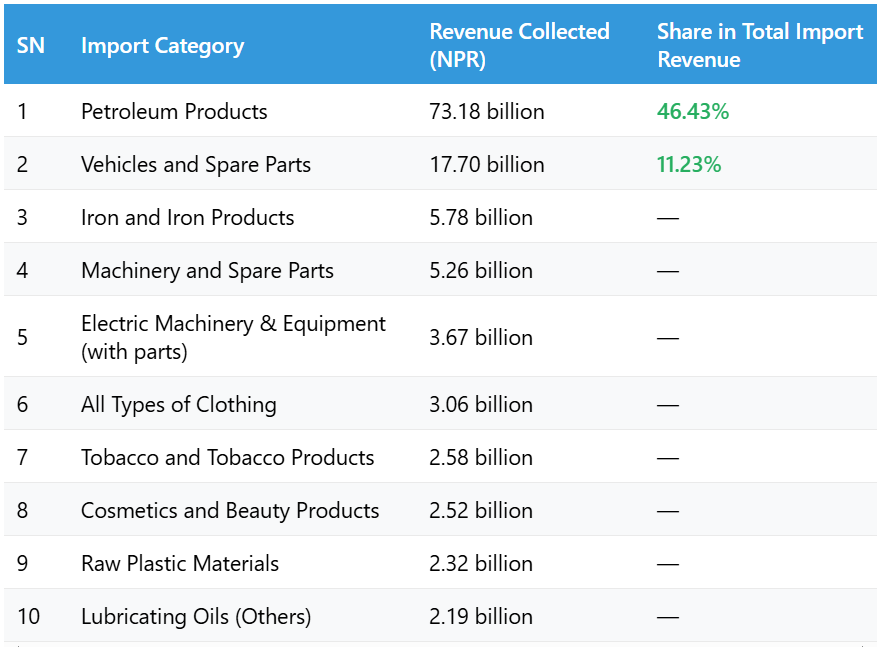

Birgunj Customs Office Collects Highest Revenue from Petroleum Imports

The Birgunj Customs Office has collected the highest revenue from the import of petroleum products in the first 11 months of the current fiscal year 2081/82. According to the office, a total of NPR 73.18 billion was collected in revenue from petroleum imports alone.

During this period, Nepal spent about NPR 174.09 billion to import five different types of petroleum products. These petroleum imports contributed 46.43% of the total revenue collected from the top 20 imported items, making it the most important source of income for the customs office.

Major Revenue Contributors from Imports

What Officials Say

Customs Chief Administrator Deepak Lamichhane stated that petroleum products and vehicle imports are the main sources of customs revenue at Birgunj. He highlighted that these two sectors consistently contribute the highest share of government income collected through imports.

Conclusion

The data from the Birgunj Customs Office shows that fuel and vehicles remain Nepal’s most heavily imported and taxed items. With more than 46% of the revenue coming from petroleum alone, any changes in fuel prices or import volumes can significantly affect national customs revenue.

-

Blogs4 days ago

Blogs4 days agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs4 days ago

Blogs4 days agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs1 week ago

Blogs1 week agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs4 days ago

Blogs4 days agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs3 months ago

Blogs3 months agoPure Energy IPO For General Public

-

Blogs4 days ago

Blogs4 days ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs1 year ago

Broker no. 58: Naasa Securities Co. Ltd.