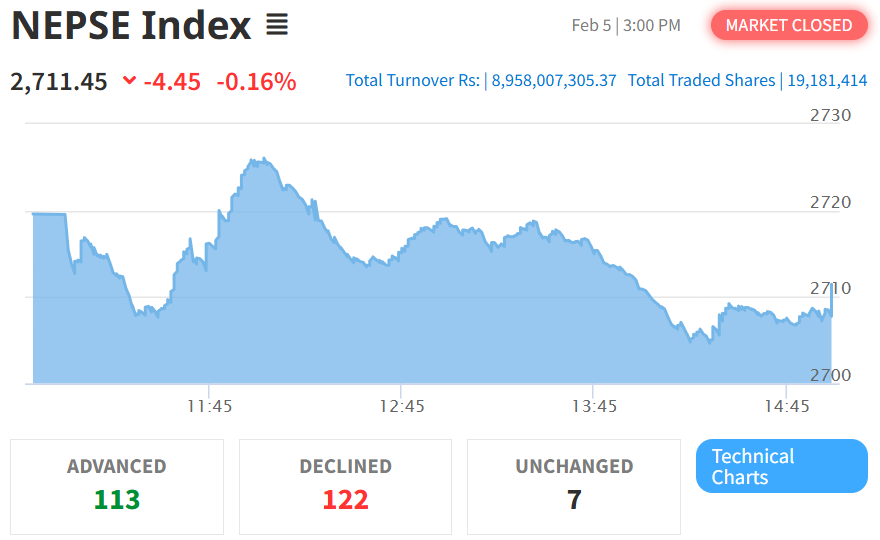

On February 5, the stock market recorded a 4.45-point decrease, closing at 2,711.45, marking a 0.16% decline from the previous trading day. The market exhibited volatility, reaching an intraday high of 2,725.63 before closing lower. Total turnover increased slightly to NPR 8.95 Arba, up from NPR 8.91 Arba.

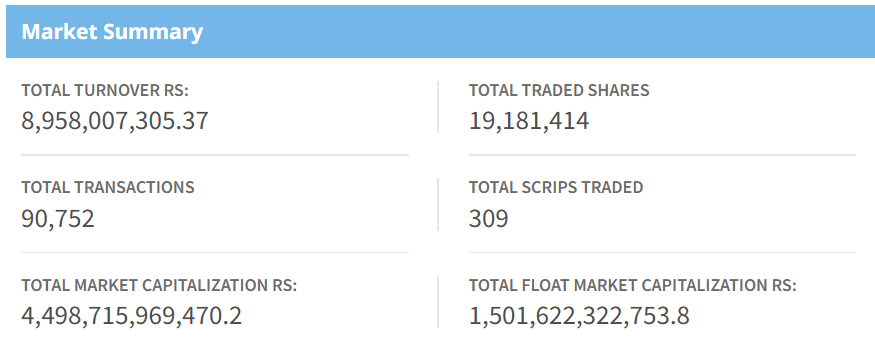

Market Summary

By the end of the trading day, the market summary shows that 19,181,414 shares were traded through 90,752 transactions involving 309 scrips. Among these, 113 companies experienced price gains, 122 saw declines, and 7 remained unchanged. Despite fluctuations, the overall market sentiment remained negative, with increased selling activity.

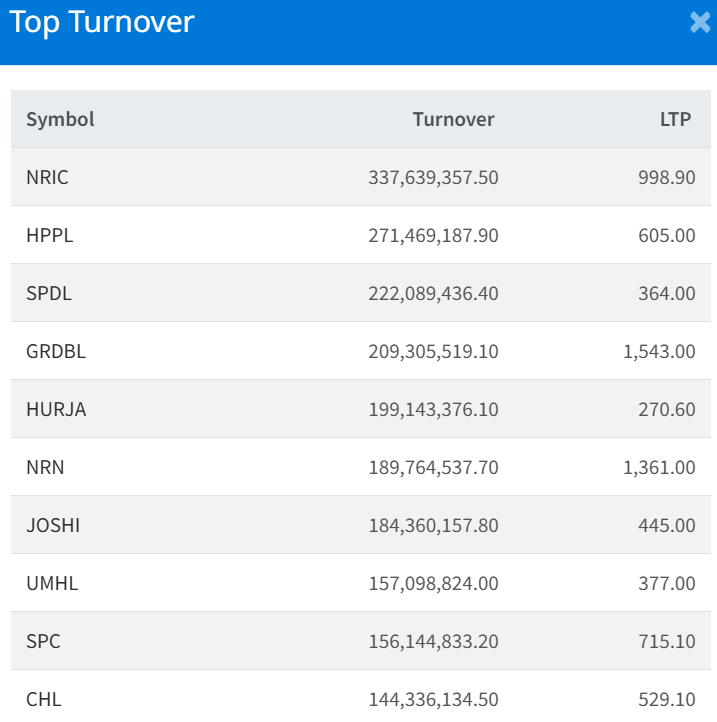

Top Turnover

Nepal Reinsurance Company Limited (NRIC) recorded the highest turnover at NPR 33.76 crores, as its stock price increased to Rs. 998.90, up from Rs. 988.00.

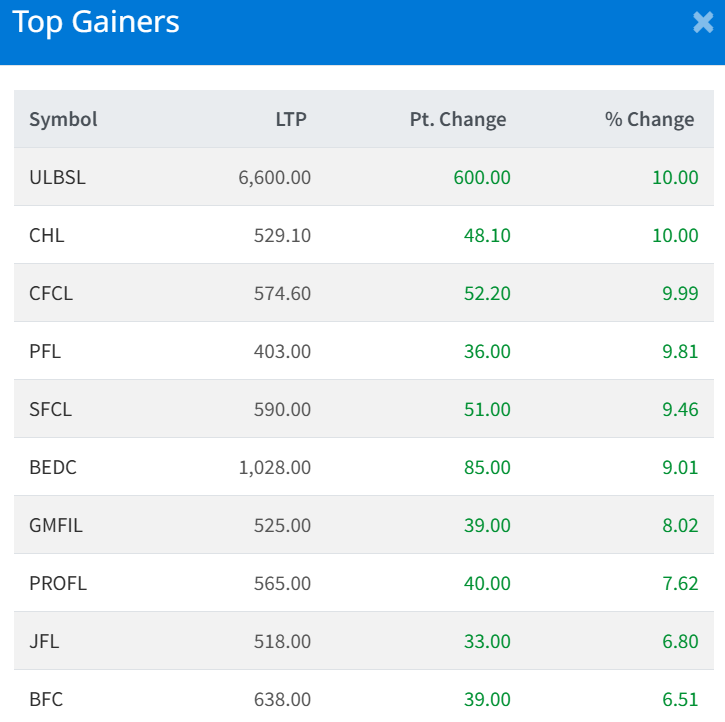

Top Gainer

Upakar Laghubitta Bittiya Sanstha Limited (ULBSL) and Chhyangdi Hydropower Ltd. (CHL) hit the positive circuit, each gaining 10%.

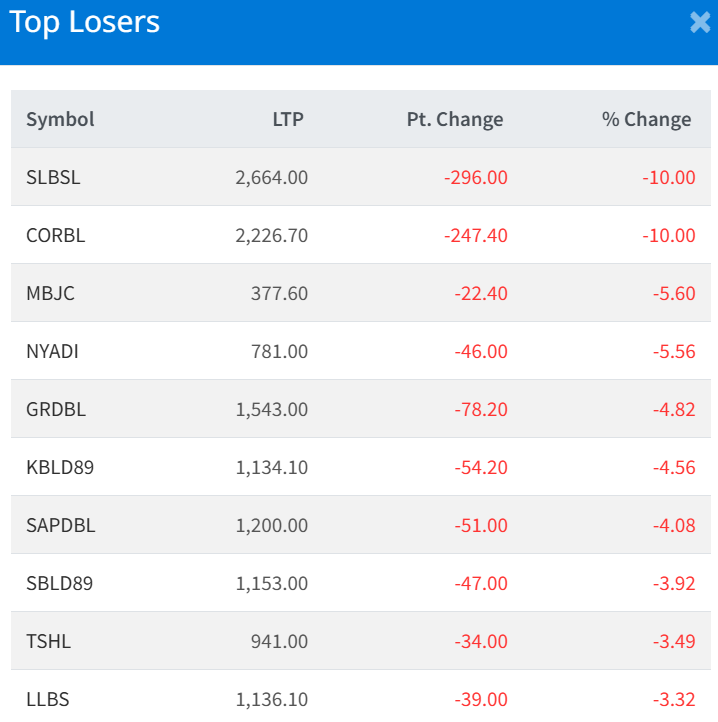

Top Losers

Samudayik Laghubitta Bittiya Sanstha Limited (SLBSL) and Corporate Development Bank Limited (CORBL) were the biggest losers, dropping 10% in today’s market.

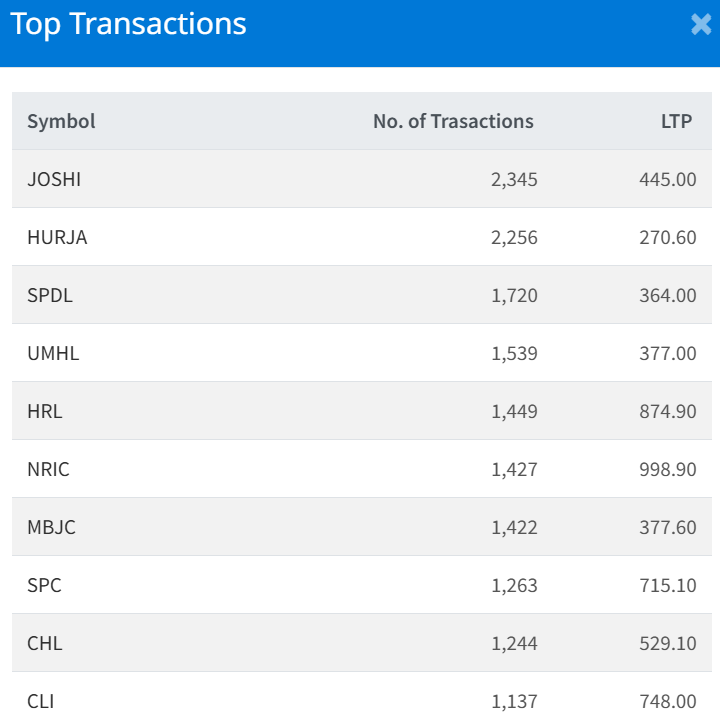

Top Transaction

Joshi Hydropower Development Company Ltd (JOSHI) recorded the highest number of transactions, completing 2,345 trades at an LTP of Rs. 445.00.

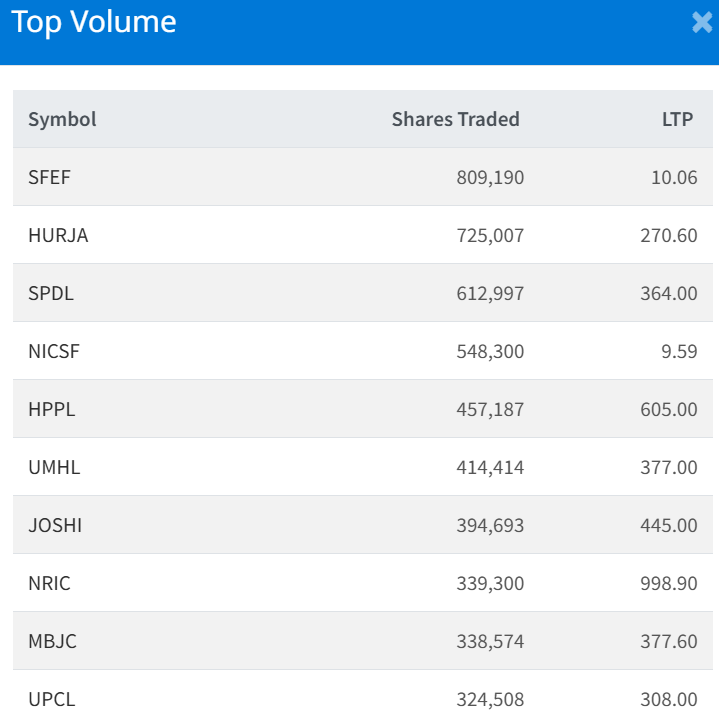

Top Volume

Sunrise Focused Equity Fund (SFEF) led in trading volume, with 809,190 shares traded at an LTP of Rs. 10.06.

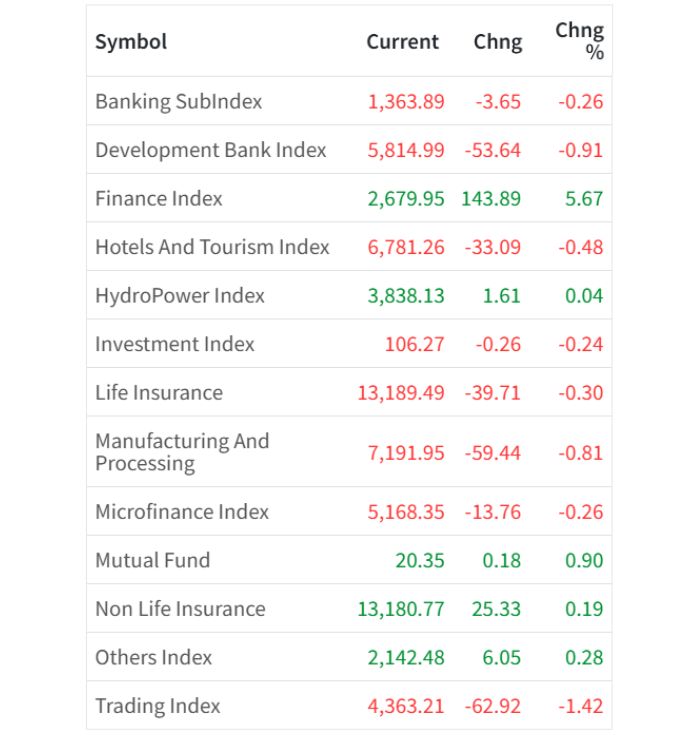

Sector-wise Performance

Among all the sectors 5 closed in green and 7 closed in red where:

- Finance Index: Gained the most, rising by 5.67%.

- Development Bank Index: Declined the most, dropping by 0.91%.

The market ended on a slightly negative note, with mixed sector performances and increased turnover compared to the previous session.