Blogs

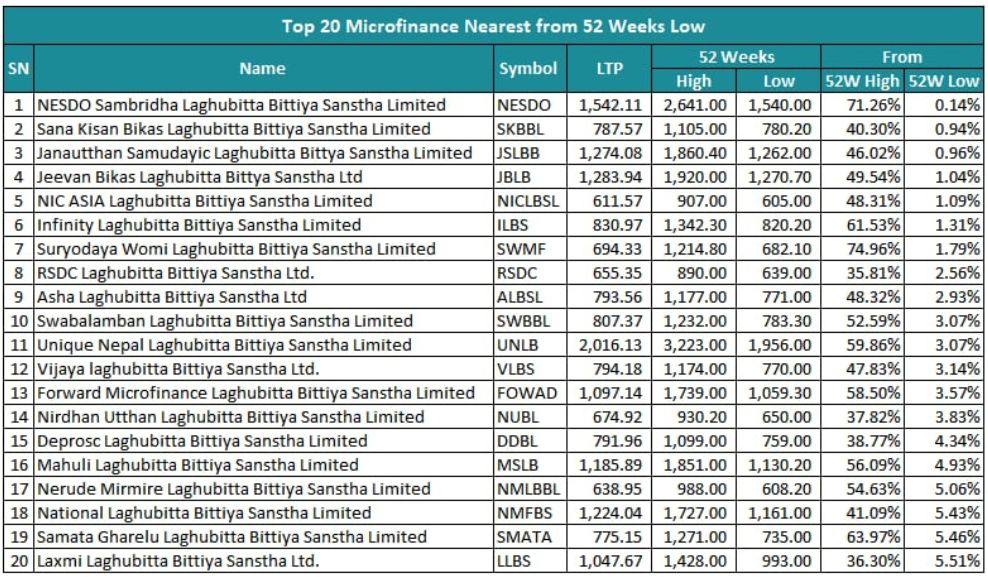

Deprosc Laghubitta Bittiya Sanstha Reports Remarkable Growth in Q2 FY 2081/82

Deprosc Laghubitta Bittiya Sanstha Limited (DDBL) has shown strong financial performance in the second quarter of fiscal year 2081/82. The company recorded impressive improvements across key metrics, marking a period of significant growth. This remarkable growth highlights DDBL’s strong operational efficiency and strategic financial management. Below is a detailed breakdown of its performance:

1. Key Financial Highlights

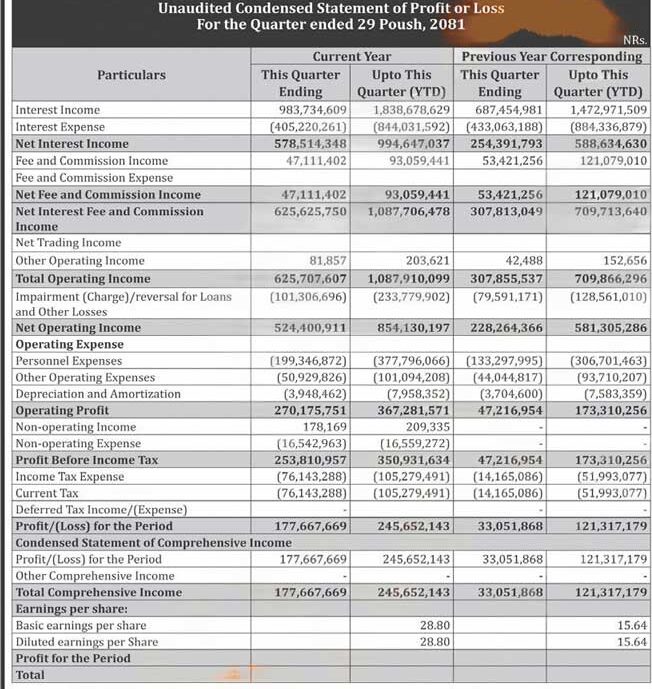

- Net Profit: Increased by 102.49% to Rs. 24.56 crores (up from Rs. 12.13 crores in Q2 of FY 2080/81).

- Net Interest Income: Grew by 68.98% to Rs. 99.46 crores.

- Operating Profit: Surged by 111.92% to Rs. 36.72 crores.

2. Impairment Charges and Cost of Funds

- Impairment Charges: Rose sharply by 81.84% to Rs. 23.37 crores, reflecting higher provisions for potential loan losses.

- Cost of Funds: Declined from 9.66% in Q2 2080/81 to 8.11% this quarter, easing financial pressure.

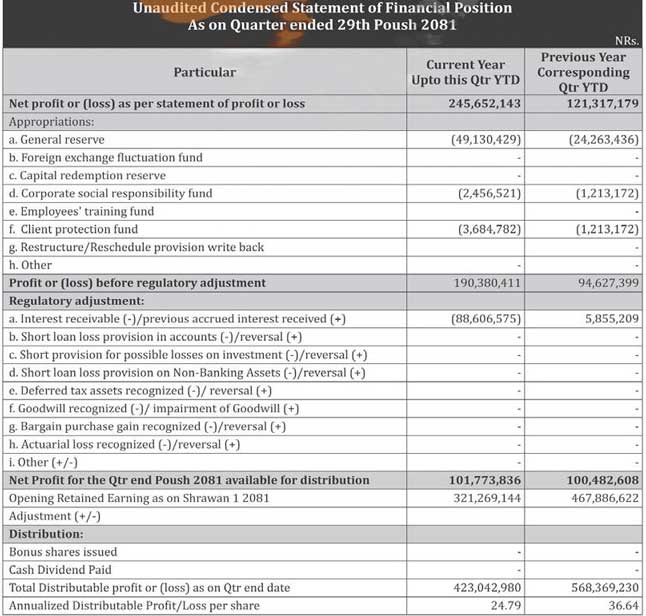

3. Growth in Deposits and Loans

- Customer Deposits: Expanded by 6.67% to Rs. 10.24 Arba.

- Loans and Advances: Increased by 4.61% to Rs. 24.23 Arba, demonstrating the company’s growing outreach in microfinance.

4. Capital Adequacy Ratio (CAR)

- The capital adequacy ratio (CAR) declined to 12.40% from 14.03% in the previous year, indicating a need for closer regulatory compliance monitoring.

5. Shareholder Metrics

- Earnings Per Share (EPS): Annualized EPS improved to Rs. 28.80 (up from Rs. 14.22 in the previous year).

- Net Worth Per Share: Increased by 7.45% to Rs. 204.22, reflecting growth in shareholder value.

- Market Performance: The stock closed at Rs. 785 per share, with a Price-to-Earnings (P/E) ratio of 27.26 times.

Comparison of Key Financial Highlights for Q2 of This Fiscal Year and the Previous Fiscal Year

Unaudited Condensed Statement of Financial Position As on Quarter Ended 29th Poush 2081

Unaudited Condensed Statement of Profit or Loss For The Quarter Ended 29th Poush 2081

Conclusion

Deprosc Laghubitta Bittiya Sanstha Limited (DDBL) has delivered an exceptional financial performance in the second quarter of FY 2081/82, with a 102.49% surge in net profit and significant growth in net interest income and operating profit. Despite higher impairment charges and a slight decline in the capital adequacy ratio, the company’s strong financial position and improved shareholder metrics like EPS of Rs. 28.80 and net worth per share of Rs. 204.22 highlight its resilience and growth potential. DDBL continues strengthening its position in the microfinance companies sector, offering promising prospects for its stakeholders.

Blogs

52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

The microfinance sector in Nepal has been moving sideways for a long time. The group sub-index has been fluctuating between 4,600 and 5,600. Recently, the index reached a swing high of nearly 4,900 but then closed at 4,671.74.

The national budget did not bring any immediate changes that could affect the capital market. So, investors are now waiting for the upcoming monetary policy. After the newly appointed Governor of Nepal Rastra Bank, Dr. Bishwanath Paudel, reduced the risk weight on margin loans from 125% to 100% during the third quarterly review, investor confidence grew.

Investors now hope that the following changes will be introduced in the next monetary policy:

- Removal of the current Rs. 15 crore limit on individual investment

- Removal of the 15% dividend cap on microfinance institutions

- Permission for banks and financial institutions to trade shares for less than one year

Governor Paudel’s public remarks have made investors hopeful that the upcoming monetary policy will be share-market friendly.

Despite the pressure on the market at the end of Ashar, investors are optimistic about a rebound afterward. Experts say microfinance and insurance stocks—whose prices have not surged yet compared to others—might offer better opportunities in the coming days.

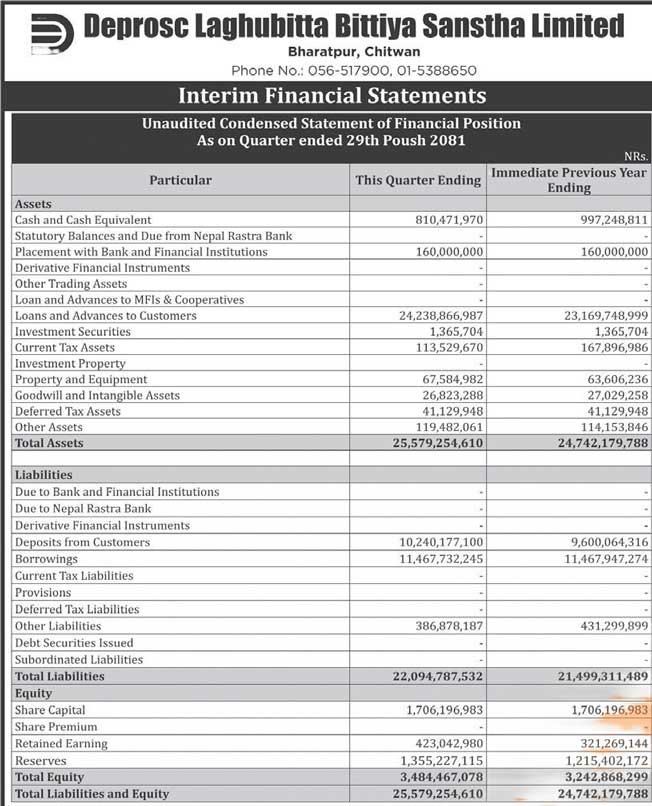

Top 20 Microfinance Companies Nearest to 52-Week Low

Some microfinance companies are trading close to their 52-week low prices. These stocks may offer good value for long-term investors. Here are some examples:

-

Nesdo Samriddhi Microfinance had a high of Rs. 2,641 and a low of Rs. 1,540 in the past year. It is currently trading near its lowest point.

-

Sana Kisan Bikas Microfinance and Jan Utthan Community Microfinance are both trading less than 1% above their 52-week lows.

-

Jeevan Bikas, NIC Asia, Infinity, Suryodaya Womi, RSDC, Asha, and Swabalamban Microfinance are trading just 1–3% above their yearly lows.

-

Other companies like Unique Nepal, Bijaya, Forward, Nirdhan Utthan, Diprox, Mahuli, Nerude Mirmire, National, Samata Gharelu, and Laxmi Microfinance are also trading only 3–5.5% above their low points.

According to experts, these stocks could be worth watching for those looking to invest at lower prices.

Microfinance Stocks Near 52-Week High

Interestingly, a few companies are still trading near their 52-week highs even though the overall market is in a downtrend:

-

Unnati Sahakarya Microfinance reached a high of Rs. 5,276 and is now trading at around Rs. 1,804.

-

CYCL Nepal Microfinance had a high of Rs. 1,958 and is still trading at Rs. 1,615, which is relatively strong.

On the other hand, many microfinance stocks are trading 20–40% below their 52-week highs:

-

Aatmanirbhar, Mahila, Grameen Bikas, Kalika, Global IME, Chhimek, Mero Microfinance, and Abhiyan are all trading 22% to 31% below their highs.

-

NMB, First Microfinance, RSDC, Laxmi, Nirdhan Utthan, Diprox, Sana Kisan, Mithila, National, and Swabhiman are trading 34% to 44% below their 52-week highs.

These stocks may still have room to rise if the market recovers and favorable policies are introduced.

Conclusion

The microfinance sector in Nepal is at a turning point. While the market has been moving sideways, investor confidence is building, especially with hopes for a supportive monetary policy. Stocks near their 52-week lows may offer attractive entry points, while those holding near their highs show relative strength.

For both new and experienced investors, this could be a good time to study the microfinance sector closely and plan for the long term. As always, careful research and risk assessment are essential before making any investment decisions.

Blogs

Asian Life Insurance to Issue Rights Shares from Asar 25

Asian Life Insurance Company Limited (ALICL) has announced the opening of its rights share issuance from Asar 25, 2082 (July 9, 2025). The company is offering 42% rights shares based on its current paid-up capital.

This means that shareholders will receive 4.2 new shares for every 10 existing shares they own. This issuance aims to raise over NPR 1.42 billion, with each share priced at NPR 100.

Key Details of the Rights Issue

| Topic | Information |

| Company Name | Asian Life Insurance Company Limited (ALICL) |

| Rights Share Ratio | 10:4.2 (42%) |

| Total Rights Shares to be Issued | 14,279,312.48 shares |

| Total Amount to be Raised | NPR 1,427,931,248 |

| Par Value Per Share | NPR 100 |

| Current Paid-Up Capital | NPR 3.39 billion |

| Paid-Up Capital After Issuance | NPR 4.82 billion |

| Issue Manager | Muktinath Capital Limited |

| Credit Rating | [ICRA Nepal] IRN A- (Adequate Safety) |

The company had set the book closure date for Jestha 16, 2082 (June 29, 2025). This means that only those shareholders who held shares until Jestha 14, 2082 (June 27, 2025) are eligible to apply for the rights shares. The application period for the rights issue will begin from Asar 25, 2082 (July 9, 2025) and will remain open until Shrawan 13, 2082 (July 28, 2025).

Application Process

- Eligible shareholders (who held shares before the book closure date) can apply for rights shares.

- Applications can be submitted through:

- Muktinath Capital

- Selected branches of Muktinath Bikas Bank (e.g., Biratnagar, Pokhara, Nepalgunj, etc.)

- Asian Life Insurance offices

- ASBA-approved banks and financial institutions

- Online via Meroshare (using C-ASBA system)

Why This Matters to Investors

- The rights issue provides existing shareholders with an opportunity to increase their holdings at par value.

- The company’s credit rating of A- suggests good ability to meet financial obligations.

- After the rights issuance, the company will have a stronger capital base of NPR 4.82 billion, which may support future business expansion.

Blogs

Citizens Mutual Fund Opens for Application from Asar 13

Citizens Mutual Fund is opening its public offering for the Citizens Sadabahar Yojana from Asar 13 (June 26, 2025). This open-ended mutual fund is being launched under the fund sponsorship of Citizens Bank International Limited and will be managed and sold by Citizens Capital Limited.

Out of the total 50 million units, 42.5 million units will be issued to the public. The fund is priced at Rs. 10 per unit, and investors can apply for a minimum of 100 units.

Applications can be submitted through the Meroshare online system, starting from Asar 13, with an early closing date of Asar 17 and the final closing date being Asar 27, if fully subscribed earlier.

What Makes This a Unique Investment?

The Citizens Sadabahar Yojana is an open-ended mutual fund, meaning investors can buy or sell units even after the initial offering period. However, it will not be listed on the stock exchange. Instead, investors can buy or sell units later through specified fund distributors at their convenience.

Where Will the Fund Be Invested?

According to the fund’s structure, the collected amount will be invested with the following limits:

-

Up to 75% in the stock market

-

Up to 10% in fixed deposits

-

Up to 5% in call deposits

-

Up to 10% in bonds and debentures

This structure provides a balanced investment approach, with a major portion in the equity market and the rest in safer financial instruments.

-

Blogs3 days ago

Blogs3 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs50 minutes ago

52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs4 days ago

Blogs4 days agoBanks Invest Rs. 16.45 Trillion in Directed Loans, 14% in Agriculture Sector | Says Nepal Rastra Bank

-

Blogs7 months ago

Blogs7 months agoKarnali Yaks Win By 6 Wickets Against Chitwan Rhinos | Nepal Premier League 2024

-

Blogs6 months ago

Blogs6 months agoSiuri Nyadi Power Limited Added to IPO Pipeline by SEBON

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs6 months ago

Blogs6 months agoJanakpur Bots Vs Kathmandu Gurkhas 21st Match Highlights | NPL 2024

-

AGM6 months ago

AGM6 months agoShivam Cements Proposes a 9% Dividend For FY 2080/81 and Announces Book Closure Date