As of Magh (mid-January), mutual funds in Nepal have allocated the largest portion of their investments i.e. 37.5% of their total portfolio to commercial bank shares. According to the latest data, mutual funds are managing assets worth NPR 57.29 billion, with 76.13% (NPR 43.62 billion) invested in the secondary market. Additionally, 16.18% (NPR 9.27 billion) is held in cash reserves, and 7.67% (NPR 4.39 billion) is placed in fixed deposits. Mutual funds are allowed to invest up to 15% of their total assets in fixed deposits.

Decline in Mutual Fund Size

The total size of mutual funds has decreased compared to the previous period. By Shrawan (mid-July, mutual funds had assets worth NPR 61 billion, but this figure dropped by Magh (mid-January). The decline is attributed to the closure of some closed-end schemes, such as Citizens Mutual Fund-1 and Sanima Equity Fund, which were recently liquidated.

Sector-Wise Investment Breakdown

After commercial banks, mutual funds have diversified their investments across various sectors:

- Hydropower: 11.71%

- Development Banks: 11.66%

- Life Insurance: 10.55%

- Non-Life Insurance: 9.90%

- Microfinance: 8.63%

The remaining 10% is invested in manufacturing, hotel and tourism, institutional funds, etc.

How Mutual Funds Select Companies

Mutual funds employ research teams to analyze and study companies before making investment decisions. These teams evaluate various indicators, and based on their findings, the management team selects investment companies. A CEO of a merchant bank explained that mutual funds follow strategies such as selling shares when prices rise, holding if further growth is expected, and buying when prices fall below average levels. Mutual funds also distribute dividends to unit holders from the earnings generated through share investments.

Investment Strategy and Market Insights

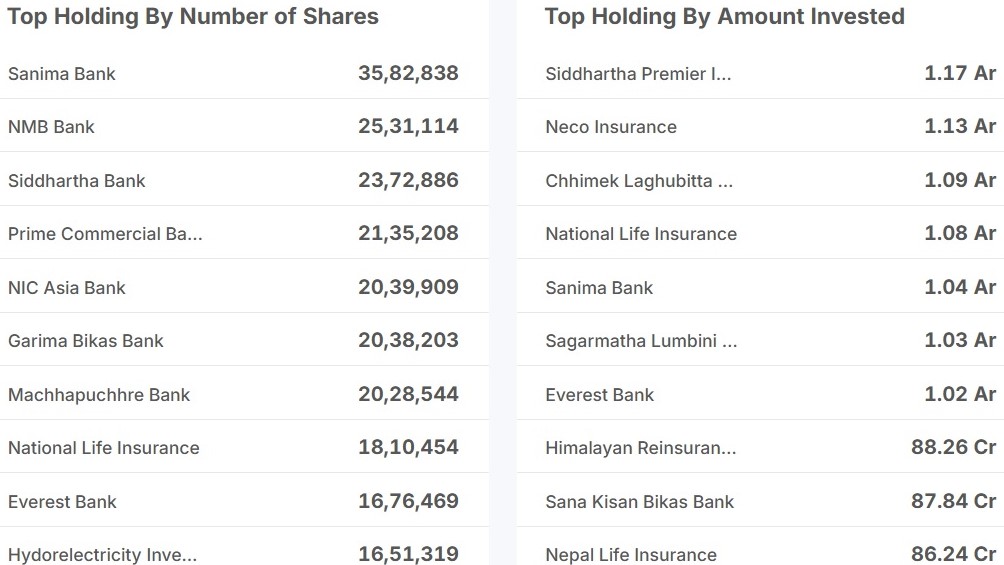

Mutual funds regularly publish their investment details, providing transparency about which companies they are investing in and the amounts allocated. This information can help individual investors make informed decisions. For instance, if a mutual fund’s average purchase price for a stock is lower than the current market price, it may indicate a good buying opportunity. However, investors are advised to avoid blindly following mutual funds, as these funds frequently trade shares and may sell off holdings when prices rise, potentially leading to losses for late entrants.

Key Takeaways for Investors

- Research: Mutual funds’ investment choices can serve as a reference for individual investors.

- Timing: Buying shares when prices are below the mutual fund’s average purchase price can reduce the risk of losses.

- Caution: Mutual funds actively trade shares, so their holdings may not always be long-term investments.

Conclusion

Mutual funds play a significant role in Nepal’s stock market, with a strong focus on commercial banks and diversified investments across other sectors. Their transparent investment strategies and regular disclosures provide valuable insights for individual investors, but caution is advised to avoid potential risks associated with market fluctuations.