Guardian Micro Life Insurance Limited is set to launch the second phase of its Initial Public Offering (IPO) for the general public in Nepal from Poush 21 to Poush 24, 2081, after distributing the IPO to Nepalese citizens working abroad in the first phase.

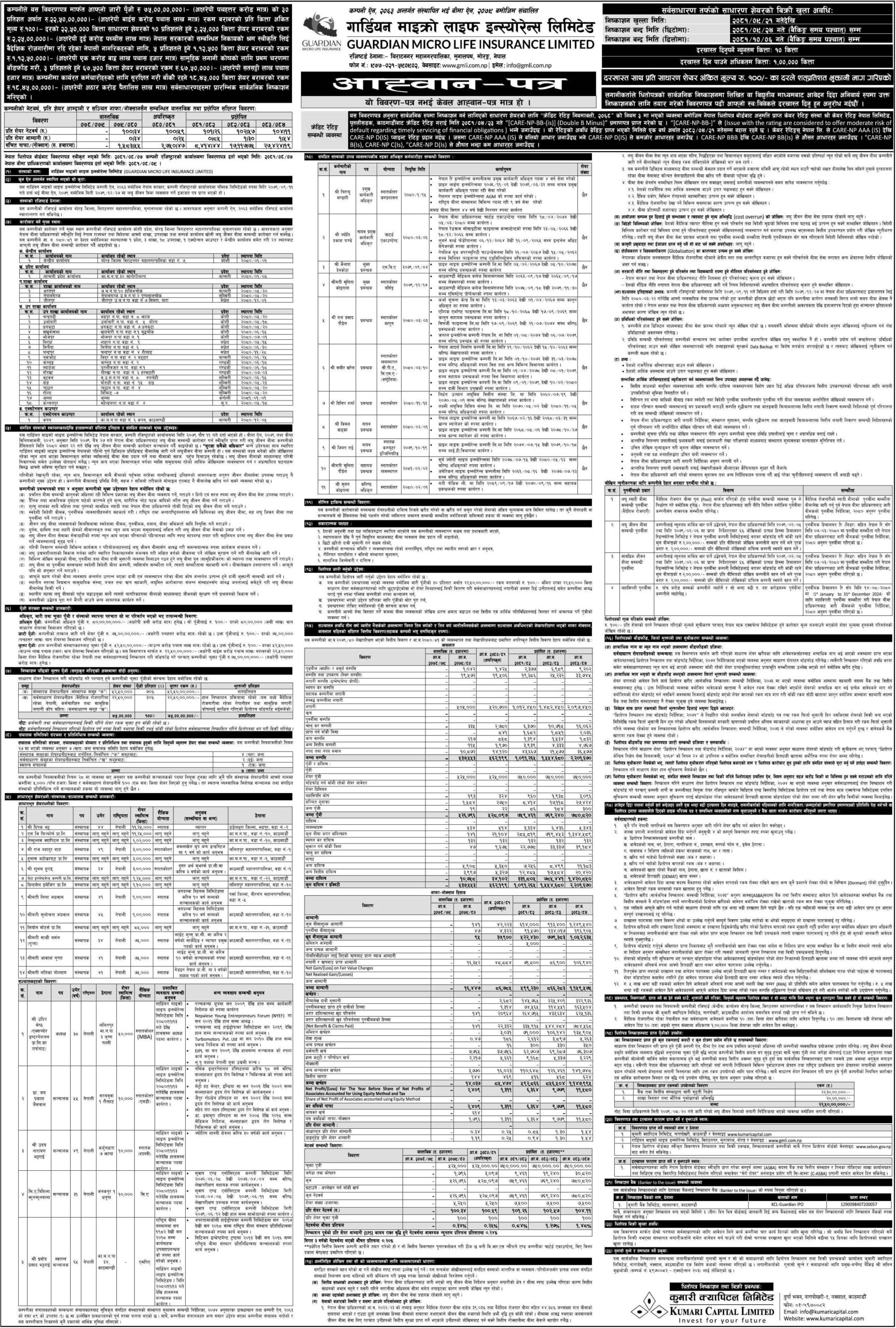

The company is going to distribute 18,45,000 units of shares in this second phase at NPR 100 per share. Applicants can apply for a minimum of 10 units and up to a maximum of 1,00,000 units. Kumari Capital Limited will manage the IPO issuance, as an agreement has already been signed between Guardian Micro Life Insurance and Kumari Capital Limited.

If the IPO is not fully subscribed within the given period (Poush 21-Poush 24), then the IPO application period will be extended until Magh 6, 2081. The IPO allotment result of Guardian Micro Life Insurance for Nepalese residing in Nepal will be published within one week after the closing date.

Read Now: Total IPO shares of Guardian Micro Life Insurance approved by SEBON

Key Details:

Notice: Guardian Micro Life Insurance IPO Opens for General Public

Notice Published By Guardian Micro Life Insurance For IPO Issuance To The General Public in Nepal

About Company:

Guardian Micro Life Insurance Limited has been assigned a ‘CARE NP Double B Minus Issuer Rating’ by CARE Ratings Nepal. This indicates a moderate risk in fulfilling its financial obligations. The company was established on 26th December 2022, received its operating license from the Nepal Insurance Authority on 10th April 2023, and began commercial operations on 7th July 2023. It has Headquare in Biratnagar, Morang, and offers affordable and reliable micro-life insurance solutions tailored to the unique needs of families, especially low-income earners. Committed to transparency, integrity, and personalized service, the company ensures financial security and peace of mind while fostering social responsibility for a better future.