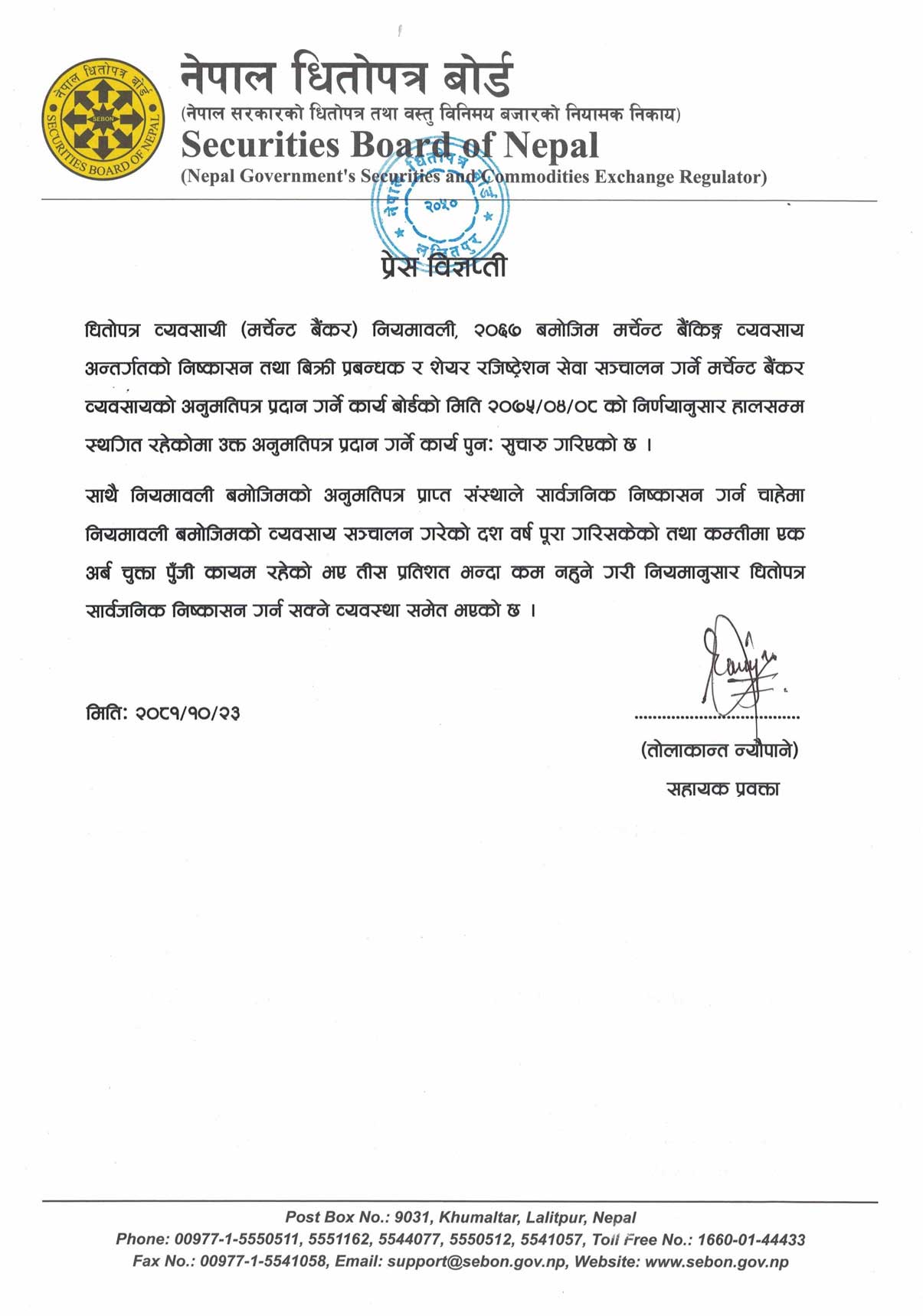

The Securities Board of Nepal (SEBON) has restarted the process of issuing licenses for merchant banking services. This license covers activities like issue management and share registrar services. Previously, this process was put on hold on Shrawan 4, 2075. The move aims to strengthen Nepal’s capital market infrastructure and promote regulated financial services.

Key Highlights of the Decision

1. Reinstatement of License Issuance:

- SEBON has restarted granting merchant banking licenses for institutions involved in public issuance management and share registration services.

- This follows a six-year suspension imposed in 2075 to review and tighten regulatory frameworks.

2. Eligibility Criteria for Applicants:

To receive a license for conducting public issuances, institutions must meet these requirements:

- Experience Requirement: Institutions must have at least 10 years of operational experience in merchant banking.

- Capital Requirement: They need to have a minimum paid-up capital of Rs. 1 Arba.

- Equity Capital: At least 30% of this capital should be in the form of equity.

These criteria ensure that only well-established and financially stable institutions can participate in public issuances.

3. Public Issuance Approval:

- Licensed merchant bankers can now manage public share offerings for companies, provided they meet SEBON’s stringent criteria.

Notice: SEBON Resumes Issuance of Merchant Banking Licenses for Issue Management and Share Registrar Services

Why This Matters

- Boost to Capital Markets: The resumption of licenses will enhance market efficiency by increasing the number of qualified intermediaries.

- Investor Protection: Strict eligibility criteria ensure that only experienced and financially sound institutions handle public issuances.

- Regulatory Compliance: The move aligns with SEBON’s commitment to fostering a transparent and stable financial ecosystem.

Contact Information

For inquiries or applications, stakeholders can reach SEBON through:

- Address: Khumaltar, Lalitpur, Nepal | Post Box No.: 9031

- Phone: 00977-1-5550511, 5551162, 5544077 | Toll-Free: 1660-01-44433

- Email: [email protected] | Website: www.sebon.gov.np

Conclusion

SEBON’s decision to restart the licensing process for merchant banking services marks an important step in reopening opportunities for institutions that meet the strict experience and capital requirements. With these new measures, only qualified and financially robust organizations will be allowed to manage public issues and share registration services. If you need more information, you can contact SEBON using the details provided in the official notice.