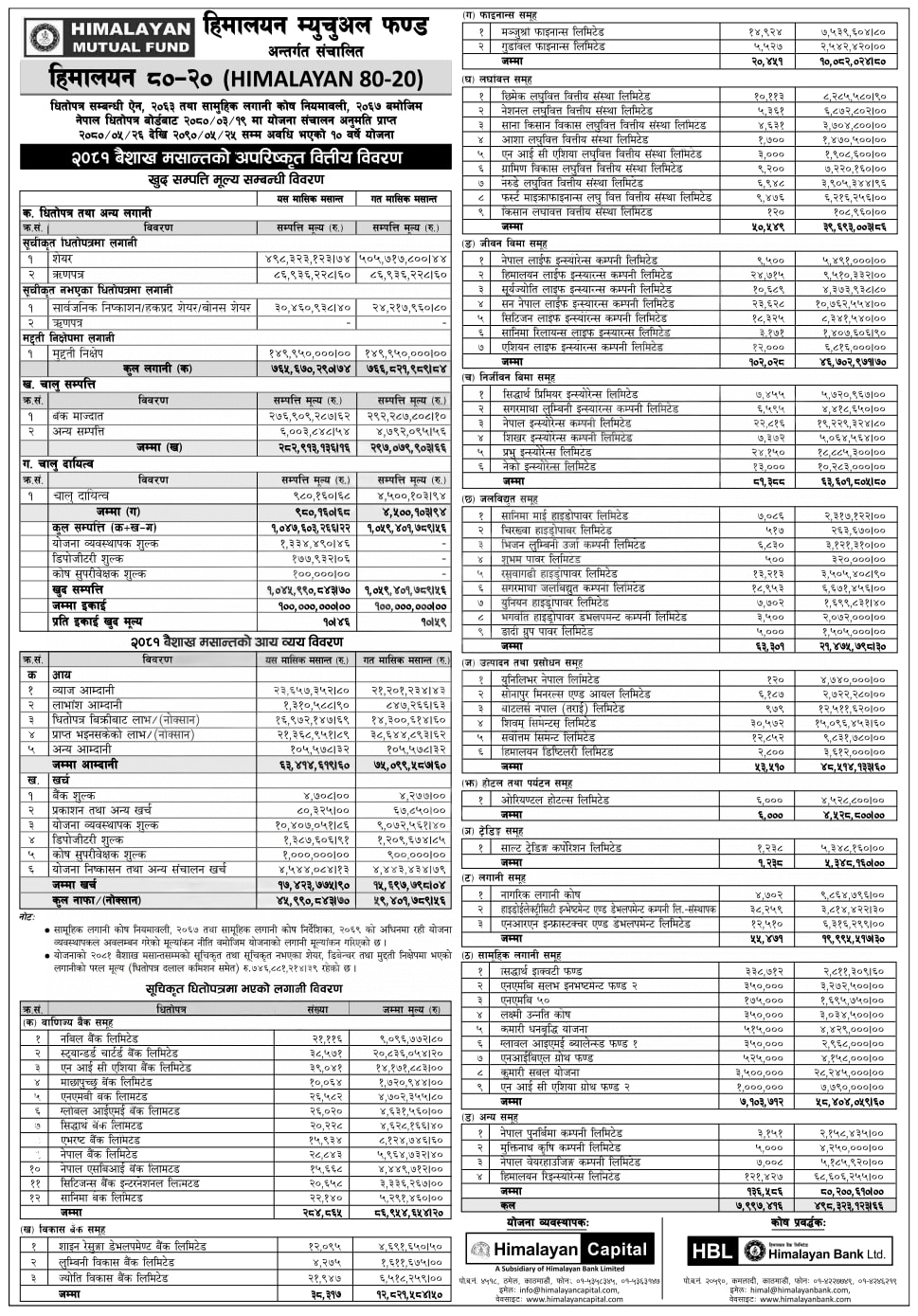

Himalayan 80-20 (H8020) has recorded a Net Asset Value (NAV) of Rs. 10.46 at the end of Baisakh, 2081 BS, showing a decrease from Rs. 10.59 at the end of Chaitra, 2080 BS. This closed-end mutual fund scheme is managed by Himalayan Capital Limited under Himalayan Mutual Fund. The scheme started with a fund amount of Rs. 1 Arba and has a 10-year maturity period, ending on Bhadra 25, 2090 BS.

Key Points of Himalayan 80-20 NAV 2081

| Detail | Value |

| NAV (End of Baisakh, 2081 BS) | Rs. 10.46 |

| NAV (End of Chaitra, 2080 BS) | Rs. 10.59 |

| Total Investment in Listed Securities | Rs. 49.83 crores |

| Previous Month Investment in Listed Securities | Rs. 50.57 crores |

| Investment in Debentures/Bonds | Rs. 8.69 crores |

| Investment in Fixed Deposits | Rs. 14.99 crores |

| Bank Balance | Rs. 27.69 crores |

| Gross Profit (First 10 months of Fiscal Year 2080/81) | Rs. 4.59 crores |

| Net Profit (Baisakh) | Rs. 4.59 crores |

| Net Profit (Chaitra) | Rs. 5.94 crores |

| Fund Size | Rs. 1 Arba |

| Maturity Period | 10 years |

| Retirement Date | Bhadra 25, 2090 BS |

As of the end of Baisakh, H8020 had invested Rs. 49.83 crore in stocks, a decrease from Rs. 50.57 crore the previous month. Additionally, the scheme holds Rs. 8.69 crores in debentures and bonds and Rs. 14.99 crores in fixed deposits. It also maintains a bank balance of Rs. 27.69 crores.

The scheme’s net profit for the month of Baisakh is Rs. 4.59 crore, which is lower than the Rs. 5.94 crore net profit for Chaitra.

Net Assets Value (NAV) Report of the Himalayan Capital Limited “Himalayan 80-20” till Baisakh, 2081.