The Securities Board of Nepal (SEBON) has instructed the Nepal Stock Exchange (NEPSE) to proceed with offering 30% of its shares to the public as part of its restructuring initiative.

Background

Earlier, the Ministry of Finance sent a letter to SEBON based on recommendations from a committee led by Nepal Rastra Bank director Chintamani Siwakoti. This committee was created to recommend changes in the capital market.

SEBON spokesperson Tolakant Neupane said, “Following the committee’s suggestions, NEPSE has been instructed to proceed with restructuring. The board will also take necessary steps. We have urged the government to take action as well.”

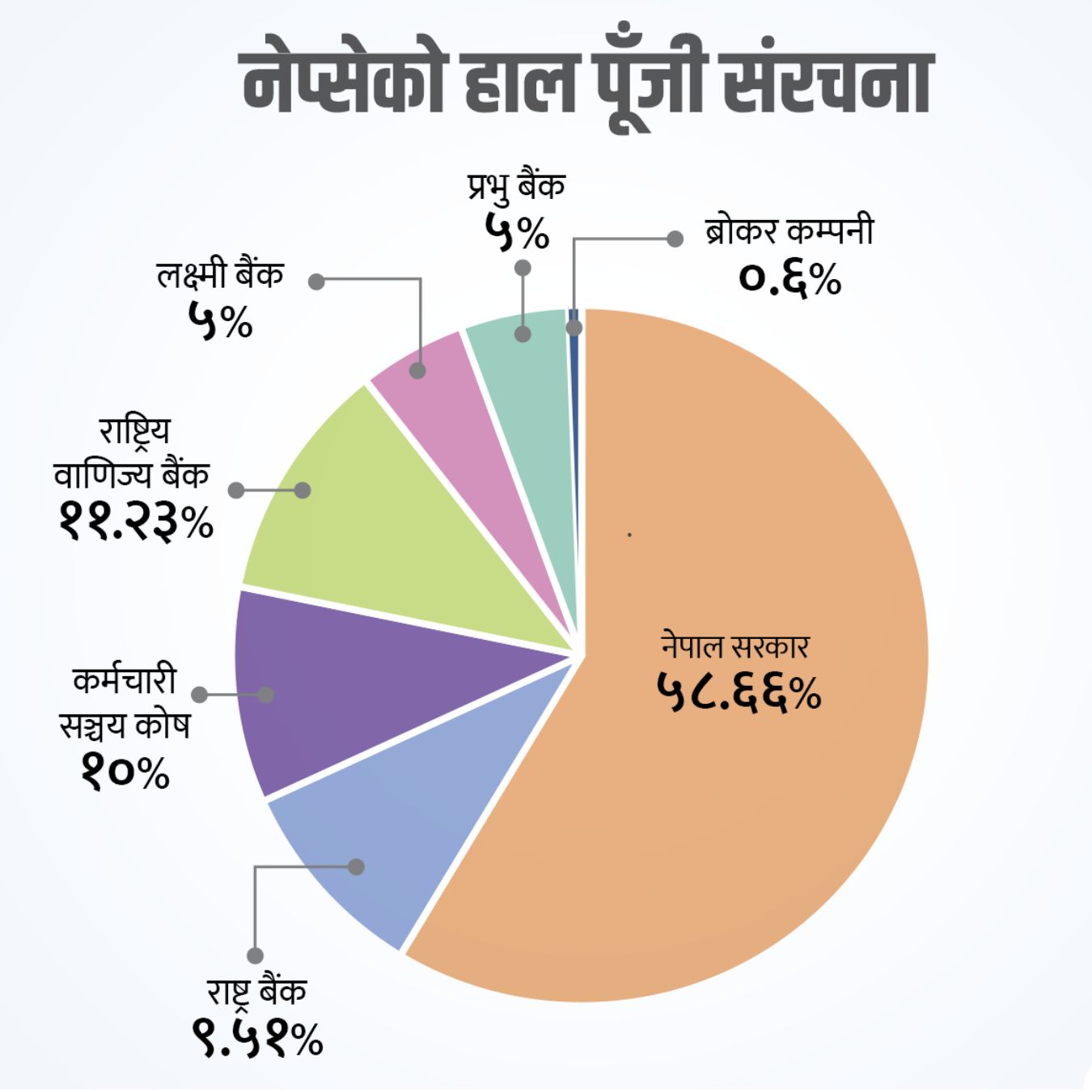

Current Shareholding Structure

Currently, NEPSE’s shares are held by:

| Shareholder | Percentage |

|---|---|

| Government of Nepal | 58.66% |

| Rastriya Banijya Bank | 11.23% |

| Employees Provident Fund | 10% |

| Nepal Rastra Bank | 9.51% |

| Laxmi Sunrise Bank | 5% |

| Prabhu Bank | 5% |

| Brokerage firms | 0.6% |

The government plans to reduce its stake and distribute shares to foreign strategic partners, public institutions, banks, insurance companies, and the general public.

Capital Increase Plan

NEPSE’s current paid-up capital is NPR 1 billion. The objective is to raise the amount to NPR 3 billion. The additional NPR 2 billion will be offered to foreign investors, public institutions, banks, insurance companies, and the public.

A NEPSE official said, “The government must first decide to increase the capital. Only then can other steps proceed.”

Restructuring Process

Once the government approves the capital increase, NEPSE will:

- Hold a general meeting to pass the decision.

- Amend its policies and regulations.

- Appoint a sales manager for share issuance.

- Seek approval from SEBON.

The final plan is to:

- Keep total capital at NPR 3 billion.

- Reduce the government’s share to 20%.

- Allocate 30% to the public.

- Distribute the remaining 50% to public institutions, banks, insurance companies, and foreign partners.

Foreign Investment Interest

Foreign investors have previously shown interest in Nepal’s stock market. A NEPSE source said, “Many international stock market entities want to enter Nepal, but government delays have held them back.”

Policy Changes Needed

Current regulations treat NEPSE and new stock exchanges differently. For example, Regulations require new exchanges to publicly list 30% of their shares and maintain NPR 3 billion in capital, but NEPSE has been excluded from both these requirements.

These rules must be revised for NEPSE’s restructuring.

Challenges with Government Ownership

Experts say NEPSE cannot compete effectively unless the government reduces its ownership. A former NEPSE CEO said, “As long as the government has control, decision-making is slow. Even small decisions face threats and legal warnings.”

He shared that during his tenure, suppliers demanded commissions and threatened lawsuits if not paid.

Conclusion

NEPSE is preparing its action plan for SEBON. Once approved, the government must make key decisions to move forward. Without full privatization, NEPSE’s growth and competition with new exchanges will remain difficult.