Daily Report

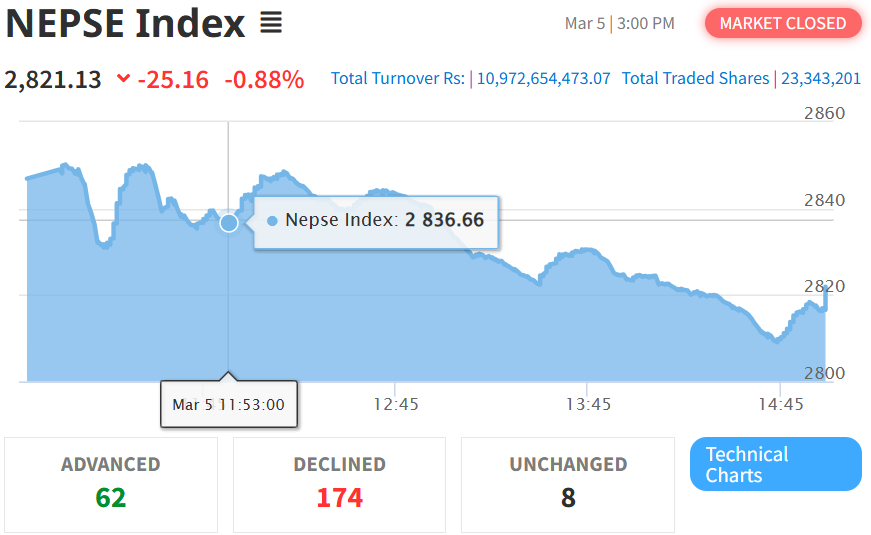

March 5 Market Update: Market Declines with Increased Selling Activity

On March 5, 2081, the stock market began with a slight increase, reaching an intraday high of 2,850.16 during the opening session. However, the market then fluctuated with a downward trend, dropping to the day’s lowest point of 2,809.09 before closing. Along with the overall loss, the total turnover decreased to NPR 10.97 Arba, down from NPR 12.94 Arba the previous day.

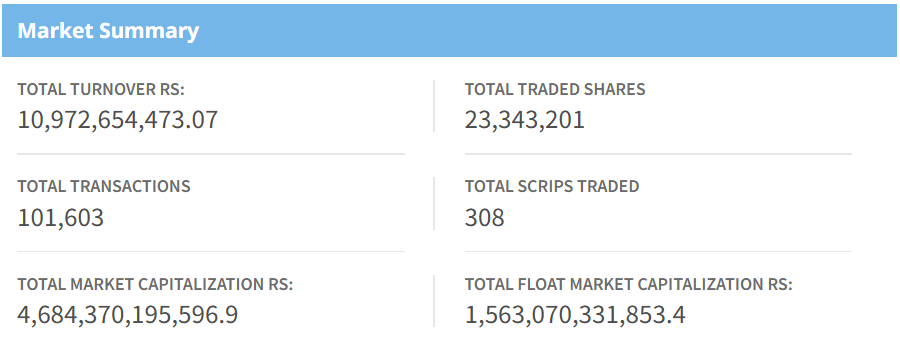

Market Summary

By the end of the trading day, 23,343,201 shares were traded in 101,603 transactions, involving 308 scripts. Among these, 62 companies saw their prices rise, 174 experienced declines, and 8 remained unchanged. The market sentiment remained negative, with increased selling activity overall.

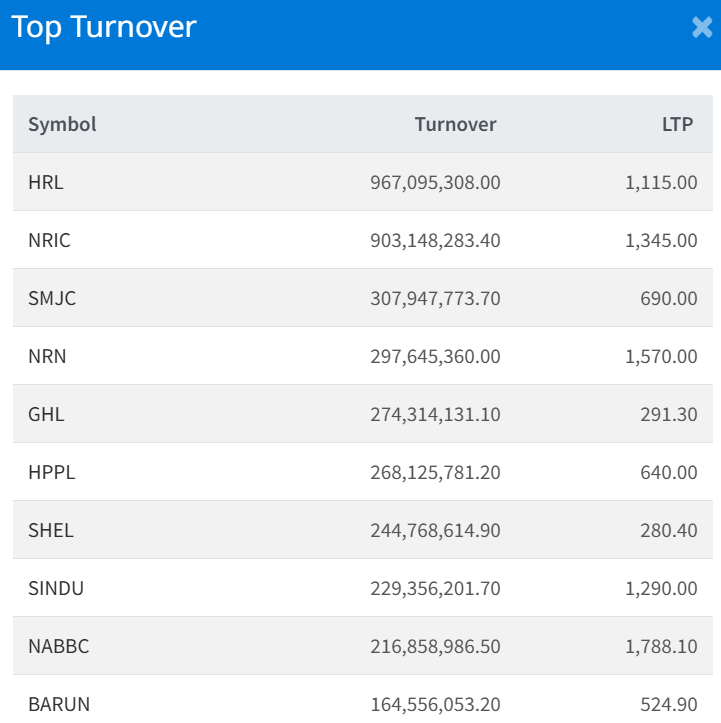

Top Turnover

Himalayan Reinsurance Limited (HRL) recorded the highest turnover of NPR 96.70 crore. Its stock price decreased by 0.81%, closing at Rs. 1,115.00, down from Rs. 1,124.10.

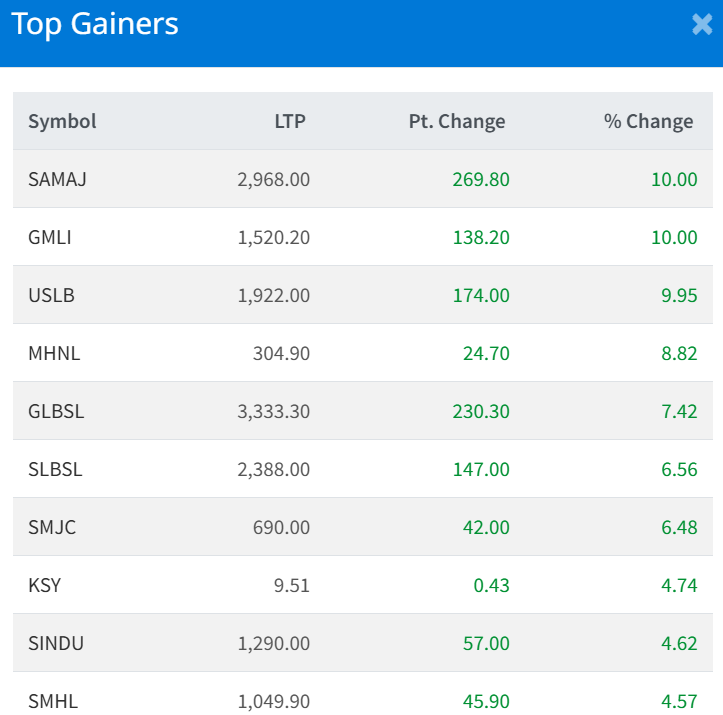

Top Gainer

Samaj Laghubittya Bittiya Sanstha Limited (SAMAJ) and Guardian Micro Life Insurance Limited (GMLI) were the top gainers of the day, with their prices increasing by 10% and hitting the upper circuit limit.

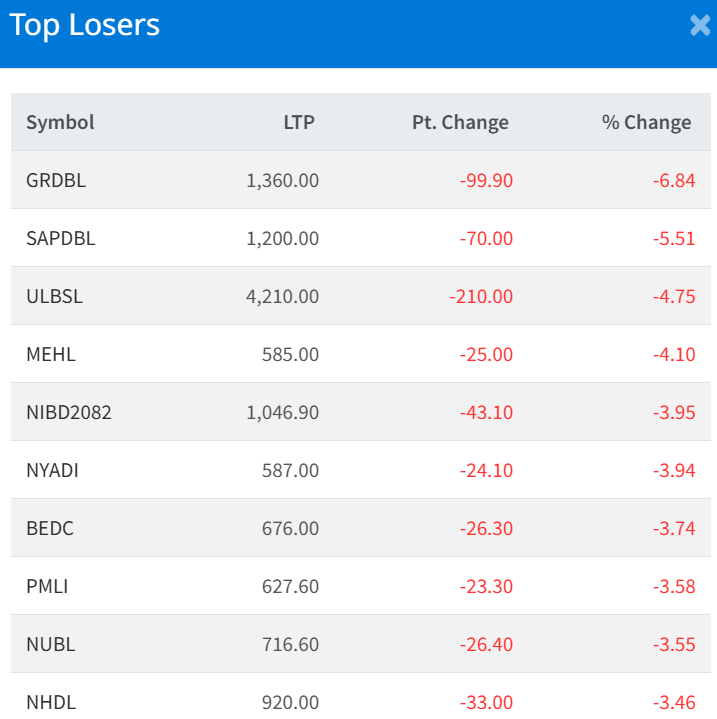

Top Loser

Green Development Bank Ltd. (GRDBL) was the biggest loser of the day, dropping 6.84% with an LTP of Rs. 1,360.00, down from Rs. 1,459.90.

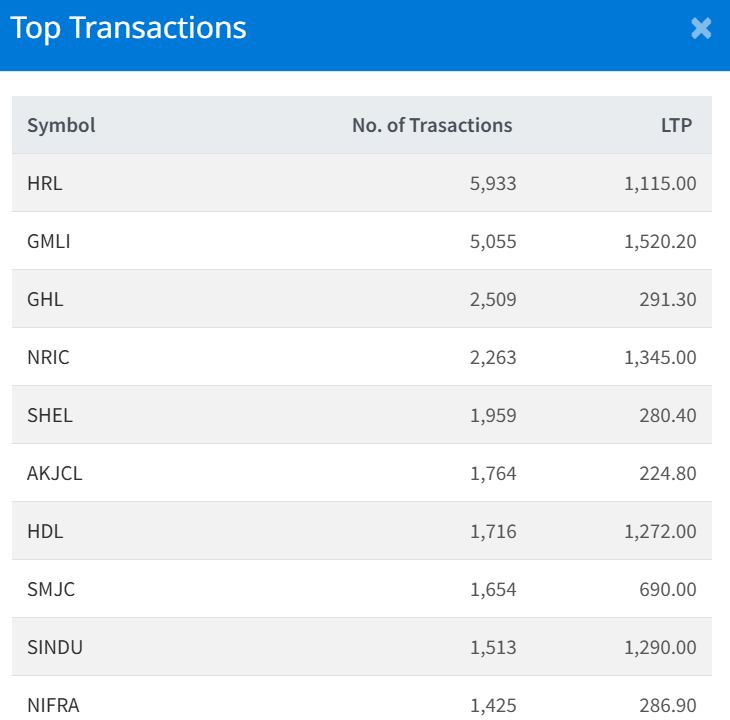

Top Transaction

Himalayan Reinsurance Limited (HRL) also recorded the highest number of transactions, with 5,933 trades at an LTP of Rs. 1,115.00.

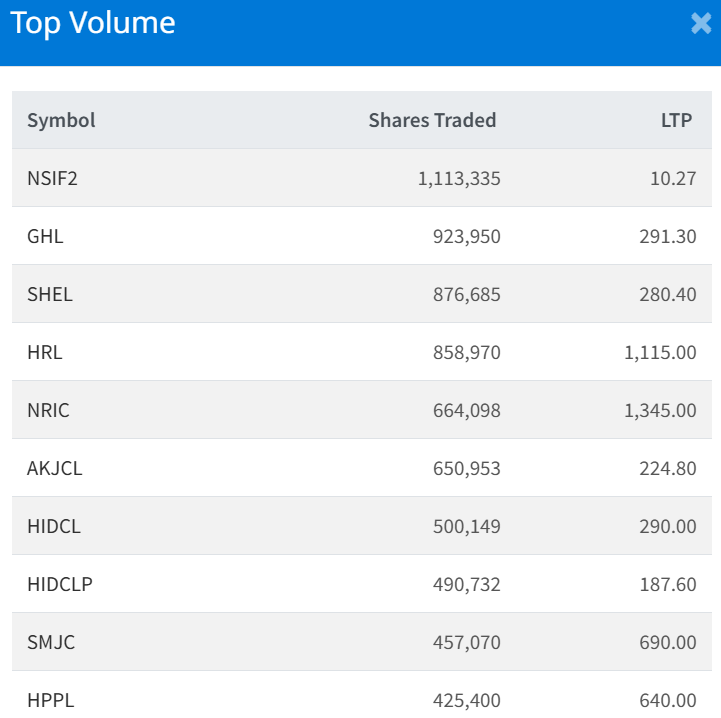

Top Volume

NMB Sulav Investment Fund – 2 (NSIF2) led in trading volume, with 1,113,335 shares traded at an LTP of Rs. 10.27.

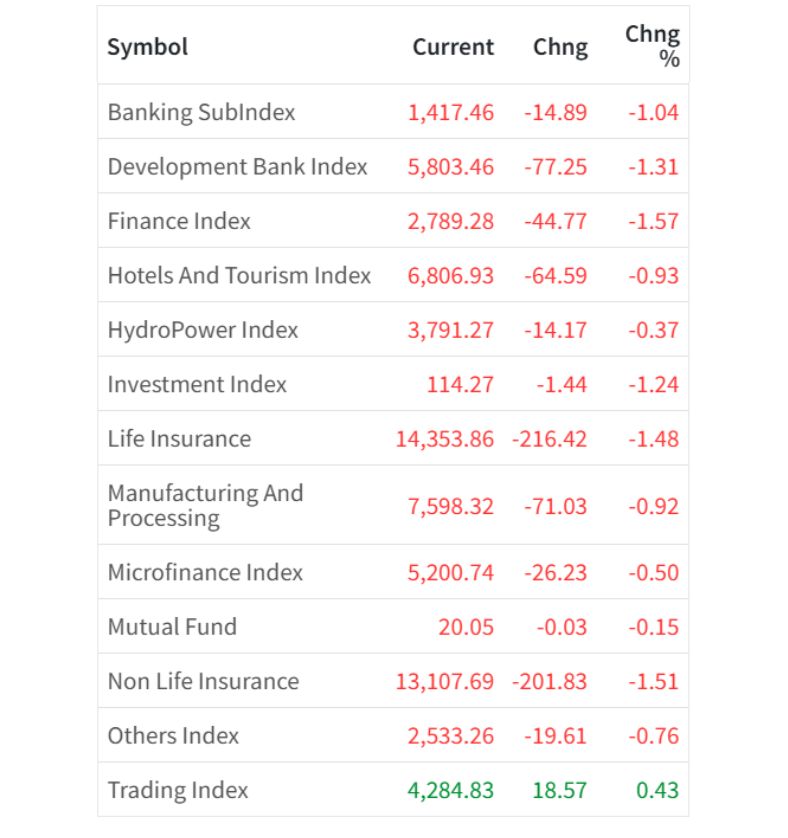

Sector-wise Performance

In today’s market, except for the Trading Index, all sectors closed in the red.

- Trading Index gained the most, rising by 0.43%.

- Finance Index declined the most, dropping by 1.57%.

The market ended on a negative note, with increased selling activity and declines across most sectors.

Daily Report

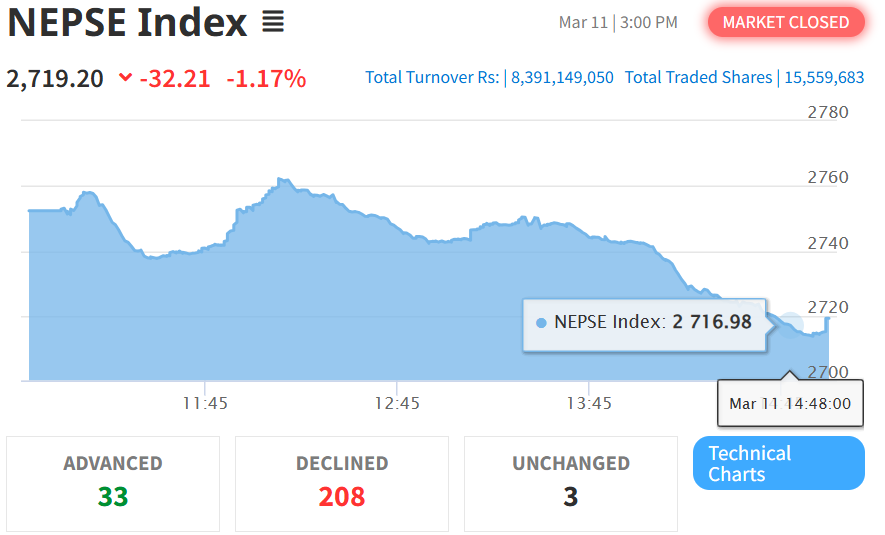

2025 March 11 Market Update: Market Declines By 32.21 Points with Increased Turnover

On March 11, 2081, the stock market began with a slight decrease and fluctuated throughout the day, reaching an intraday high of 2,761.86. After hitting the day’s high, the market started falling and dropped to the lowest point of 2,714.07 before closing. Despite the overall loss, the total turnover increased slightly to NPR 8.39 Arba, up from NPR 8.37 Arba the previous day.

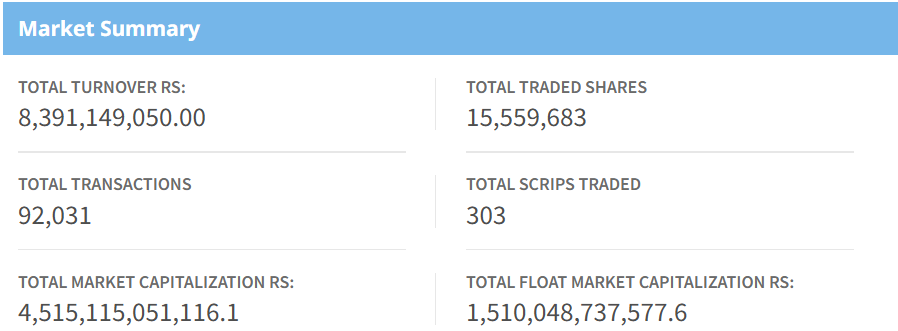

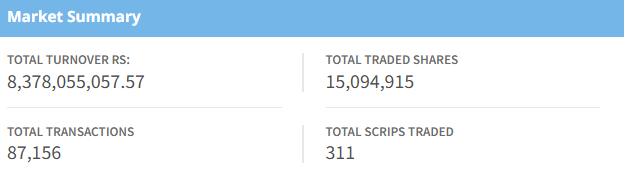

Market Summary

By the end of the trading day, 15,559,683 shares were traded in 92,031 transactions, involving 303 scripts. Among these, 33 companies saw their prices rise, 208 experienced declines, and 3 remained unchanged. The market sentiment remained negative, with increased selling activity overall.

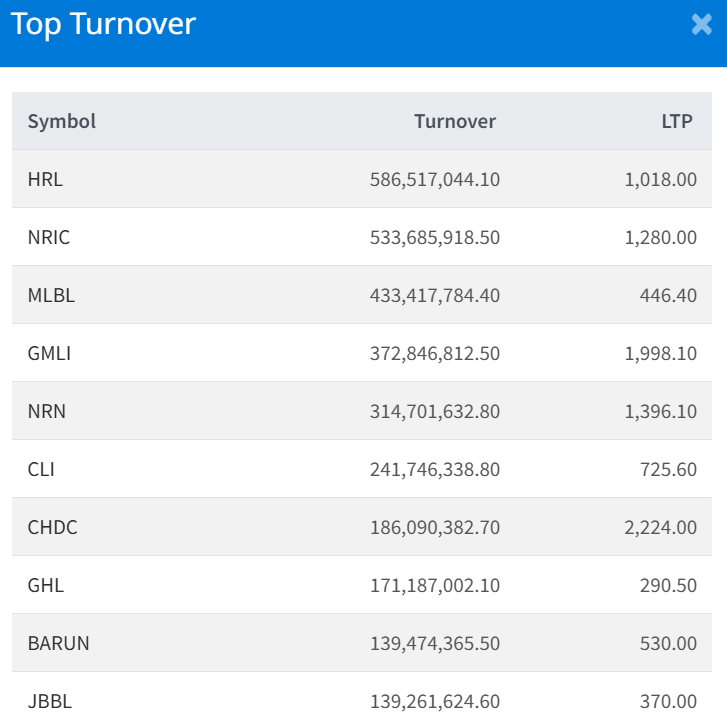

Top Turnover

Himalayan Reinsurance Limited (HRL) recorded the highest turnover of NPR 58.65 crore. Its stock price decreased by 3.80%, closing at Rs. 1,018.00, down from Rs. 1,058.20.

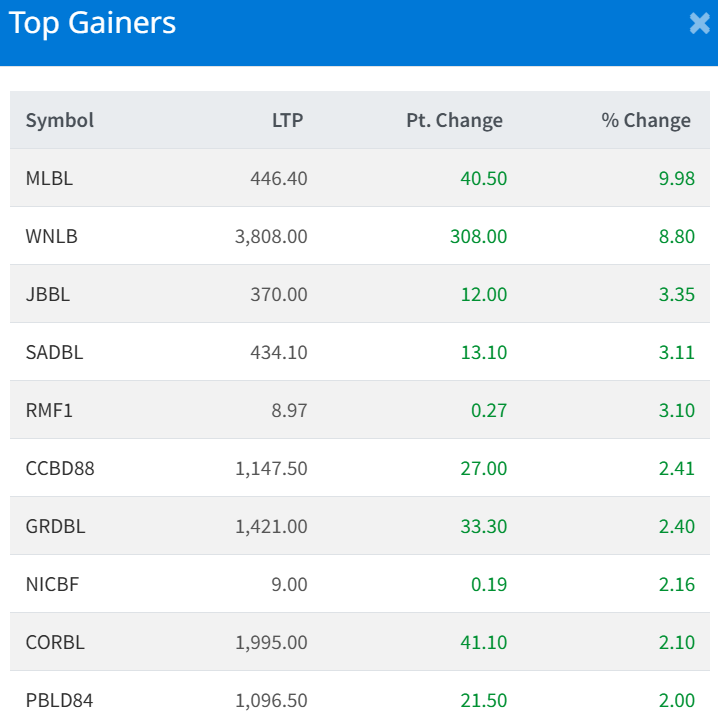

Top Gainer

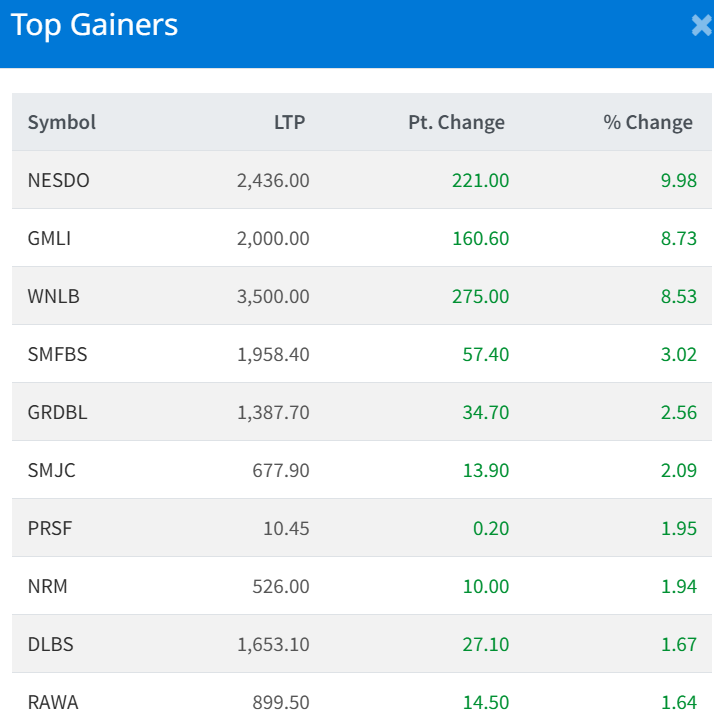

Mahalaxmi Bikas Bank Ltd. (MLBL) was the top gainer of the day, with its price increasing by 9.98%, closing at Rs. 446.40, up from Rs. 405.90.

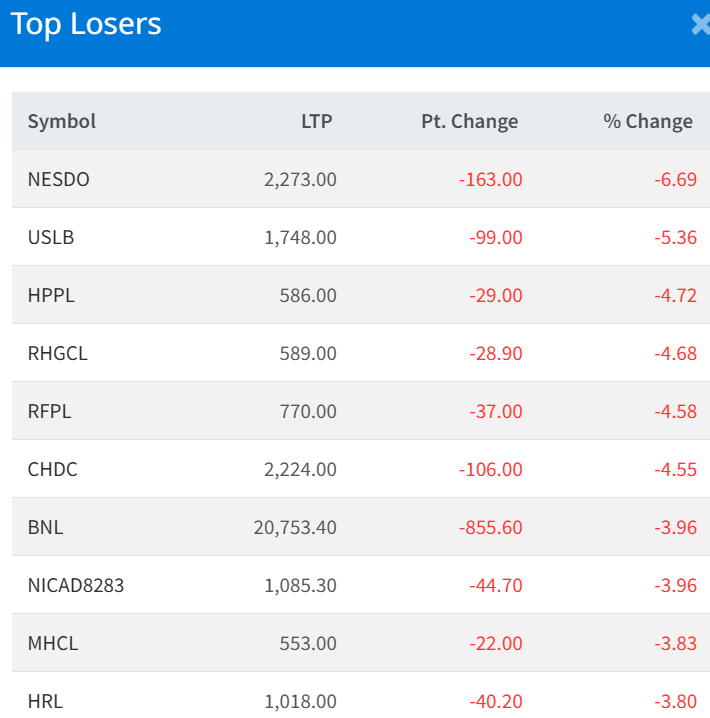

Top Loser

NESDO Sambridha Laghubitta Bittiya Sanstha Limited (NESDO) was the biggest loser of the day, dropping 6.69% with an LTP of Rs. 2,273.00, down from Rs. 2,436.00.

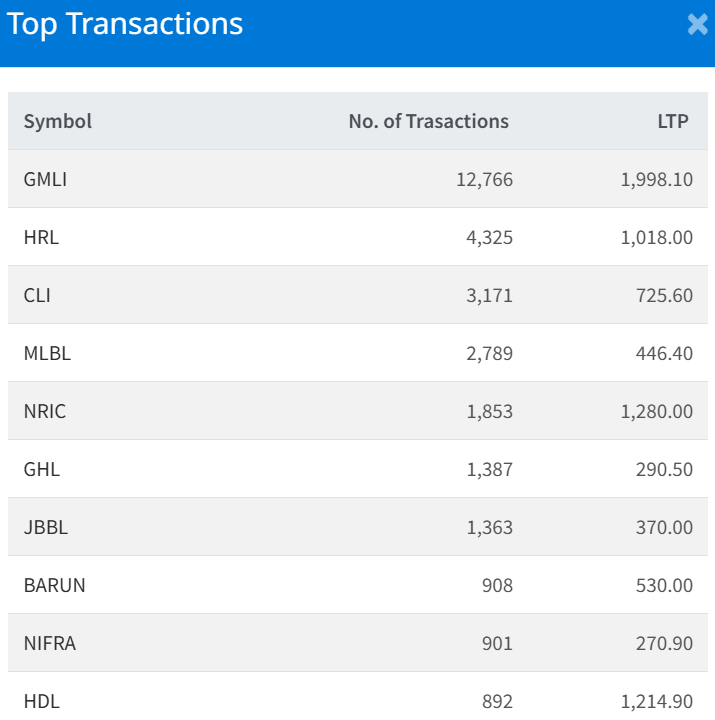

Top Transaction

Guardian Micro Life Insurance Limited (GMLI) recorded the highest number of transactions, with 12,766 trades at an LTP of Rs. 1,998.10.

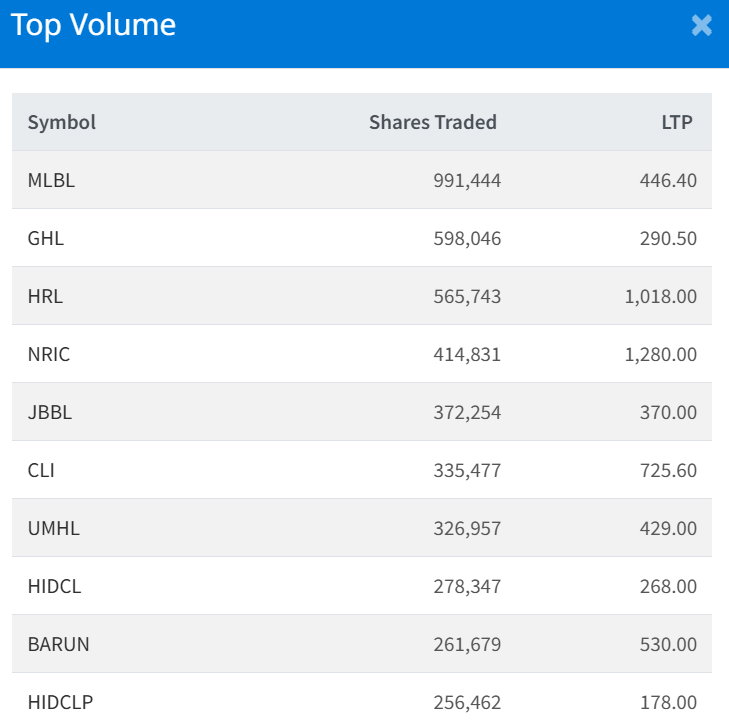

Top Volume

Mahalaxmi Bikas Bank Ltd. (MLBL) led in trading volume, with 991,444 shares traded at an LTP of Rs. 446.40.

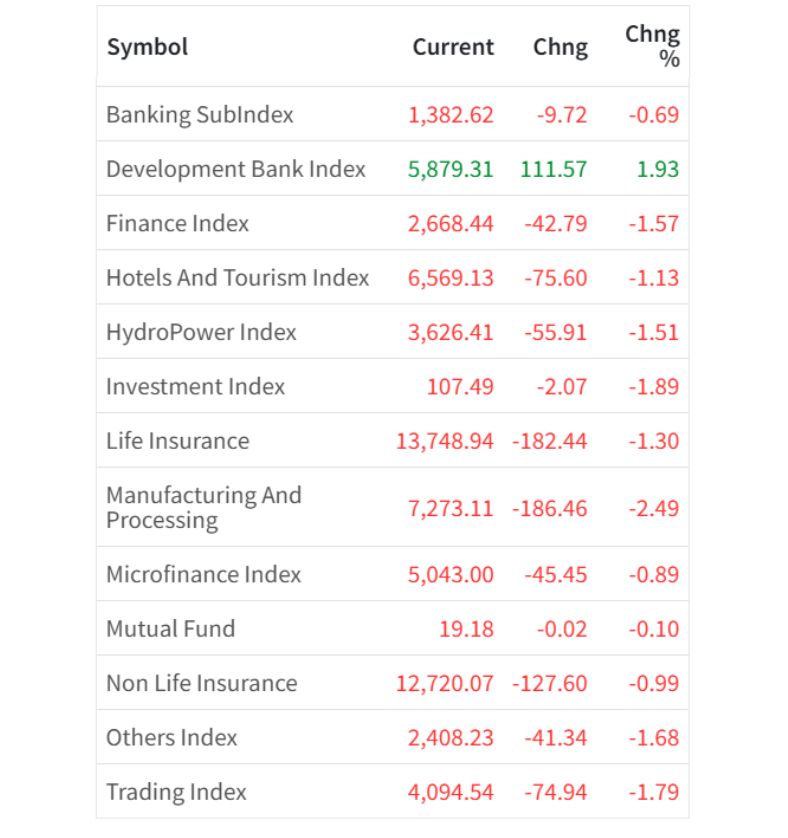

Sector-wise Performance

In today’s market, except for the Development Bank Index, all sectors closed in the red.

- Development Bank Index gained the most, rising by 1.93%.

- Manufacturing and Processing Index declined the most, dropping by 2.49%.

The market ended on a negative note, with increased selling activity and declines across most sectors.

Daily Report

2025 March 10 Market Update: Market Declines with Increased Selling Activity

On March 10, 2081, the stock market began with a slight increase and fluctuated throughout the day, reaching an intraday high of 2,791.04 before falling to the day’s lowest point of 2,744.23 and closing lower. Along with the overall loss, the total turnover decreased to NPR 8.37 Arba, down from NPR 10.09 Arba the previous day.

Market Summary

By the end of the trading day, 15,094,915 shares were traded in 87,156 transactions, involving 311 scripts. Among these, 44 companies saw their prices rise, 191 experienced declines, and 8 remained unchanged. The market sentiment remained negative, with increased selling activity overall.

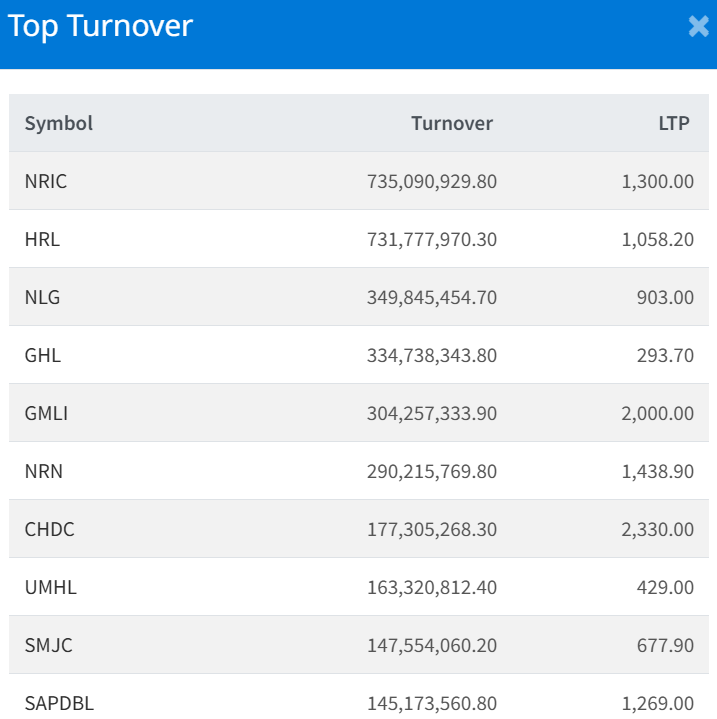

Top Turnover

Nepal Reinsurance Company Limited (NRIC) recorded the highest turnover of NPR 73.50 crore. Its stock price decreased by 0.31%, closing at Rs. 1,300.00, down from Rs. 1,304.00.

Top Gainer

NESDO Sambridha Laghubitta Bittiya Sanstha Limited (NESDO) was the top gainer of the day, with its price increasing by 9.98%.

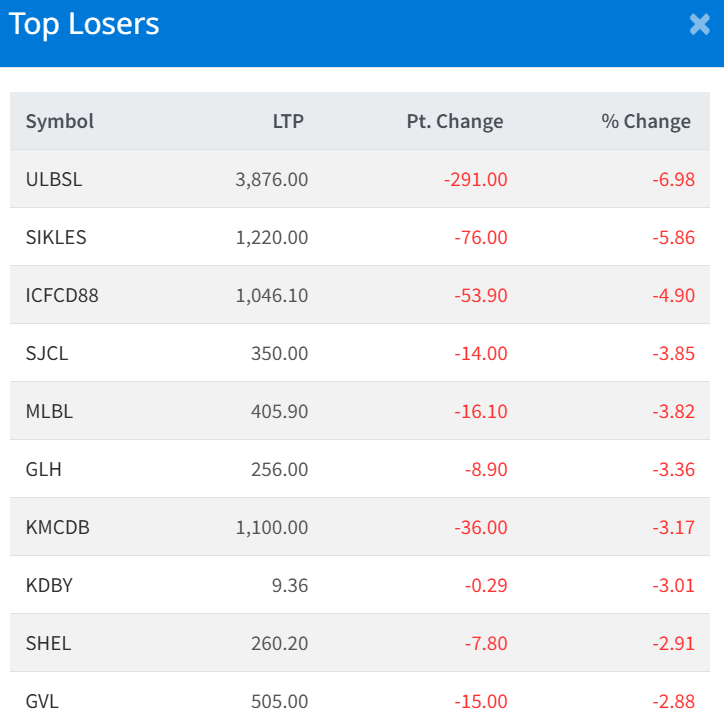

Top Loser

Upakar Laghubitta Bittiya Sanstha Limited (ULBSL) was the biggest loser of the day, dropping 6.98% with an LTP of Rs. 3,876.00, down from Rs. 4,167.00.

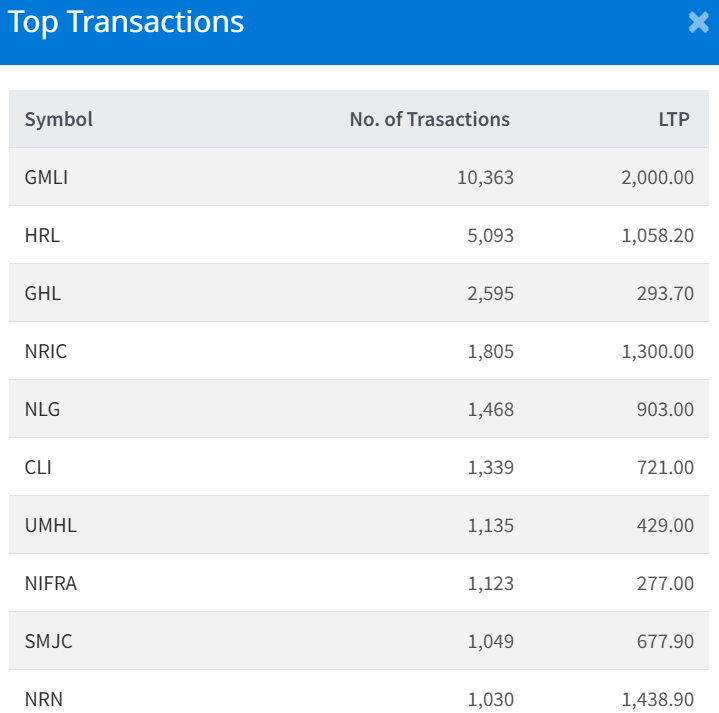

Top Transaction

Guardian Micro Life Insurance Limited (GMLI) recorded the highest number of transactions, with 10,363 trades at an LTP of Rs. 2,000.00.

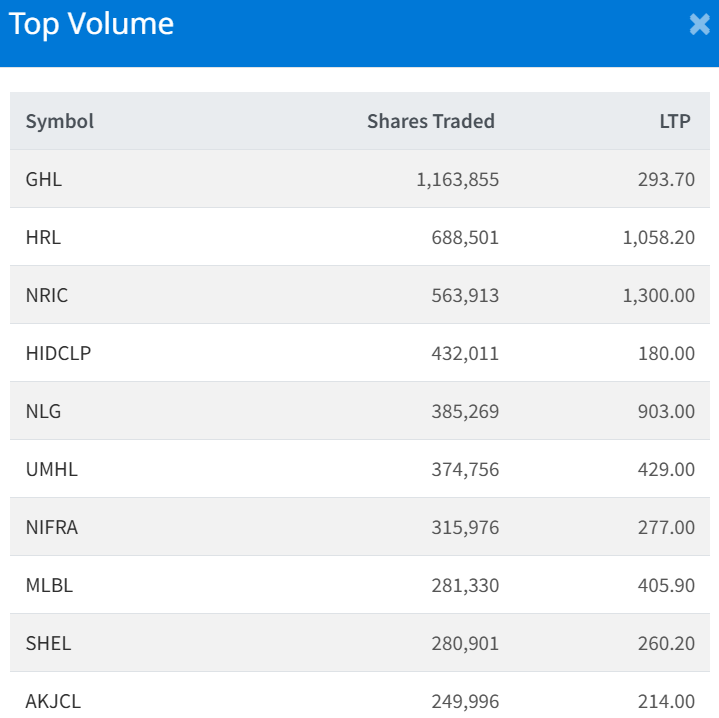

Top Volume

Ghalemdi Hydro Limited (GHL) led in trading volume, with 1,163,855 shares traded at an LTP of Rs. 293.70.

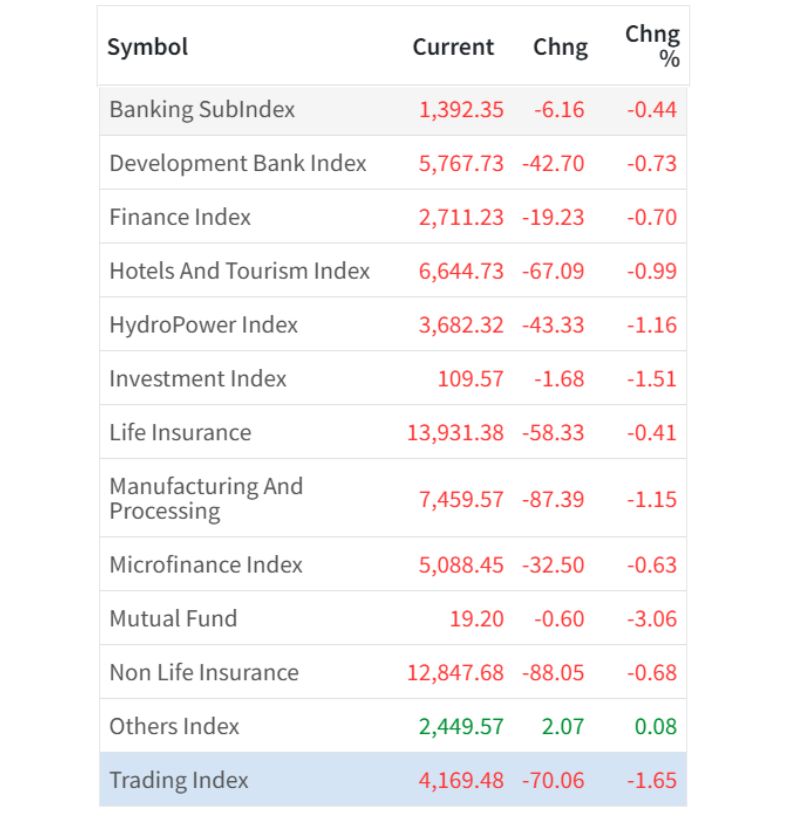

Sector-wise Performance

In today’s market, except for the Others Index, all sectors closed in the red.

- Others Index gained the most, rising by 0.08%.

- Trading Index declined the most, dropping by 1.65%.

The market ended on a negative note, with increased selling activity and declines across most sectors.

Daily Report

Feb 27 Market Update: Strong Gains with Increased Turnover

On February 27, the stock market experienced a significant increase of 47.15 points, closing at 2,815.04, marking a 1.77% rise from the previous day. The day began with an upward movement, reaching an intraday high of 2,817.15 within the first hour. After fluctuating throughout the day, the market dropped to its lowest point of 2,790.24 before closing higher. Along with the overall gain, the total turnover increased to NPR 11.39 Arba, up from NPR 9.90 Arba the previous day.

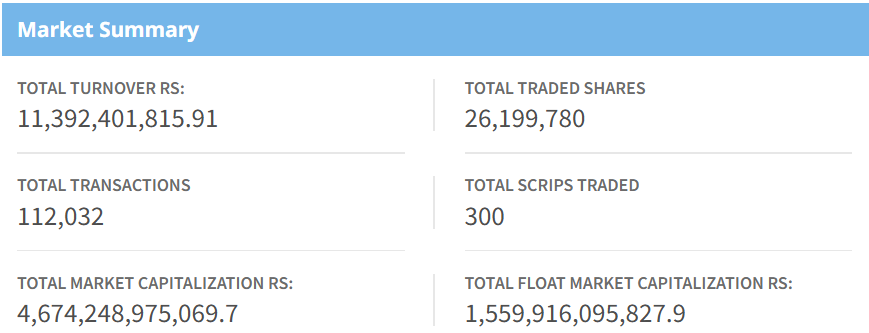

Market Summary

By the end of the trading day, 26,199,780 shares were traded in 112,032 transactions, involving 300 scripts. Among these, 186 companies saw their prices rise, 52 experienced declines and 6 remained unchanged. The market sentiment remained positive, with increased buying activity overall.

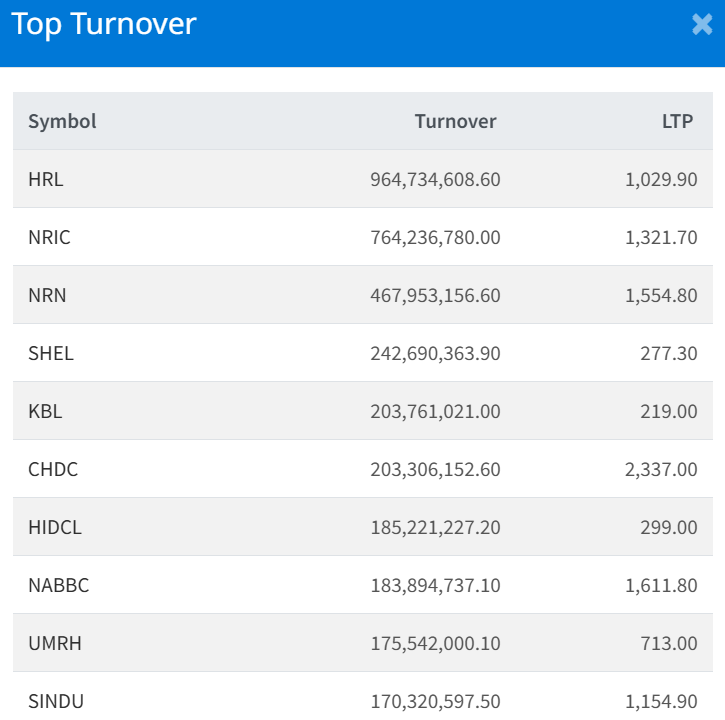

Top Turnover

Himalayan Reinsurance Limited (HRL) recorded the highest turnover of NPR 96.4 crore. Its stock price rose by 0.48%, closing at Rs. 1,029.90, up from Rs. 1,025.00.

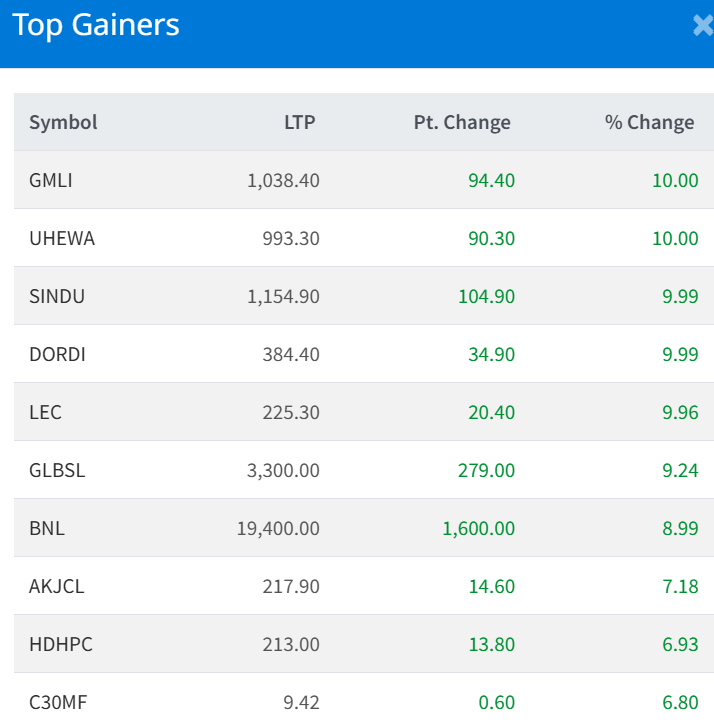

Top Gainer

- Guardian Micro Life Insurance Limited (GMLI) and Upper Hewakhola Hydropower Company Limited (UHEWA) were the top gainers of the day, with their prices increasing by 10% and hitting the upper circuit limit.

- Sindhu Bikash Bank Ltd (SINDU) and Dordi Khola Jal Bidyut Company Limited (DORDI) also saw significant gains, rising by 9.99%, and nearly hitting the upper circuit.

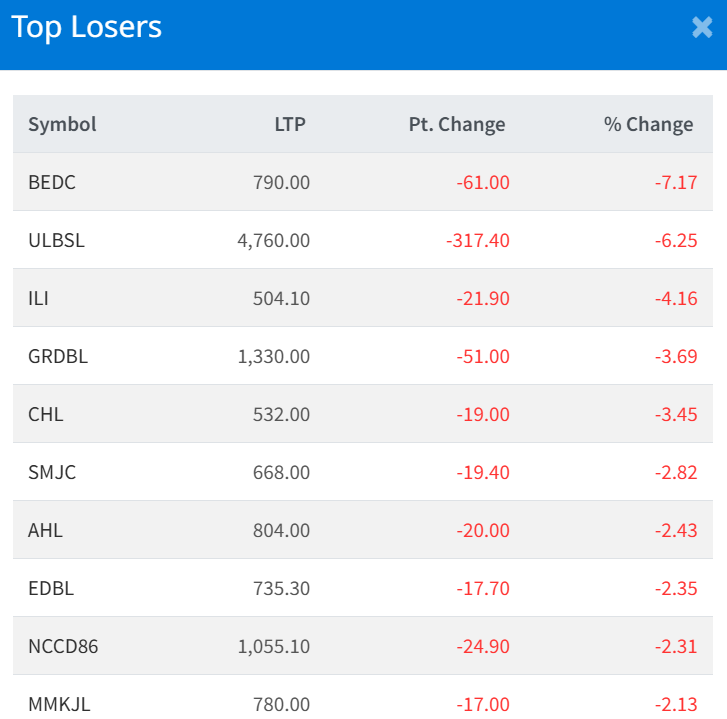

Top Loser

Bhugol Energy Development Company Limited (BEDC) was the biggest loser of the day, dropping 7.17% with an LTP of Rs. 790.00, down from Rs. 851.00.

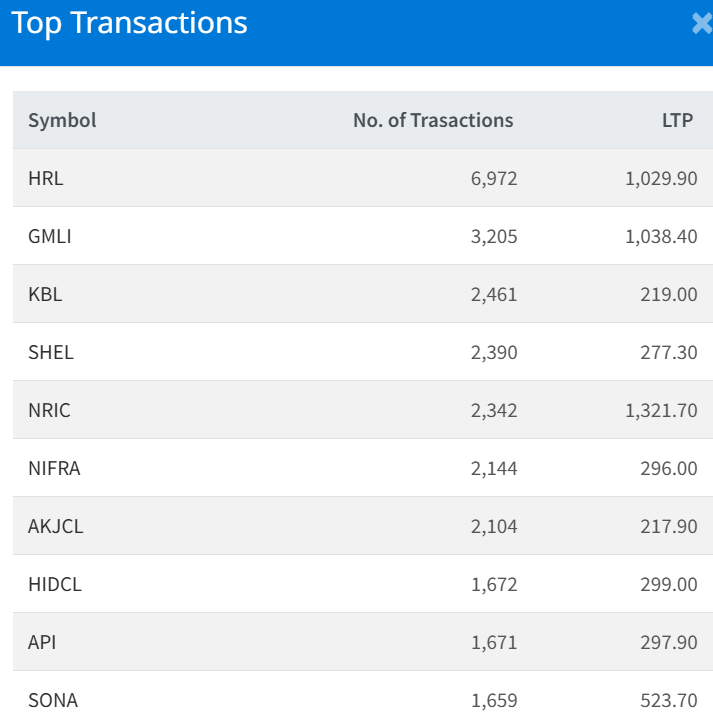

Top Transaction

Himalayan Reinsurance Limited (HRL) also recorded the highest number of transactions, with 6,972 trades at an LTP of Rs. 1,029.90.

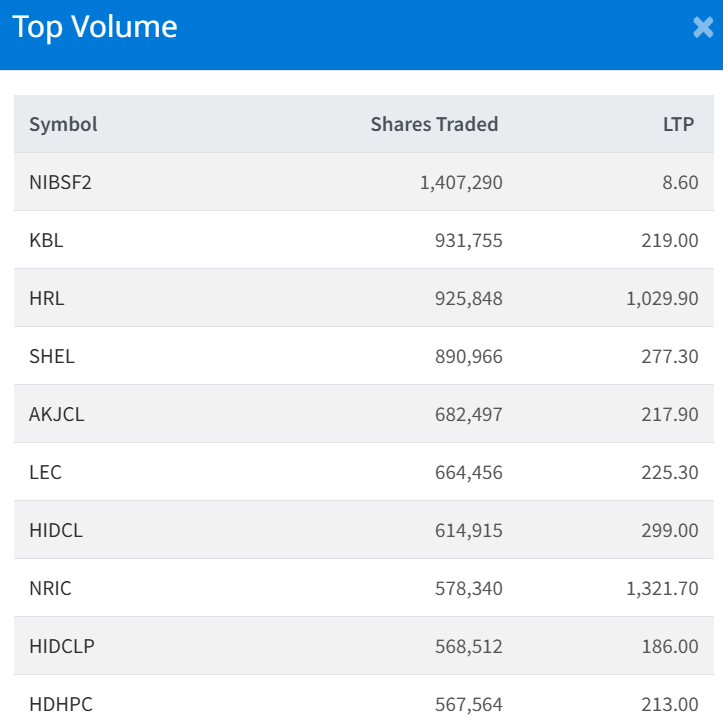

Top Volume

NIBL Samriddhi Fund -2 (NIBSF2) led in trading volume, with 1,407,290 shares traded at an LTP of Rs. 8.60.

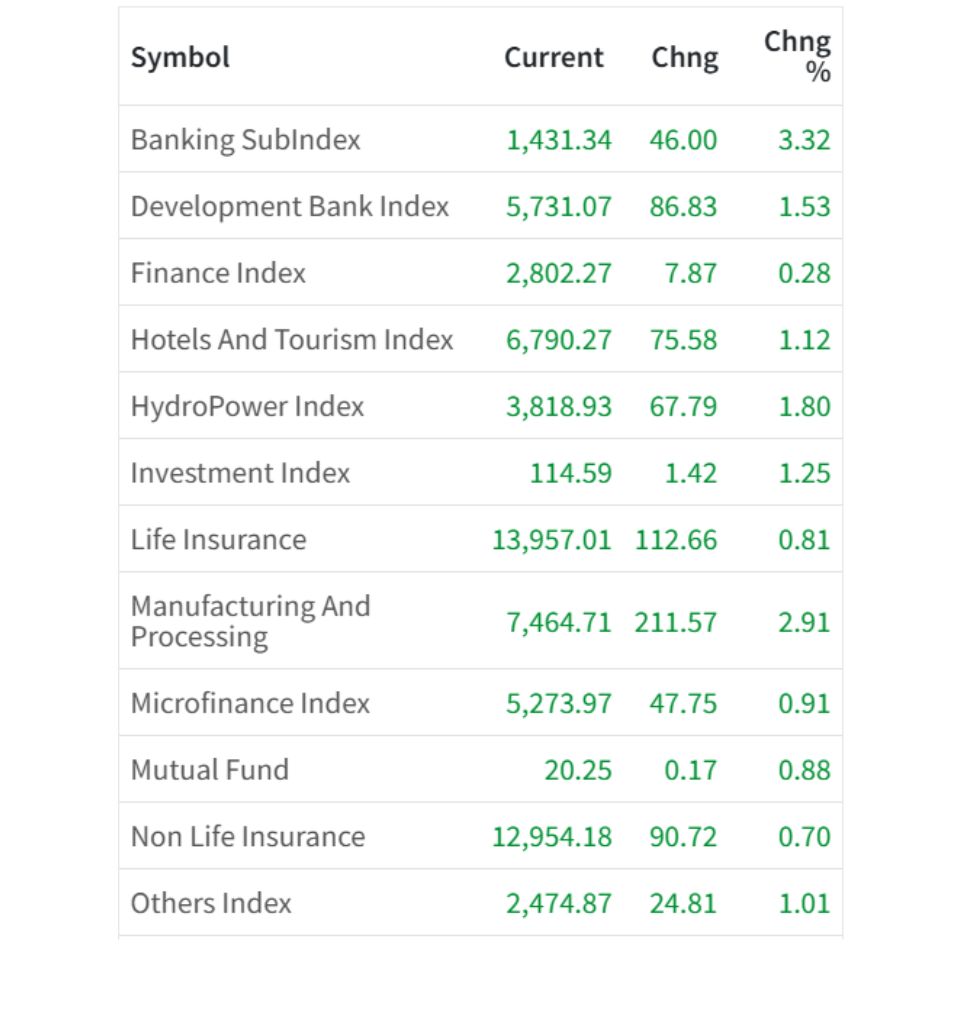

Sector-wise Performance

In today’s market, all sectors are closed in the green.

- Banking Sub-Index gained the most, rising by 3.32%.

- Finance Index declined the most, dropping by 0.28%.

The market ended on a strong positive note, with increased buying activity and gains across most sectors.

-

Blogs3 days ago

Blogs3 days agoHydropower Gains 7.8% in One Month, Outperforming All Sectors

-

Blogs6 hours ago

Blogs6 hours agoPrivate Power Producers Protest ‘Take and Pay’ Provision in Budget

-

Blogs7 hours ago

Blogs7 hours agoNepal Rastra Bank to Withdraw NPR 60 Billion from the Banking System on Monday

-

Blogs8 hours ago

Blogs8 hours ago52-Week Low & High Microfinance Shares in Nepal: Current Status and Future Outlook

-

Blogs1 year ago

Blogs1 year agoList of Stock Brokers in Nepal with NEPSE TMS Login – Updated

-

Blogs8 hours ago

Blogs8 hours agoAsian Life Insurance to Issue Rights Shares from Asar 25

-

Blogs6 months ago

Blogs6 months agoSiuri Nyadi Power Limited Added to IPO Pipeline by SEBON

-

Blogs4 days ago

Blogs4 days agoBanks Invest Rs. 16.45 Trillion in Directed Loans, 14% in Agriculture Sector | Says Nepal Rastra Bank