Global IME Laghubitta Bittiya Sanstha Limited (GILB) has published its financial report for the second quarter of the fiscal year 2081/82. The report includes details about the financial performance, management analysis, legal matters, stock market trends, and challenges faced by the institution.

Financial Performance

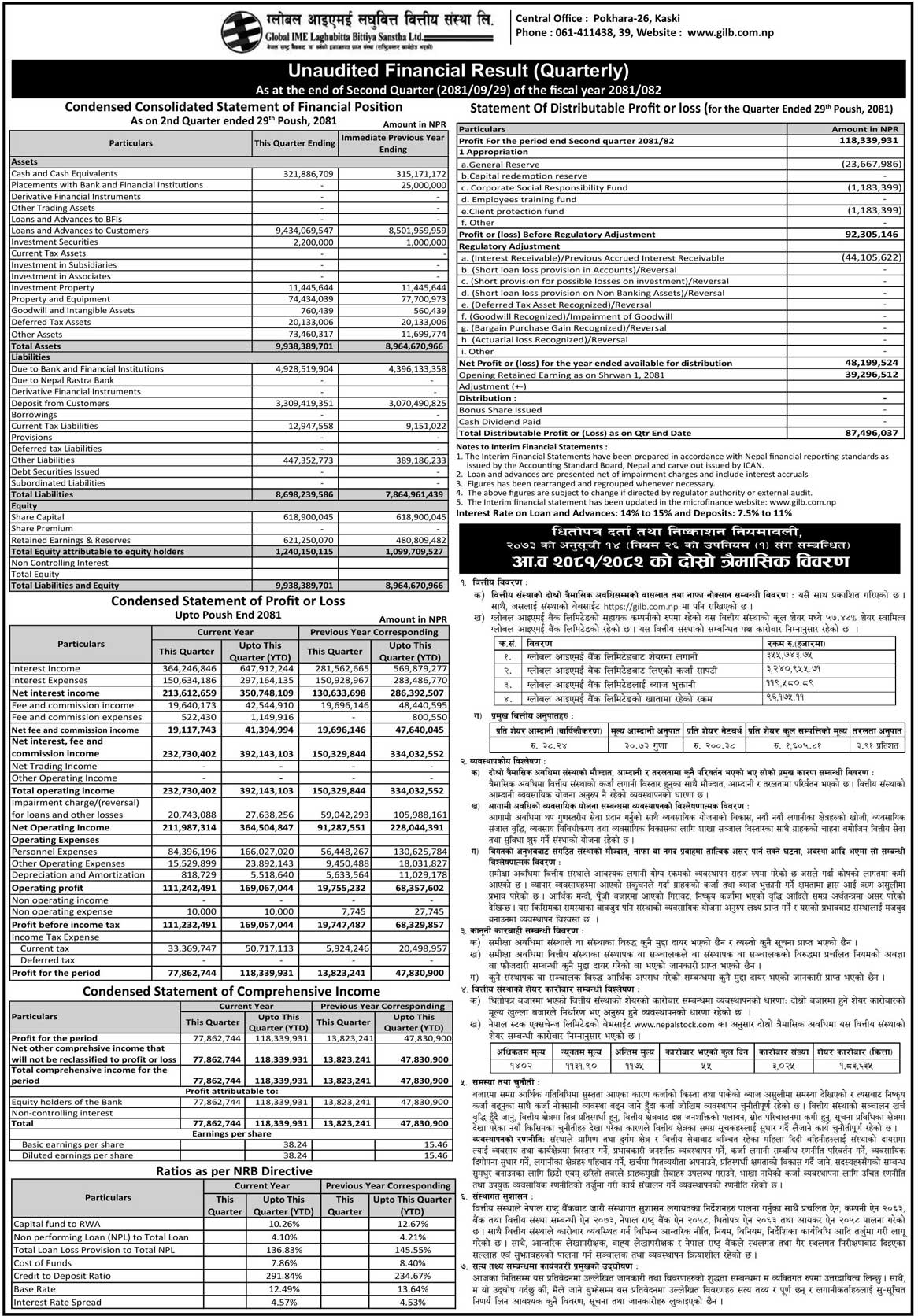

GILB has shared its second quarter’s balance sheet and profit & loss details. These details are available on the company’s website (https://gilb.com.np). The financial institution operates as a subsidiary of Global IME Bank Limited, which holds 178 shares in GILB. The key economic figures are as follows:

- Net Profit: Rs. 11.83 crores, significantly rising from Rs. 4.78 crores in the same quarter last year.

- Net Interest Income: Rs. 35.07 crores, increasing by 22.47%.

- Loans and Advances: Rs. 9.43 Arba, growing by 10.96%.

- Customer Deposits: Rs. 3.31 Arba, increasing by 7.78%.

- Earnings Per Share (EPS): Rs. 38.24 (annualized).

- Net Worth Per Share: Rs. 200.38.

- Liquidity Ratio: 3.91%.

Management Analysis

During this quarter, the company expanded its loan investments, resulting in changes in liquidity and income. The institution believes its earnings align with its business plans.

For future growth, GILB plans to:

- Improve service quality.

- Expand business operations.

- Explore new investment opportunities.

- Diversify financial services based on customer needs.

- Expand branch networks to increase reach.

Despite economic challenges, the institution remains confident in achieving its business goals and strengthening its financial position.

Legal Matters

During the review period:

- No legal cases were filed against or by the company.

- No cases were filed against its board members or management.

- There were no reports of financial crimes involving any board member or executive.

Stock Market Performance

The company’s stock performance in the second quarter is as follows:

- Highest Share Price: Rs. 1,402

- Lowest Share Price: Rs. 1,190

- Closing Price: Rs. 1,175

- Total Trading Days: 55

- Total Shares Traded: 1,83,635

GILB believes that share prices in the secondary market are determined by open-market trading.

Challenges and Future Strategies

The financial institution faces various challenges, including:

- Economic slowdown affecting loan repayments.

- Increase in non-performing loans.

- Rising operational costs.

- Intense competition in the financial sector.

- Lack of skilled financial professionals.

- Technological advancements require constant upgrades.

To overcome these challenges, GILB aims to:

- Expand financial services in rural and underprivileged areas.

- Focus on women’s financial inclusion.

- Improve credit investment strategies.

- Enhance cost management.

- Strengthen customer relationships by providing faster services.

Corporate Governance

GILB follows regulatory guidelines set by Nepal Rastra Bank and complies with laws such as the Companies Act 2062, Banking and Financial Institution Act 2073, Nepal Rastra Bank Act 2058, Securities Act 2063, and Income Tax Act 2058. The company has implemented internal policies to ensure transparency and regulatory compliance.

The management remains committed to maintaining financial stability and delivering quality financial services while navigating market challenges. The second-quarter report reflects the company’s growth, strong financial standing, and dedication to long-term success.

Comparison of Global IME Laghubitta Bittiya Sanstha Limited’s Key Financial Highlights for Q2 of FY 2081/82 and the Previous Fiscal Year.

Notice: Global IME Laghubitta Bittiya Sanstha Limited: Q2 Financial Report for FY 2081/82