Blogs

IME Life Insurance Company Reports Strong Financial Performance in Q2 of FY 2081/82

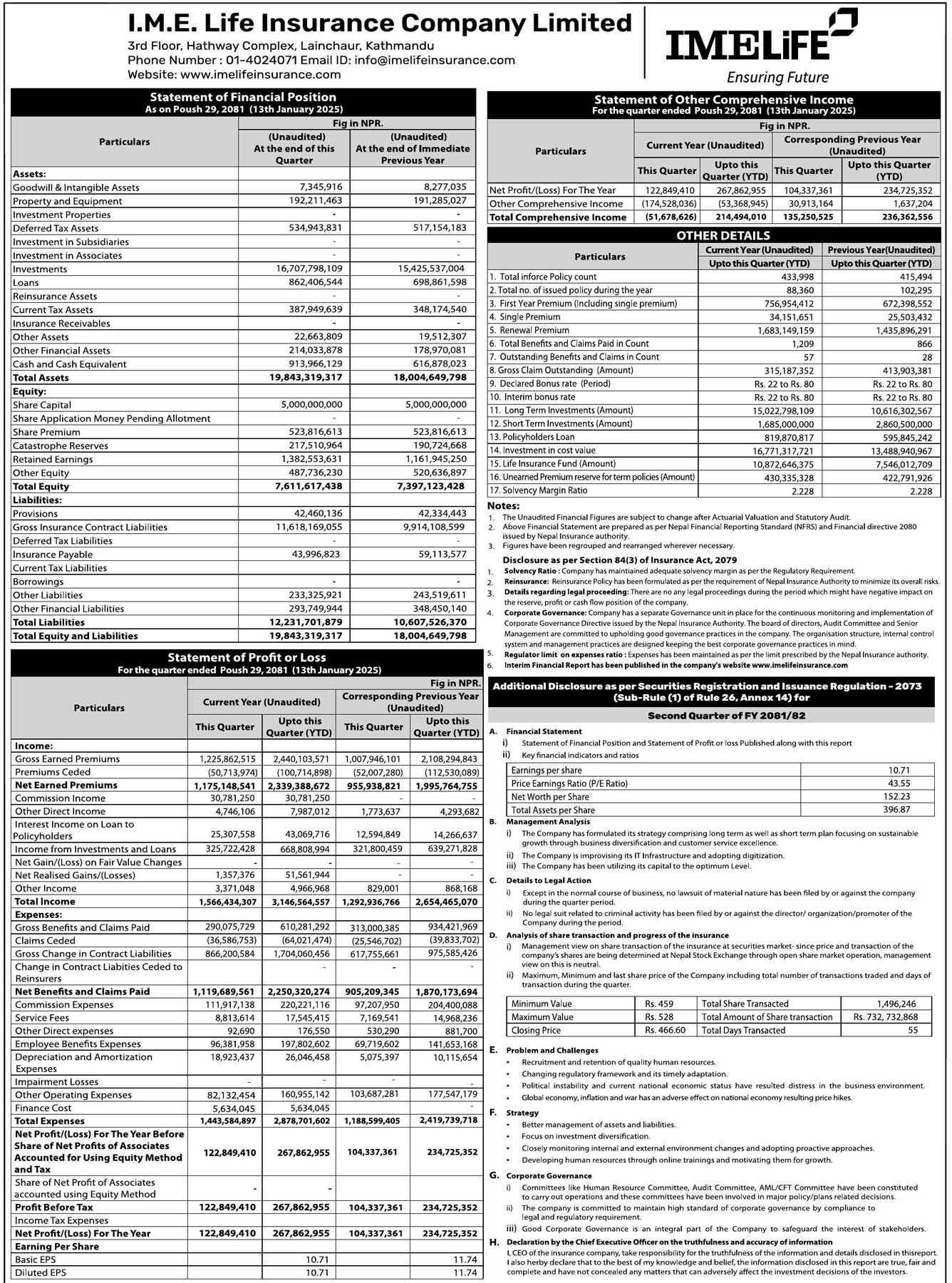

IME Life Insurance Company Limited (ILI) has showcased impressive financial results for the second quarter of the fiscal year 2081/82. The company has reported a significant increase in net profit, along with steady growth in other key financial areas. Below is a detailed breakdown of its performance:

1. Increase in Net Profit

ILI recorded a 14.12% rise in net profit during the second quarter of FY 2081/82. The net profit climbed to Rs. 26.78 crores, up from Rs. 23.47 crores in the same quarter of the previous fiscal year. This growth highlights the company’s ability to maintain profitability despite challenges in the market.

2. Strong Financial Base

The company continues to maintain a robust financial position, supported by the following:

- Paid-up Capital: Rs. 5 Arba

- Share Premium: Rs. 52.38 crores

- Reserves:

- Retained Earnings: Rs. 1.38 Arba

- Other Equity: Rs. 48.77 crores

- Catastrophe Reserves: Rs. 21.75 crores

This solid foundation ensures the company’s stability and ability to meet future obligations.

3. Growth in Net Premiums and Revenue

ILI experienced a 17.22% increase in net premiums, which reached Rs. 2.33 Arba during the quarter. Additionally, the company generated Rs. 66.88 crores from investments, loans, and other financial activities. This growth reflects the company’s effective management of its core operations and investment portfolio.

4. Increase in Net Claims and Commission Expenses

While the company achieved growth in several areas, it also faced higher expenses:

- Net Claims: Increased by 20.33% to Rs. 2.25 Arba.

- Commission Expenses: Rose by 7.74% to Rs. 22.02 crores.

These increases indicate higher payouts and operational costs, which are common in the insurance industry.

5. Key Financial Indicators

ILI’s financial health remains strong, as reflected in the following key metrics:

- Earnings Per Share (EPS): Rs. 10.71 (annualized)

- Net Worth Per Share: Rs. 152.23

- Price-to-Earnings (P/E) Ratio: 43.55

These indicators demonstrate the company’s profitability and attractiveness to investors.

Comparison of IME Life Insurance’s Key Financial Highlights for Q2 of This Fiscal Year and the Previous Fiscal Year.

| Particulars (In Rs ‘000) | Q2 2081/82 | Q2 2080/81 | Difference (%) |

|---|---|---|---|

| Paid-Up Capital | 5,000,000.00 | 5,000,000.00* | 0.00% |

| Share premium | 523,816.61 | 523,816.61* | 0.00% |

| Catastrophe Reserves | 217,510.96 | 190,724.67* | 14.04% |

| Retained Earnings | 1,382,553.63 | 1,161,945.25* | 18.99% |

| Other Equity | 487,736.23 | 520,636.90* | -6.32% |

| Life Insurance Fund | 11,618,169.06 | 9,914,108.60* | 17.19% |

| Investments | 16,707,798.11 | 15,425,537.00* | 8.31% |

| Net Premium | 2,339,388.67 | 1,995,764.76 | 17.22% |

| Income from Investment, Loan and Others | 668,808.99 | 639,271.83 | 4.62% |

| Claim Payment (Net) | 2,250,320.27 | 1,870,173.69 | 20.33% |

| Net Profit | 267,862.96 | 234,725.35 | 14.12% |

Conclusion

IME Life Insurance Company Limited (ILI) has delivered a strong financial performance in the second quarter of FY 2081/82, with significant growth in net profit, net premiums, and revenue. Despite higher claims and commission expenses, the company’s solid financial base and strong key indicators position it well for future growth and stability.

Blogs

Private Power Producers Protest ‘Take and Pay’ Provision in Budget

Private energy entrepreneurs in Nepal have taken to social media, protesting the government’s decision to introduce the ‘Take and Pay’ (Liu Ra Tir) system for electricity purchase agreements (PPA) in the new fiscal year budget.

Under this system, the government would only pay for the electricity it uses, instead of paying for the total electricity generated by hydropower projects. Entrepreneurs argue this move could severely hurt the private sector, discourage investment, and push the country back toward power shortages.

Online Campaign Targets Top Officials

Energy producers are now directly appealing to key government figures. They have publicly tagged Prime Minister Pushpa Kamal Dahal, Finance Minister Barshaman Pun, Energy Minister Shakti Bahadur Basnet, and NEA Executive Director Kulman Ghising on social media, urging them to withdraw the Take and Pay provision.

This digital campaign comes just days after developers handed over a memorandum to the Prime Minister and bombarded top officials with hundreds of SMS messages requesting the same.

Why Are Entrepreneurs Worried?

Entrepreneurs claim that this decision will:

- Weaken the private sector’s role in the energy industry

- Risk the return of load-shedding (power cuts)

- Causes financial losses to investors

- Damage the overall economy

The Independent Power Producers’ Association of Nepal (IPPAN) has strongly opposed the provision. According to IPPAN’s Vice President and protest coordinator Mohan Kumar Dangi, the policy shift will discourage private hydropower development, especially for Run-of-River (RoR) projects, which are most affected by the new model.

Ongoing Protests and Next Steps

Since Asar 6, private power developers have been staging a phase-wise protest. On the third day of their movement, they moved their campaign to social media to raise public awareness and pressure the government.

Dangi warned that if the government ignores these peaceful efforts, the protests will escalate. Planned steps include:

- Lobbying political party leaders in Parliament

- Launching a nationwide street protest

- Returning the keys of privately built hydropower projects to the government — a symbolic act of handing over control

Background: The Budget Controversy

The controversy started when the budget for FY 2082/83 (announced on Jestha 15) stated that all future PPAs for RoR hydropower projects would be done under the Take and Pay model only. This was a major change from the previous Take or Pay model, where producers were paid even if electricity wasn’t consumed, offering more security for private investors.

Conclusion

The ‘Take and Pay’ decision has sparked serious concerns across Nepal’s private energy sector. Developers fear this could lead to a slowdown in future hydropower investments, and possibly, a return to unstable electricity supply. With pressure mounting both online and offline, the government’s next move will be critical for the future of Nepal’s energy landscape.

Blogs

Nepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

Nepal Rastra Bank (NRB), the central bank of Nepal, has announced it will withdraw NPR 60 billion in deposits from the banking system on Monday through a deposit collection auction. This move comes as excess liquidity continues to remain in the banking sector since the beginning of the current fiscal year 2081/82.

According to NRB, the withdrawal will be conducted through the online bidding system, and the interest rate will be determined through competitive bidding. The collected amount, including both principal and interest, will be settled on Shrawan 18, 2082 (August 2, 2025).

Key Auction Details

- Total Amount: NPR 60 billion

- Minimum Bid Amount: NPR 100 million

- Bid Increments: Must be divisible by NPR 50 million

- Eligible Participants: Class ‘A’, ‘B’, and ‘C’ licensed banks and financial institutions

- Auction Method: Competitive bidding via NRB’s online platform

- Maturity & Settlement Date: Shrawan 18, 2082

Why Is the Central Bank Taking This Step?

As per NRB, the banking system is currently holding excessive liquidity, with total deposits crossing NPR 7 trillion. However, this liquidity is not being effectively utilized, as loan disbursement has remained slow. This reflects a lack of investor confidence and limited credit demand in the economy.

To control liquidity and stabilize the financial market, NRB has been consistently withdrawing funds using monetary tools since the start of the fiscal year. Tools like reverse repo, outright sale, deposit collection, and bond issuance are being used depending on the situation, whether there is too much or too little money in the system.

Recent Trends in Liquidity Control

Last week alone, NRB withdrew NPR 90 billion in a single day, highlighting the ongoing efforts to manage surplus liquidity. The central bank is using such actions not only when there is an overflow of money but also in times of shortage, to maintain balance in the financial system.

Conclusion

The decision to withdraw NPR 60 billion on Monday shows that Nepal Rastra Bank is actively managing liquidity to ensure financial stability. With a large amount of unused funds in the system, these measures are crucial to prevent inflation, reduce financial risk, and encourage more effective use of capital in the economy.

Blogs

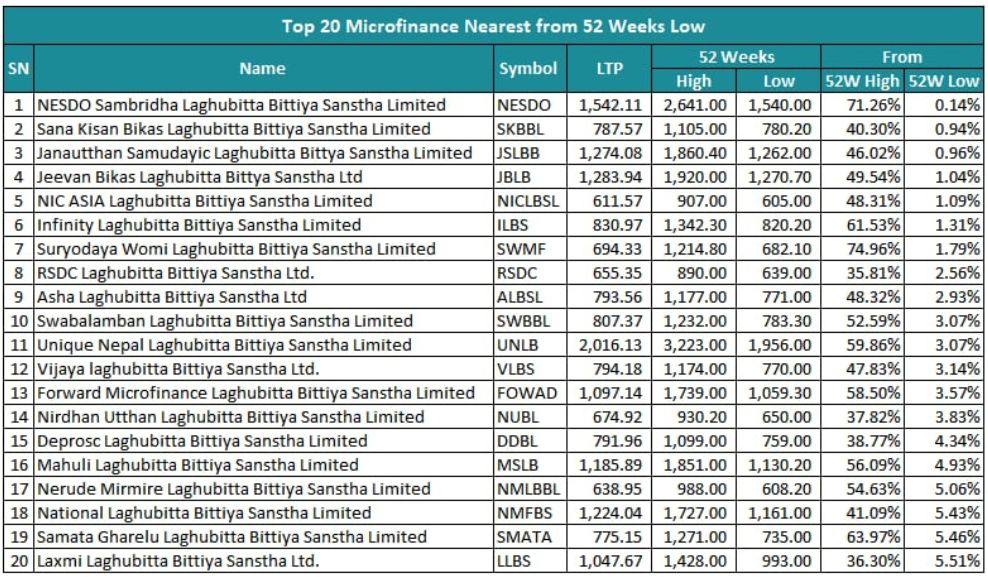

52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

The microfinance sector in Nepal has been moving sideways for a long time. The group sub-index has been fluctuating between 4,600 and 5,600. Recently, the index reached a swing high of nearly 4,900 but then closed at 4,671.74.

The national budget did not bring any immediate changes that could affect the capital market. So, investors are now waiting for the upcoming monetary policy. After the newly appointed Governor of Nepal Rastra Bank, Dr. Bishwanath Paudel, reduced the risk weight on margin loans from 125% to 100% during the third quarterly review, investor confidence grew.

Investors now hope that the following changes will be introduced in the next monetary policy:

- Removal of the current Rs. 15 crore limit on individual investment

- Removal of the 15% dividend cap on microfinance institutions

- Permission for banks and financial institutions to trade shares for less than one year

Governor Paudel’s public remarks have made investors hopeful that the upcoming monetary policy will be share-market friendly.

Despite the pressure on the market at the end of Ashar, investors are optimistic about a rebound afterward. Experts say microfinance and insurance stocks—whose prices have not surged yet compared to others—might offer better opportunities in the coming days.

Top 20 Microfinance Companies Nearest to 52-Week Low

Some microfinance companies are trading close to their 52-week low prices. These stocks may offer good value for long-term investors. Here are some examples:

-

Nesdo Samriddhi Microfinance had a high of Rs. 2,641 and a low of Rs. 1,540 in the past year. It is currently trading near its lowest point.

-

Sana Kisan Bikas Microfinance and Jan Utthan Community Microfinance are both trading less than 1% above their 52-week lows.

-

Jeevan Bikas, NIC Asia, Infinity, Suryodaya Womi, RSDC, Asha, and Swabalamban Microfinance are trading just 1–3% above their yearly lows.

-

Other companies like Unique Nepal, Bijaya, Forward, Nirdhan Utthan, Diprox, Mahuli, Nerude Mirmire, National, Samata Gharelu, and Laxmi Microfinance are also trading only 3–5.5% above their low points.

According to experts, these stocks could be worth watching for those looking to invest at lower prices.

Microfinance Stocks Near 52-Week High

Interestingly, a few companies are still trading near their 52-week highs even though the overall market is in a downtrend:

-

Unnati Sahakarya Microfinance reached a high of Rs. 5,276 and is now trading at around Rs. 1,804.

-

CYCL Nepal Microfinance had a high of Rs. 1,958 and is still trading at Rs. 1,615, which is relatively strong.

On the other hand, many microfinance stocks are trading 20–40% below their 52-week highs:

-

Aatmanirbhar, Mahila, Grameen Bikas, Kalika, Global IME, Chhimek, Mero Microfinance, and Abhiyan are all trading 22% to 31% below their highs.

-

NMB, First Microfinance, RSDC, Laxmi, Nirdhan Utthan, Diprox, Sana Kisan, Mithila, National, and Swabhiman are trading 34% to 44% below their 52-week highs.

These stocks may still have room to rise if the market recovers and favorable policies are introduced.

Conclusion

The microfinance sector in Nepal is at a turning point. While the market has been moving sideways, investor confidence is building, especially with hopes for a supportive monetary policy. Stocks near their 52-week lows may offer attractive entry points, while those holding near their highs show relative strength.

For both new and experienced investors, this could be a good time to study the microfinance sector closely and plan for the long term. As always, careful research and risk assessment are essential before making any investment decisions.

-

Blogs4 days ago

Blogs4 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs19 hours ago

Blogs19 hours agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs20 hours ago

Blogs20 hours agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs21 hours ago

Blogs21 hours ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs21 hours ago

Blogs21 hours agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs3 months ago

Blogs3 months agoPure Energy IPO For General Public

-

Blogs6 months ago

Blogs6 months agoSiuri Nyadi Power Limited Added to IPO Pipeline by SEBON