What is a DEMAT account?

A DEMAT account is an account that holds your securities like stocks, bonds, mutual funds, etc., in electronic form, just like a bank account holds your money. In short, DEMAT is the process of dematerializing physical documents into electronic form. Earlier, the market operated traditionally, where securities were issued in paper form, and investors had to hold and transfer these paper certificates physically.

Since all securities are stored in DEMAT, it has become mandatory for share traders. It has made trading faster, simplified processes, reduced paperwork, and minimized the risks of document loss and damage associated with physical certificates.

Documents required

The cost of opening a DEMAT account ranges from Rs. 50 to Rs. 150. It needs to be renewed annually, with renewal charges of up to Rs. 100 per year.

Documents required

- Citizenship Certificate of the investor (including details of three generations)

- Recent passport-size photo

- Bank Details

In the case of minors, parents/guardians should submit

- Photo of the account holder

- Birth certificate

- Copy of the parents/guardian’s citizenship

How to open a DEMAT Account in Nepal?

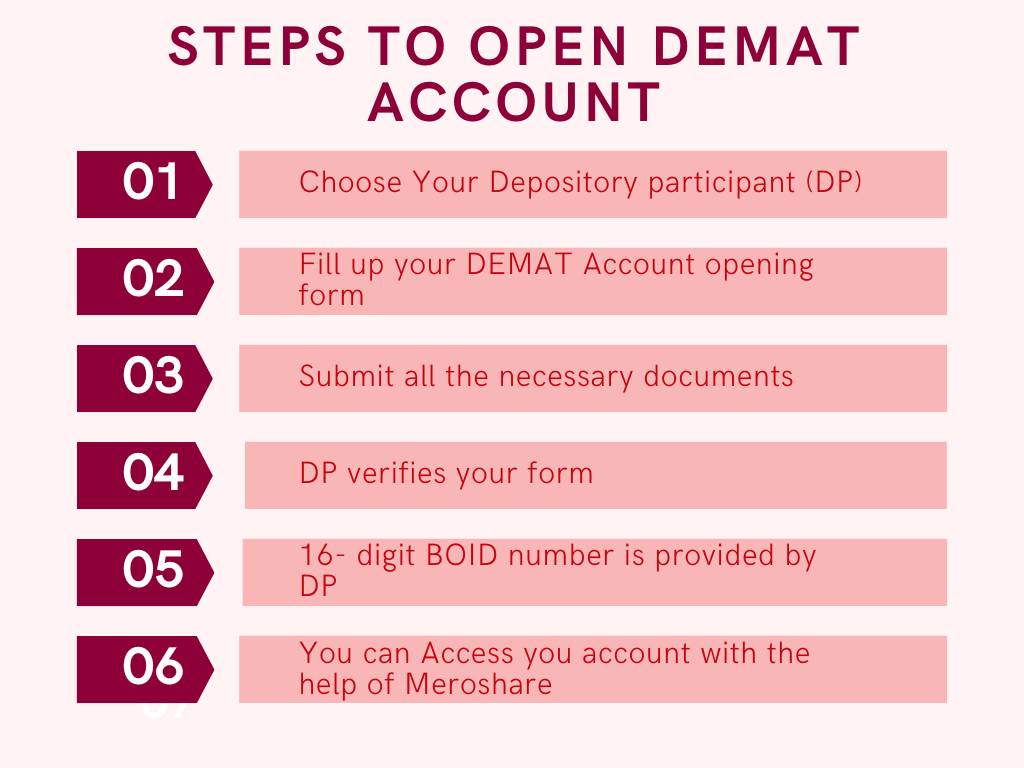

Steps to Open a Demat Account

You can open your demat account online or by visiting the bank physically. The process of opening a demat account is very similar to the bank account opening process.

Follow the below steps to open a DEMAT account:

Step 1: Visit a particular bank’s website, where you can find a form to enter your details.

Step 2: After submitting the form, the information is reviewed and entered by the Depository participant (DP) into the system of CDSC.

Step 3: CDSC verifies the form and opens the demat account for the beneficiary.

Step 4: Then CDSC writes a verification letter to the beneficiary providing the 16-digit demat account number. (8-digit DP Identification Number, 8-digit Client Identification Number)

After that, your account will be active and the shares you have issued or bought will be safely stored on your account.

Benefits of Opening a DEMAT Account

Opening a Demat account offers the following benefits:

- Electronic Holding: Securities held in electronic form.

- Convenient Trading: Facilitates online trading in the stock market.

- Quick Settlement: Faster and smoother settlement of transactions.

- Safety and Security: Eliminates risks associated with physical certificates.

- Portfolio Management: Provides a consolidated view of an investor’s holdings.

- Dividend and Interest Crediting: Automatic crediting of income from securities.

- Accessibility: Can be accessed from anywhere with an internet connection.

- Reduction in Paperwork: Minimizes paperwork associated with trading.

- Multiple Asset Classes: Can hold various types of securities.

- Loan Against Securities: Some investors can use holdings as collateral for loans.

FAQs

[saswp_tiny_multiple_faq headline-0=”h4″ question-0=”What is the charge for opening a Demat account?” answer-0=”The cost of opening a DEMAT account is Rs. 50 and Rs.100 for the renewal each year. That is, when opening a DEMAT account, you have to pay Rs. 150.” image-0=”” headline-1=”h4″ question-1=”Is a DEMAT account mandatory in Nepal?” answer-1=”Opening the DEMAT account is mandatory for all share transactions in Nepal. ” image-1=”” headline-2=”h4″ question-2=”How many DEMAT accounts can I open in Nepal?” answer-2=”In Nepal, there is no limit to owning a DEMAT account, but each must be linked to a different broker. A DEMAT account is necessary for stock trading in both markets. There’s a one-account limit, but it can be transferred to two accounts simultaneously. It’s legal to have multiple DEMAT and trading accounts with different brokers, each requiring its accounts.” image-2=”” headline-3=”h4″ question-3=”How many days it will take to open a Demat account in Nepal?” answer-3=”It usually takes one business day to open and activate a DEMAT account in Nepal. You can open a DEMAT account with an authorized depository participant (DP).” image-3=”” headline-4=”h4″ question-4=”Which Demat account is free in Nepal?” answer-4=”NIBL Ace Capital has offered a free DEMAT account to promote the Nepalese government’s ‘One Nepali, One DEMAT Account’ campaign.” image-4=”” count=”5″ html=”true”]

In conclusion, the DEMAT account is the process of converting all paperwork into an online electronic form. A DEMAT account is essential in today’s world for participation in the stock market. The process of opening a DEMAT account is straightforward. It has become significantly easier and beneficial because it facilitates the storage of paperwork and documents online, enhancing security. You can follow the given steps to open a DEMAT account.