On December 23 (8th Poush), the stock market rose by 28.91 points, closing at 2,612.20, marking a 1.11% increase compared to the previous trading day. Despite the market’s incline, today’s turnover fell to NPR 4.43 Arba, down from NPR 4.51 Arba. The market fluctuated throughout the day and finally rose at the end session.

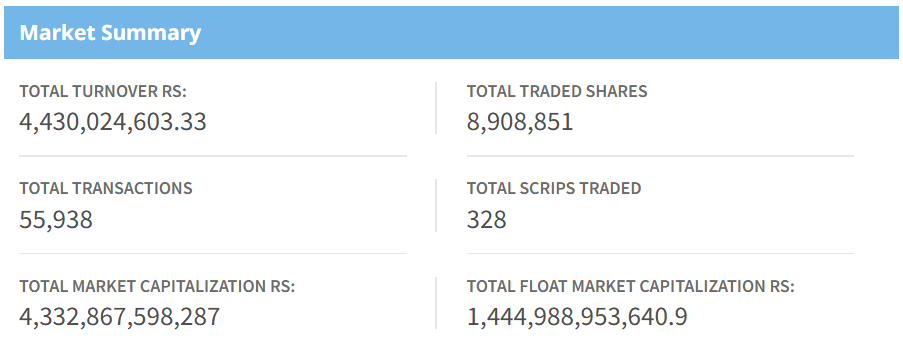

Market Summary

By the end of the day, today’s market summary shows that 8,908,851 shares were traded through 55,938 transactions involving 328 scrips. Among the traded companies, 194 experienced a rise in their stock prices, 41 saw a decline, and 9 remained unchanged. The overall sentiment was positive, with most shares being bought.

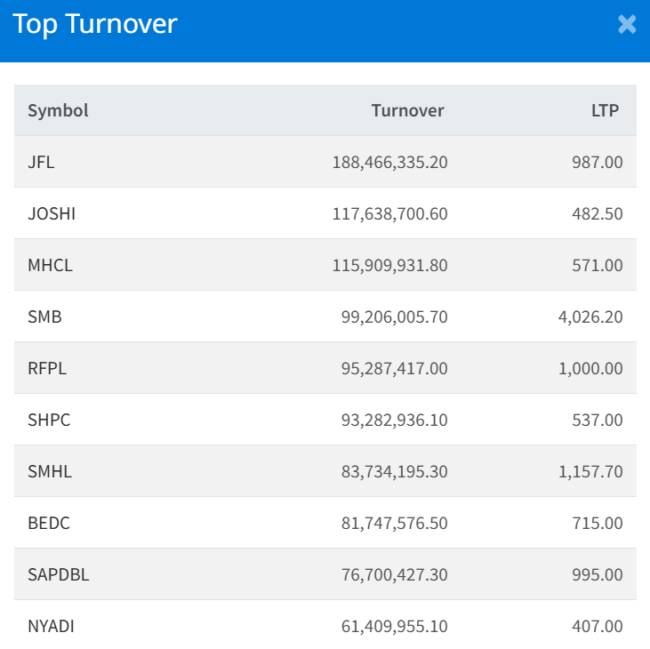

Top Turnover

Janaki Finance Company Limited (JFL) led the market with the highest turnover of NPR 18.84 crores. Closing at Rs. 987.00 per share, this marked an increase from the previous trading day’s closing price of Rs. 932.00.

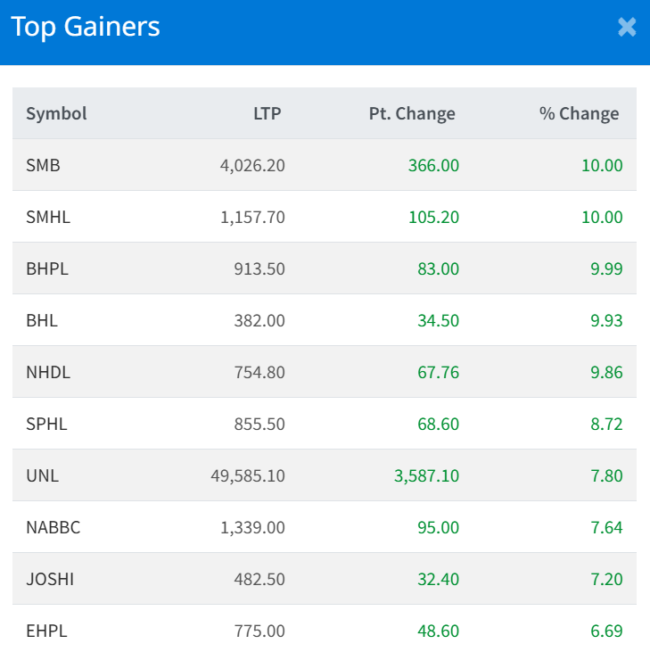

Top Gainer

Support Microfinance Bittiya Sanstha Ltd. (SMB) and Super Madi Hydropower Limited (SMHL) hit the upper circuit, recording the highest growth with a 10% increase in their stock prices. Additionally, Barahi Hydropower Public Limited (BHPL) saw a 9.99% increase. The top 10 gainers of the day are as follows:

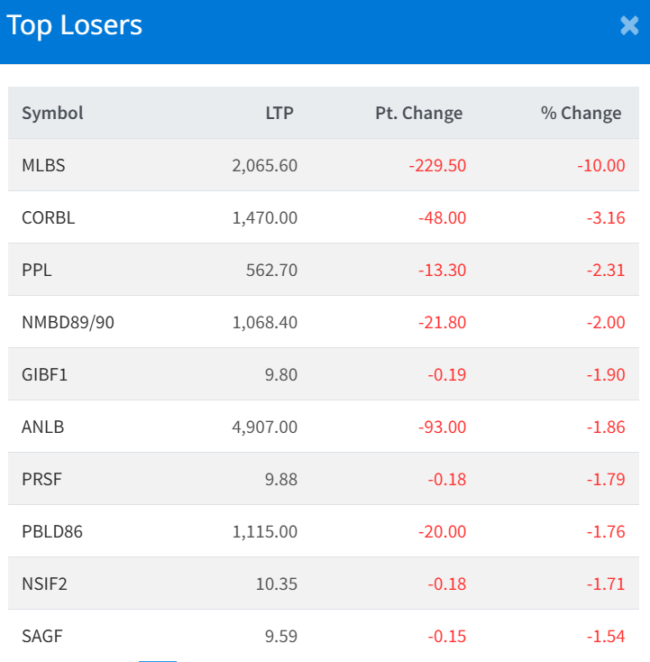

Top Loser

Manushi Laghubitta Bittiya Sanstha Limited (MLBS) recorded the highest decline of 10.00%, making it the biggest loser of the day. Its last trading price was Rs. 2,065.60, down from the previous trading day’s price of Rs. 2,295.10. The top 10 losers of the day are as follows:

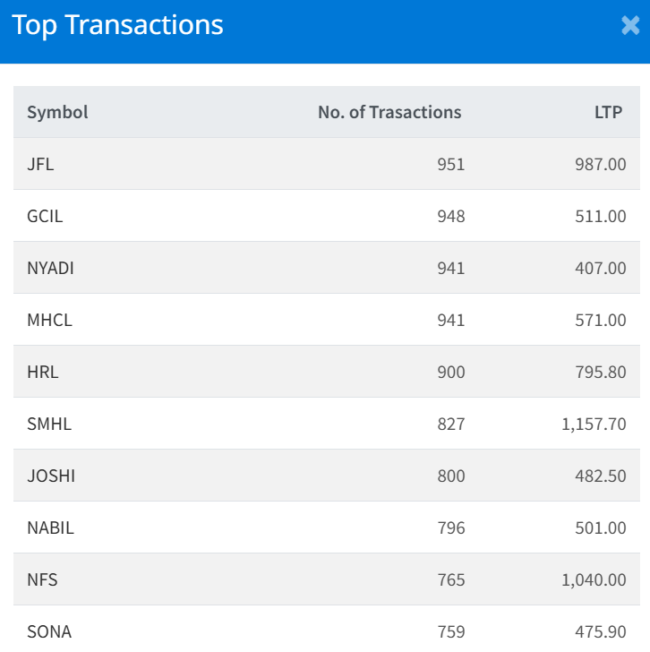

Top Transaction

Janaki Finance Company Limited (JFL) recorded the highest number of transactions, with 951 trades completed. Its last traded price was NPR 987.00.

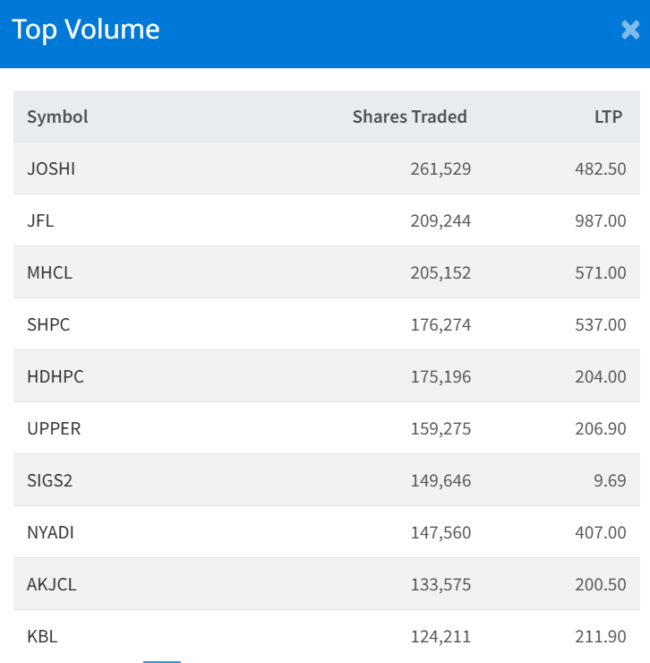

Top Volume

Joshi Hydropower Development Company Ltd. (JOSHI) had the highest trading volume, with 261,529 shares traded. Its last trading price was Rs. 482.50.

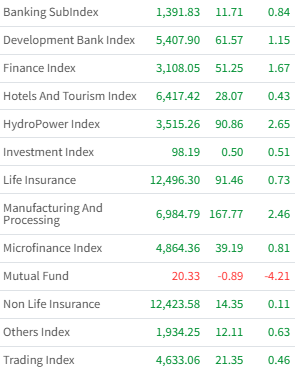

Sector-wise Performance:

Today’s sector-wise market performance revealed that all indices, except the Mutual Fund Index, saw gains. The Hydropower Index recorded the highest increase, rising by 90.86 points (2.65%), while the Mutual Fund Index experienced the largest decline, dropping by 0.89 points (4.21%).