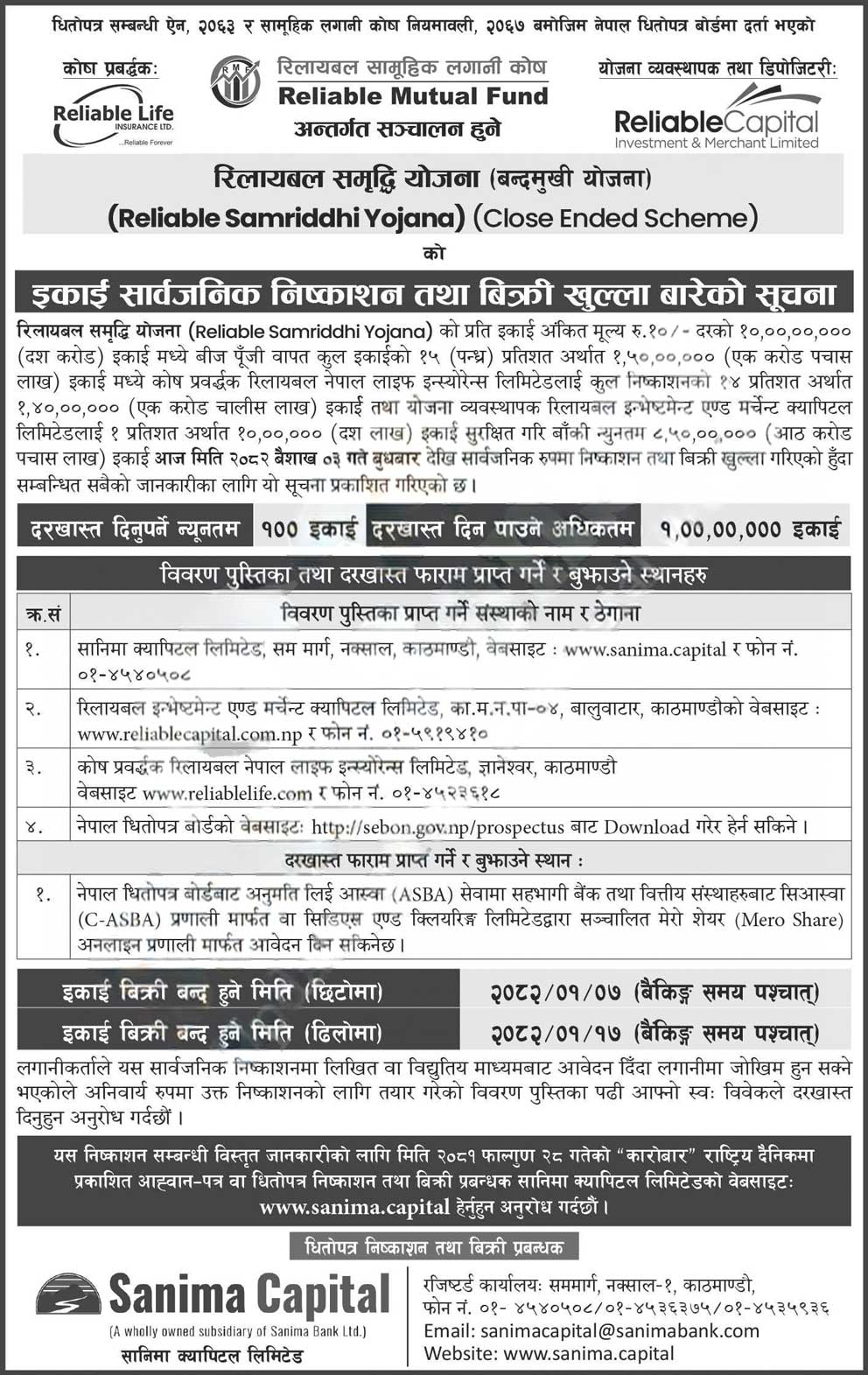

Reliable Capital Limited has unveiled its first-ever mutual fund, the “Reliable Samriddhi Yojana,” a closed-end scheme now open for subscription from Baishakh 3 to 7, 2082, with an extension option until Baishakh 17 if undersubscribed. Here’s a simplified guide to the fund’s structure, allocation, and application process.

Key Highlights of the Fund

- Type: Closed-end mutual fund (units locked until maturity).

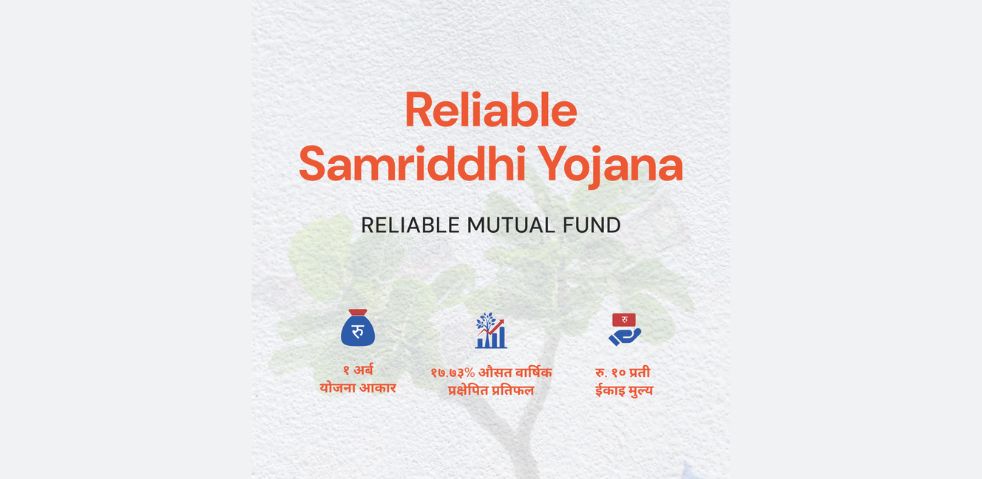

- Total Units: 10 crore units at Rs. 10 face value each.

- Public Allocation: 8.5 crore units (85%) worth Rs. 85 crore.

- Sponsor & Manager Allocation:

- Reliable Nepal Life Insurance (Sponsor): 1.4 crore units (14%).

- Reliable Capital (Manager): 10 lakh units (1%).

- Investment Range: Apply for 100 to 1 crore units.

Critical Dates & Deadlines

Unit Allocation Breakdown

How to Apply?

- Application Methods:

- C-ASBA: Via ASBA-affiliated banks/financial institutions.

- Online: Use the Mero Share platform.

- Documents Required:

- Prospectus (download from SEBON or Reliable Capital’s website).

- Application forms from designated offices (see notice for addresses).

Why Invest in Samriddhi Yojana?

- First-Time Fund: Managed by Reliable Capital, a trusted merchant banker in Nepal.

- Clear Allocation: 85% of units reserved for public participation.

- Flexible Investment: Start with just 100 units (Rs. 1,000).

Risks & Precautions

Investors are advised to read the prospectus carefully, assess market risks, and consult financial advisors before applying. Past performance is not indicative of future returns.

Important Contacts

- Reliable Capital: www.reliablecapital.com.np | Phone: 01-5919410

- Sanima Capital (Issue Manager): www.sanima.capital | Phone: 01-4540508

Notice of Reliable Samriddhi Yojana Mutual Fund Launch