Blogs

Four Companies Submit IPO Proposals to SEBON | Added to Pipeline

Four companies have recently submitted their IPO proposals to the Securities Board of Nepal (SEBON) for the issuance of IPO, which are currently under review. These Upcoming IPOs are intended to raise capital to support business expansion and development. Below is a simplified overview of each proposal, including key updates, financial highlights, and company backgrounds. A summary table is also provided for quick reference.

1. Mountain Glory Limited

- IPO Proposal: Plans to issue 4,000,000 shares to raise Rs. 40 crores.

- Application Date: Submitted on Chaitra 26, 2081.

- Issue Manager: Laxmi Sunrise Capital Limited.

- Sector: Hotels And Tourism

- Credit Rating: CARE Ratings Nepal withdrew its earlier rating (“CARE-NP B/A4”) due to insufficient cooperation from the company. Investors are advised to proceed cautiously.

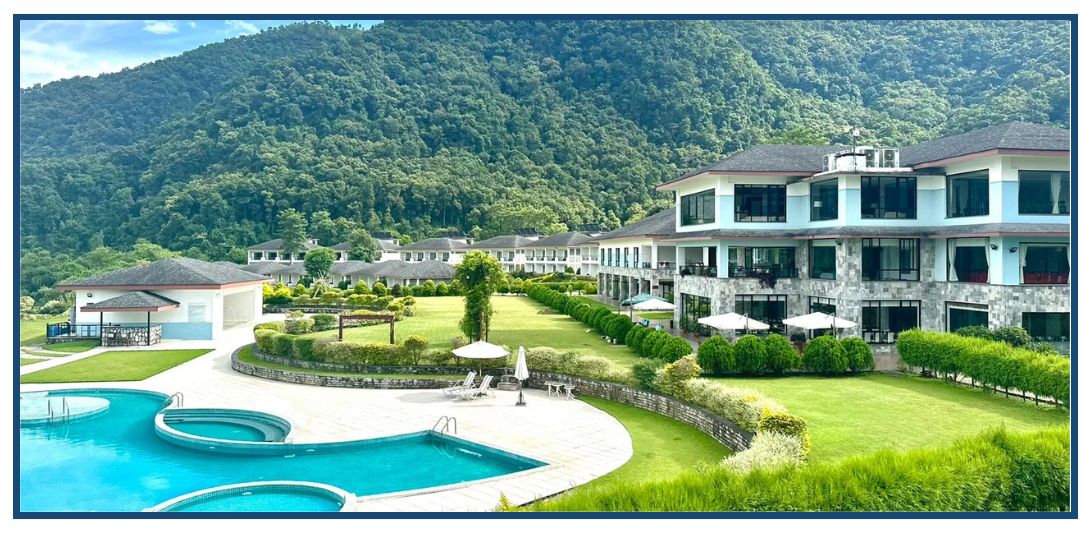

About the Company:

Mountain Glory Private Limited, established on May 24, 2007, owns and operates the luxurious Mountain Glory Forest Resort & Spa in Dovilla-21, Pokhara. Spread over 7.42 acres with 64 rooms, the resort blends natural serenity with modern amenities and has been recognized as a Tourist Standard Hotel by the Ministry of Culture, Tourism & Civil Aviation. Guests enjoy panoramic views of the Himalayas, premium hospitality, and peaceful experiences ideal for relaxation and events.

2. Varnabas Museum Hotel Limited

- IPO Proposal: Aims to issue 3,960,000 shares to raise Rs. 39.60 crores.

- Application Date: Submitted on Falgun 19, 2081.

- Issue Manager: Himalayan Capital Limited.

- Sector: Hotels And Tourism

- Credit Rating: ICRA Nepal downgraded its long-term loan rating to [ICRANP] LB- but maintained the short-term rating at [ICRANP] A4.

About the Company:

Varnabas Museum Hotel Limited, established in June 2018, opened its 5-star hotel in Kathmandu in February 2024. Each of the hotel’s ten floors represents a different Nepali ethnic group, offering guests a unique cultural experience. The hotel features 48 uniquely named suites, a rooftop pool inspired by Gokyo Lake, and dining options like the Kharka-La restaurant and South Col bar. In June 2024, it became Nepal’s only member of the Small Luxury Hotels of the World collection.

3. Myagdi Hydropower Limited

- IPO Proposal: Intends to issue 4,745,000 shares to raise Rs. 47.45 crores.

- Application Date: Submitted on Chaitra 27, 2081.

- Issue Manager: NMB Capital Limited.

- Sector: Hydropower

- Credit Rating: ICRA Nepal assigned a [ICRANP-IR] BB-rating, indicating moderate default risk.

About the Company:

Myagdi Hydropower Limited, founded on April 18, 2017, operates the 14 MW Ghar Khola Hydropower Project in Gandaki Province. Initially planned for 8.3 MW, the project was upgraded and began operations on August 25, 2023. The total project cost was NPR 3.413 billion. As of mid-October 2024, the company has a paid-up capital of NPR 926 million, fully held by promoters.

4. Prabhu Helicopter Limited

- IPO Proposal: Seeks to issue 6,125,000 shares to raise Rs. 61.25 crores.

- Application Date: Submitted on Chaitra 20, 2081.

- Issue Manager: Muktinath Capital Limited.

- Sector: Hotels And Tourism Index

- Credit Rating: CARE Ratings revised its rating to ‘CARE-NP B’ (long-term) and ‘CARE-NP A4’ (short-term) after earlier concerns about non-cooperation were resolved.

About the Company:

Prabhu Helicopter Limited started as a private company in 2015 and became public on July 14, 2022. Operating from Kathmandu and Pokhara, it offers domestic helicopter services, including sightseeing tours, mountain flights, and medical evacuations. The company expanded its operations by acquiring Muktinath Airlines in 2015.

Summary Table: Key IPO Details

Blogs

Citizens Mutual Fund Opens for Application from Asar 13

Citizens Mutual Fund is opening its public offering for the Citizens Sadabahar Yojana from Asar 13 (June 26, 2025). This open-ended mutual fund is being launched under the fund sponsorship of Citizens Bank International Limited and will be managed and sold by Citizens Capital Limited.

Out of the total 50 million units, 42.5 million units will be issued to the public. The fund is priced at Rs. 10 per unit, and investors can apply for a minimum of 100 units.

Applications can be submitted through the Meroshare online system, starting from Asar 13, with an early closing date of Asar 17 and the final closing date being Asar 27, if fully subscribed earlier.

What Makes This a Unique Investment?

The Citizens Sadabahar Yojana is an open-ended mutual fund, meaning investors can buy or sell units even after the initial offering period. However, it will not be listed on the stock exchange. Instead, investors can buy or sell units later through specified fund distributors at their convenience.

Where Will the Fund Be Invested?

According to the fund’s structure, the collected amount will be invested with the following limits:

-

Up to 75% in the stock market

-

Up to 10% in fixed deposits

-

Up to 5% in call deposits

-

Up to 10% in bonds and debentures

This structure provides a balanced investment approach, with a major portion in the equity market and the rest in safer financial instruments.

Blogs

Hydropower Gains 7.8% in One Month, Outperforming All Sectors

In the past month, Nepal’s share market has shown only slight growth, with the NEPSE index rising by just 1.68%. However, the hydropower sector has emerged as the top-performing sector, recording a sharp 7.89% increase during the same period. This rise comes even as several other sectors faced a decline.

Some hydropower companies have seen their stock prices jump by as much as 92% within a month. Two of the most notable performers are Butwal Power Company and newly listed Pure Energy, both of which have reached their highest-ever market prices.

Not only has the sector index grown, but trading volume and turnover have also increased significantly. A month ago, hydropower stocks accounted for around 50% of the total market turnover. Now, that figure has surged to nearly 70%. For example, on a recent trading day, out of a total NPR 9.08 billion turnover, NPR 6.03 billion (or 66%) came from the hydropower sector alone.

Companies with the Highest Price Growth in One Month

Hydropower Gains 7.8% in One Month

Why is Hydropower Attracting More Investors?

The key reason behind this increased interest is the improving financial reports of hydropower companies and the expectation of even better results. According to Bharat Ranabhat, former president of the Stock Brokers Association of Nepal, falling interest rates have reduced the financing costs of hydropower projects. This has positively impacted the profit margins of these companies.

Investors believe that the upcoming fourth-quarter financial reports will be even more favorable. As explained by investor Subash Chandra Dhungana, electricity production increases during the monsoon season, boosting income. Traditionally, most of a hydropower company’s annual earnings are made in the months of Baisakh, Jestha, and Ashad — the fourth quarter of the Nepali fiscal year.

In the share market, the banking and hydropower sectors are often seen as the two strongest. Historically, when banks underperform, hydropower tends to rise, and vice versa. This pattern is visible again. While banks are currently struggling with rising non-performing loans (NPLs) and increasing loan loss provisions, hydropower is gaining strength due to financial improvement.

Other sectors face challenges in this quarter. For example, banks, development banks, and finance companies are affected by rising NPLs, which directly reduce profits. Insurance companies, both life and non-life, have seen a rise in share numbers due to rights and bonus shares; however, business growth has not kept pace, resulting in a decline in earnings per share.

Production and processing companies are also under pressure due to weak demand and slow sales. These difficulties are not present in the hydropower sector. Power produced is sold as per agreements, and payments are received promptly, which provides stability and confidence to investors.

Big Investors Turn to Hydropower

With other sectors struggling, large investors have shifted their focus to hydropower. Companies with larger capital have seen both prices and trading volumes rise. One key feature of this sector is the wide range of company sizes. Hydropower firms in Nepal have paid-up capital ranging from NPR 134 million to over NPR 8.72 billion. This allows both big investors and general shareholders to find suitable options in this sector. The share prices also vary widely — from under NPR 200 to as high as NPR 1,850 per share — increasing the sector’s overall appeal.

Spotlight on Butwal Power Company

Among all hydropower companies, Butwal Power Company (BPC) has gained significant attention. Its share price is at a record high, and it consistently ranks among the top five in daily trading volume. BPC had planned to sell 3.1 million shares of Nyadi Hydropower, but the Securities Board of Nepal (SEBON) halted the sale. SEBON stated that since BPC’s directors are also involved in Nyadi, the sale goes against regulatory rules.

Despite this, rumors in the market suggest that BPC may still make a huge profit by selling those shares at nearly four times their original price. The shares were initially valued at NPR 100 each, and now the market value is around NPR 440. If the sale goes through, BPC could earn over NPR 1 billion in profit, which might be distributed as dividends to shareholders.

Other hydropower companies are also rumored to be planning similar share sales, leading to expectations of strong fourth-quarter earnings from asset sales.

Conclusion

The hydropower sector is currently the most attractive area of Nepal’s stock market. With better financial performance, timely earnings, low risk of payment delays, and a wide range of investment options, it has caught the attention of both large and small investors. As other sectors struggle, hydropower continues to shine, making it the clear leader in this month’s share market activity.

Blogs

Banks Invest Rs. 16.45 Trillion in Directed Loans, 14% in Agriculture Sector | Says Nepal Rastra Bank

Nepal’s commercial banks have invested only one-third of their total loans in the sectors directed by Nepal Rastra Bank (NRB), falling short of regulatory expectations aimed at boosting domestic production and economic activity.

According to the central bank’s report, as of the end of Chaitra in the current fiscal year, commercial banks have invested 33.5% of total loans in the directed sectors. This includes agriculture, energy, small and medium enterprises (SMEs), and other production-based industries.

What Are Directed Sectors?

Directed sectors are areas the central bank wants banks to focus their lending on. These include:

- Agriculture and allied industries

- Energy

- Small, cottage, and medium enterprises (SMEs)

- Industries using 100% domestic raw materials

- Tourism, handicrafts, and IT-based businesses

To support growth in these sectors, the central bank has capped interest rates—banks can charge only up to 2% more than the base rate on loans in these areas.

Current Lending Status

- Total bank lending till Chaitra: Rs. 49.13 trillion

- Directed sector lending: Rs. 16.45 trillion

Breakdown of Directed Sector Lending:

| Sector | Required by FY 2084 Ashad | Current as of Chaitra |

| Agriculture | 15% of total loans | 13.78% |

| Energy | 10% of total loans | 8.80% |

| SMEs & Cottage | 15% of total loans | Not specified |

| Combined (Agri + SME + Energy) | 12% (for this FY for all B/FIs) | 10.92% (for commercial banks) |

Regulatory Requirements and Penalties

- Banks must meet sector-specific lending percentages by the end of Ashad 2084.

- Failing to meet these targets will result in penalties. The shortfall amount will be calculated, and banks will be fined based on the interest that would have been earned on that amount at their maximum interest rate.

- The penalty will be enforced quarterly.

Target Highlights:

- By Ashad 2084:

- At least 15% of total loans must be allocated to agriculture.

- 10% of energy.

- 15% to SMEs, including loans under Rs. 2 crores and those targeting the underprivileged.

- Development banks must allocate 20%, and finance companies 15% of their total loans to the directed sectors.

Special Provisions for Priority Lending

NRB has mandated that loans for the following must be offered at concessional rates (up to 2% above the base rate):

- Food production (up to Rs. 2 crore)

- Animal husbandry and fisheries

- Agro-supporting industries

- Domestic tool manufacturing

- Export-based industries

- IT-based enterprises

- Tourism, crafts, and skills-based businesses

Challenges Ahead

Due to low demand for credit in the economy, many banks are unlikely to meet these targets by the end of the fiscal year. The slow pace of loan disbursement in agriculture, energy, and SMEs increases the risk of penalties for several banks.

Also, many financial institutions are still below the required threshold, especially in SME and energy lending.

Conclusion

Nepal Rastra Bank has set clear goals for banks and financial institutions to encourage investment in sectors that support domestic production and reduce import dependence. However, with just weeks remaining in the fiscal year, many banks are struggling to meet these requirements.

The central bank has warned that failure to comply will lead to financial penalties, pushing banks to act quickly and direct more loans into priority sectors before the deadline.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Fashion8 years ago

Fashion8 years agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform

-

Sports8 years ago

Sports8 years agoPhillies’ Aaron Altherr makes mind-boggling barehanded play

-

Business8 years ago

Business8 years agoUber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Entertainment8 years agoDisney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Sports8 years agoSteph Curry finally got the contract he deserves from the Warriors